In recent days, Bitcoin has experienced a notable pullback from its previous all-time high above $73,000. However, experts reassure the community that this is just a temporary setback in the ongoing bull market. The key insights from various reports highlight the reasons why the Bitcoin bull market remains intact.

Reassurance Amidst Pullback

Despite the recent dip in bitcoin’s price, experts emphasize that the bull market is far from over. Ki Young Ju, CEO of CryptoQuant, asserts, “Bitcoin is still in the middle of the bull cycle,” reinforcing the sentiment that the digital asset’s upward trajectory remains intact.

This sentiment is echoed by Willy Woo, a Bitcoin analyst, who confidently states, “this is not the top,” indicating that the current dip is merely a period of consolidation. The CEO emphasized that the Spot Bitcoin ETF’s success, not the approaching Bitcoin halving in April, is driving bitcoin’s record highs.

CryptoQuant analysts:

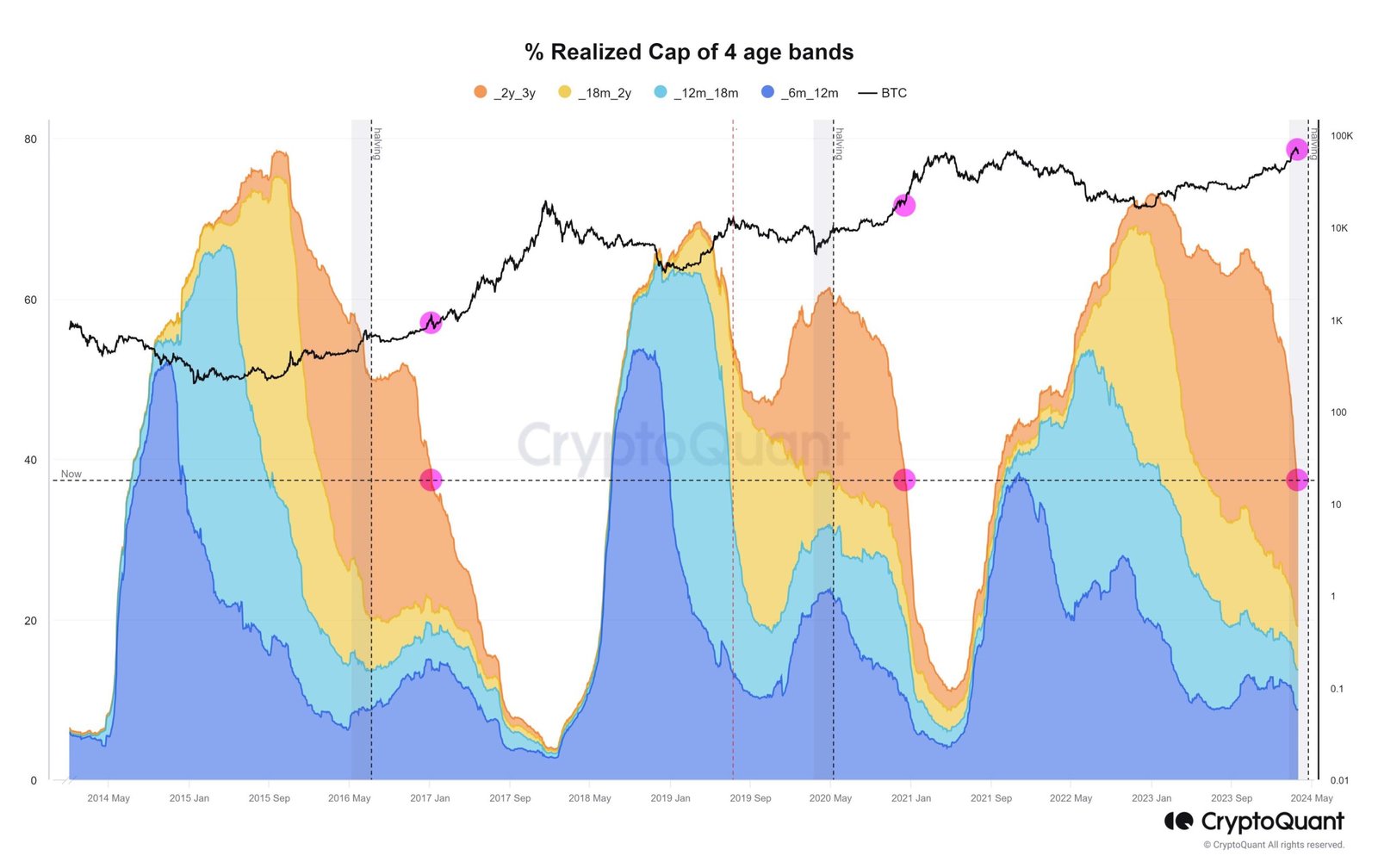

“The Bitcoin bull cycle is still far from over, as shown by the relatively low level of new investment flows.”

Factors Supporting Bullish Outlook

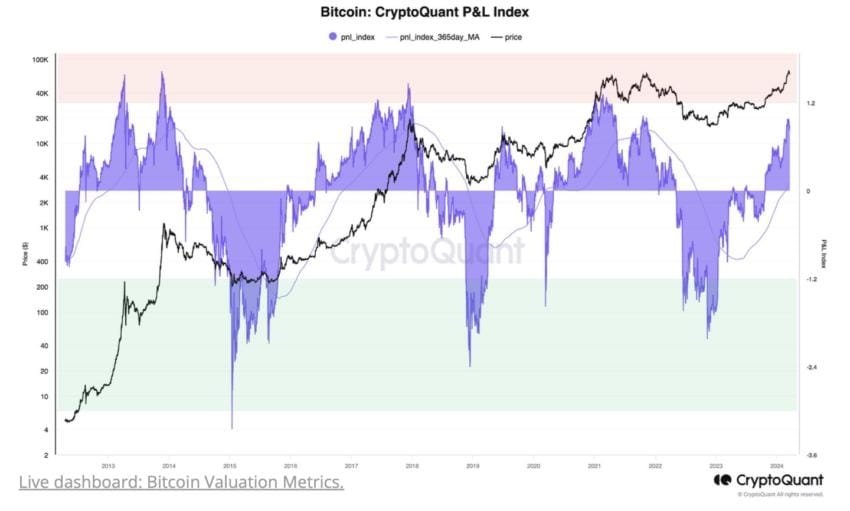

Several factors support the optimistic outlook for Bitcoin. Reports indicate that investment flows from new investors are relatively low, suggesting that there is still significant potential for growth. The CryptoQuant Profit and Loss Index, which tracks bitcoin’s profitability, remains outside the market top zone, indicating that the bull cycle is still in play. Additionally, the upcoming Bitcoin halving event is expected to further bolster BTC’s price, ushering in a parabolic uptrend historically associated with supply halvings.

The report states:

“CryptoQuant Profit and Loss Index is still outside a market top zone (red area) and above the index’s 1-year moving average.”

On a similar note on Monday, March 18, analysts from Standard Chartered Bank penned an investment note to their clients, raising their prediction of bitcoin price in 2024, highlighting:

“For 2024, given the sharper-than-expected price gains year-to-date, we now see potential for the price to reach the $150,000 level by year-end, up from our previous estimate of $100,000.”

Bitcoin Bull Market: Impact of Institutional Investors

The influence of institutional investors on Bitcoin’s price cannot be overlooked. The Coinbase Premium Gap, a metric tracking the difference between BTC prices on Coinbase and Binance, provides insights into the buying behavior of institutional entities. Positive values of this indicator suggest increased buying pressure from large investors, contributing to bitcoin’s recovery despite the recent pullback.

Retail Investors Yet to Fully Participate

While institutional investors play a significant role, retail investors are also key players in the Bitcoin market. Ki Young Ju notes that only 50% of retail investors have entered the market, indicating that we are only halfway towards “Bitcoin euphoria.”

This suggests that there is still ample room for retail investors to drive further price increases through increased demand and capital inflows. Despite potential pessimism, the CryptoQuant founder remains optimistic about the BTC bull market, relying on ongoing ETF inflows’ momentum.

Conclusion

Despite the recent pullback, the Bitcoin bull market remains robust. Experts reassure investors that this is not the end of the rally but rather a temporary consolidation phase. With factors such as low investment flows from new investors, positive institutional buying pressure, and the upcoming halving event, bitcoin is poised for continued growth. As Willy Woo aptly puts it, “this is not the top,” and analysts signal that there are still significant gains to be made in the bitcoin market.

By staying informed and understanding the underlying dynamics of the market, investors can navigate through short-term fluctuations and capitalize on the long-term potential of Bitcoin’s bull market.

Disclaimer: The information provided here is for informational purposes only and should not be considered as investment advice. Any investment decisions should be made after careful consideration of individual financial circumstances and consultation with a qualified financial advisor.