Bitcoin is currently navigating through one of the most robust bull markets in its history, as explained by an insightful analysis from Glassnode lead analyst James Check. Despite recent bitcoin corrections, the digital asset’s resilience is starkly evident, dwarfing past cycles and reaffirming its position as a formidable asset.

Rise in Bitcoin’s MVRV Ratio

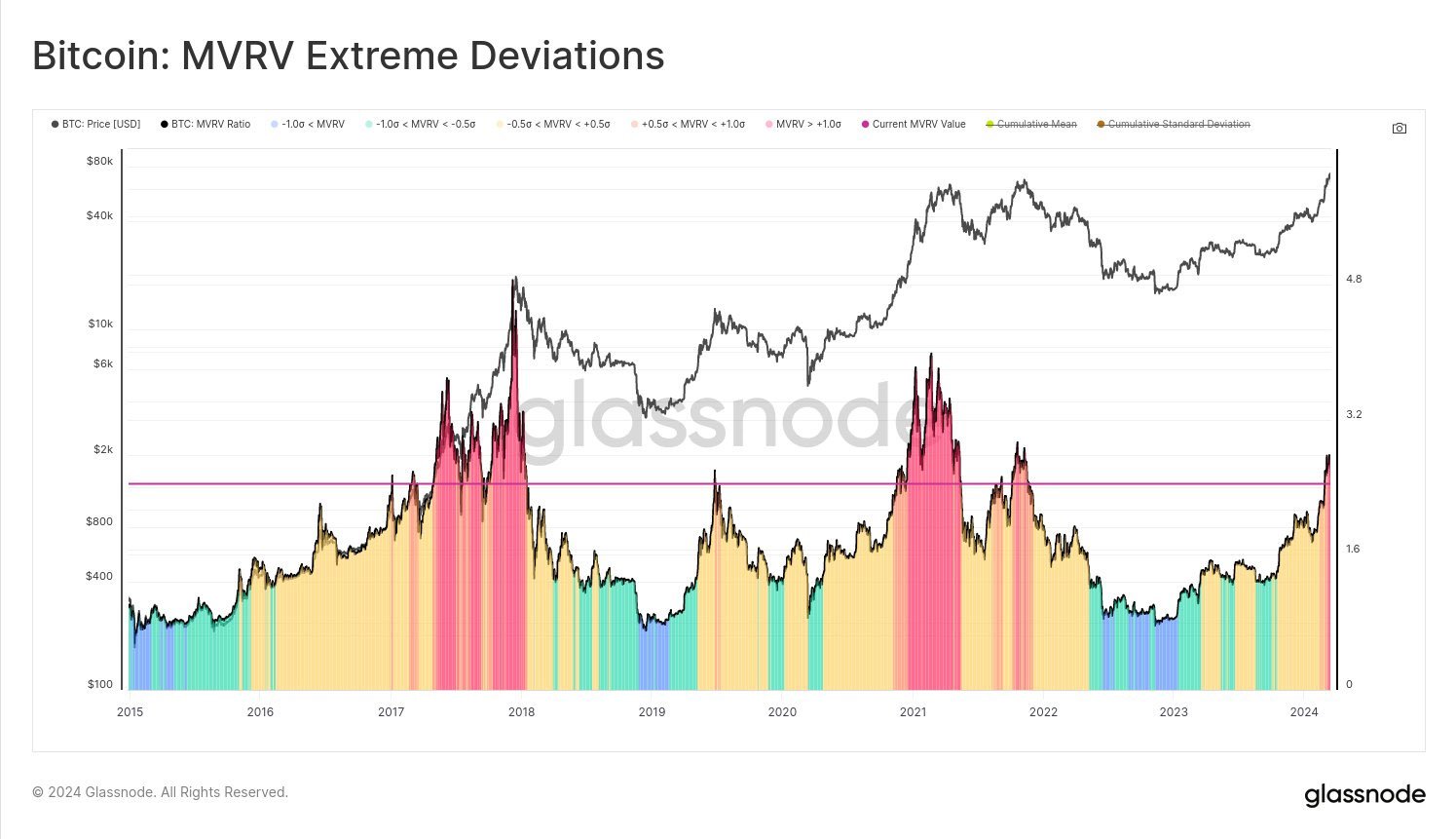

The year’s meteoric rise, witnessing a 52% surge year-to-date, has propelled Bitcoin’s MVRV (Market Value to Realized Value) ratio to remarkable heights. Notably, at $70,800, this metric soared one standard deviation above its mean, historically signaling a point where investors are incentivized to realize profits. This, in return, leads to transient selloffs in the bull market.

Check elucidated on this phenomenon, asserting:

“It makes all the sense in the world for Bitcoin to take a pause here given MVRV reached +1 [standard deviation] levels, where numerous major corrections/peaks were hit in the past.”

Bitcoin Correction: A Pivotal Sell-Side Pressure

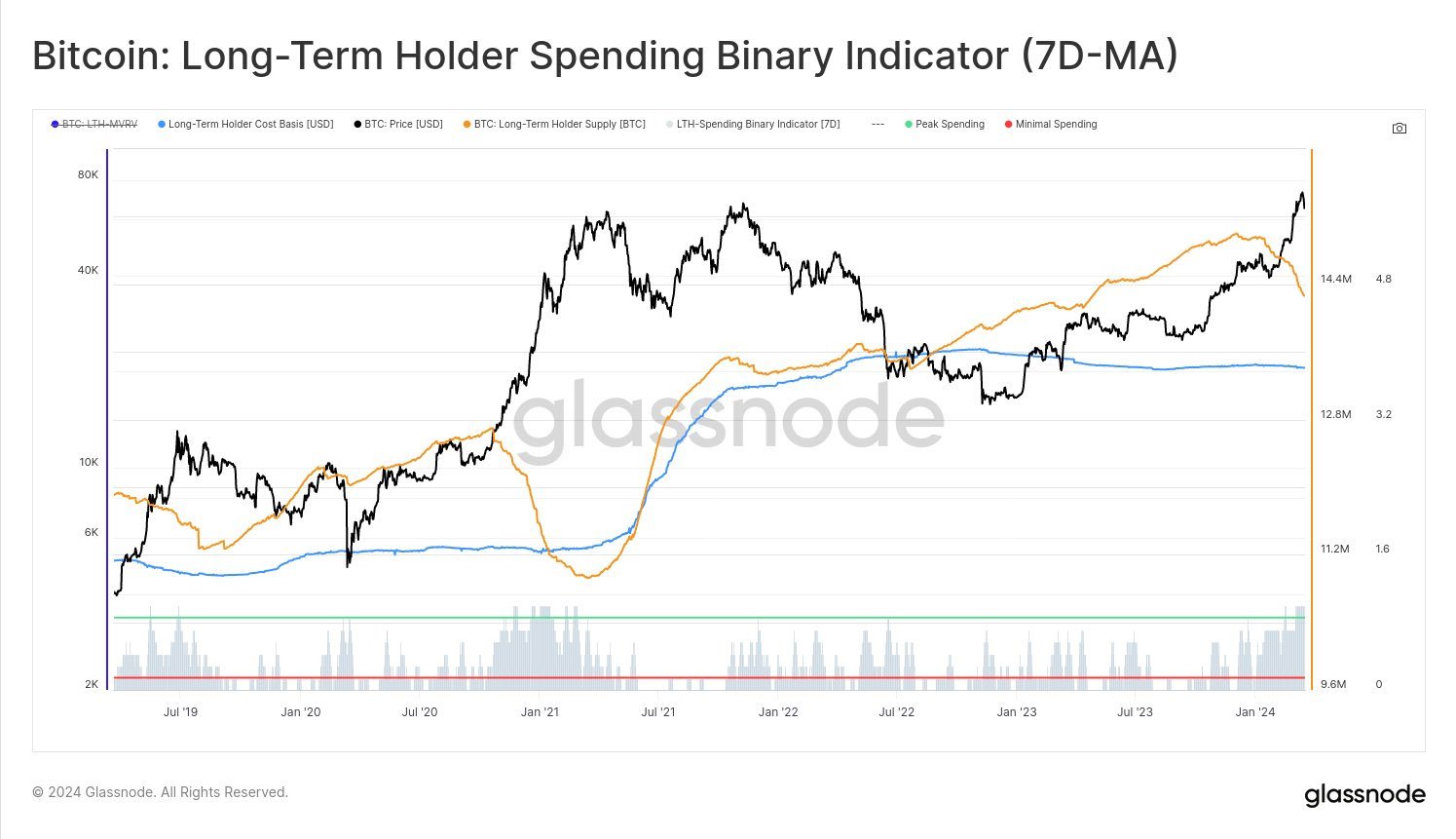

Check noted that the long-term holders, defined as entities retaining their coins for a minimum of 155 days, have been fervently offloading their holdings in recent months as bitcoin overtook its previous all-time high (ATH) of $69,000. According to analysts, their actions have been pivotal, with around 735,000 BTC re-entering liquid circulation.

Interestingly, Glassnode estimates that around 60% of this bitcoin outflow stems from the Grayscale Bitcoin Trust (GBTC), while the remaining portion can be attributed to individual HODLers.

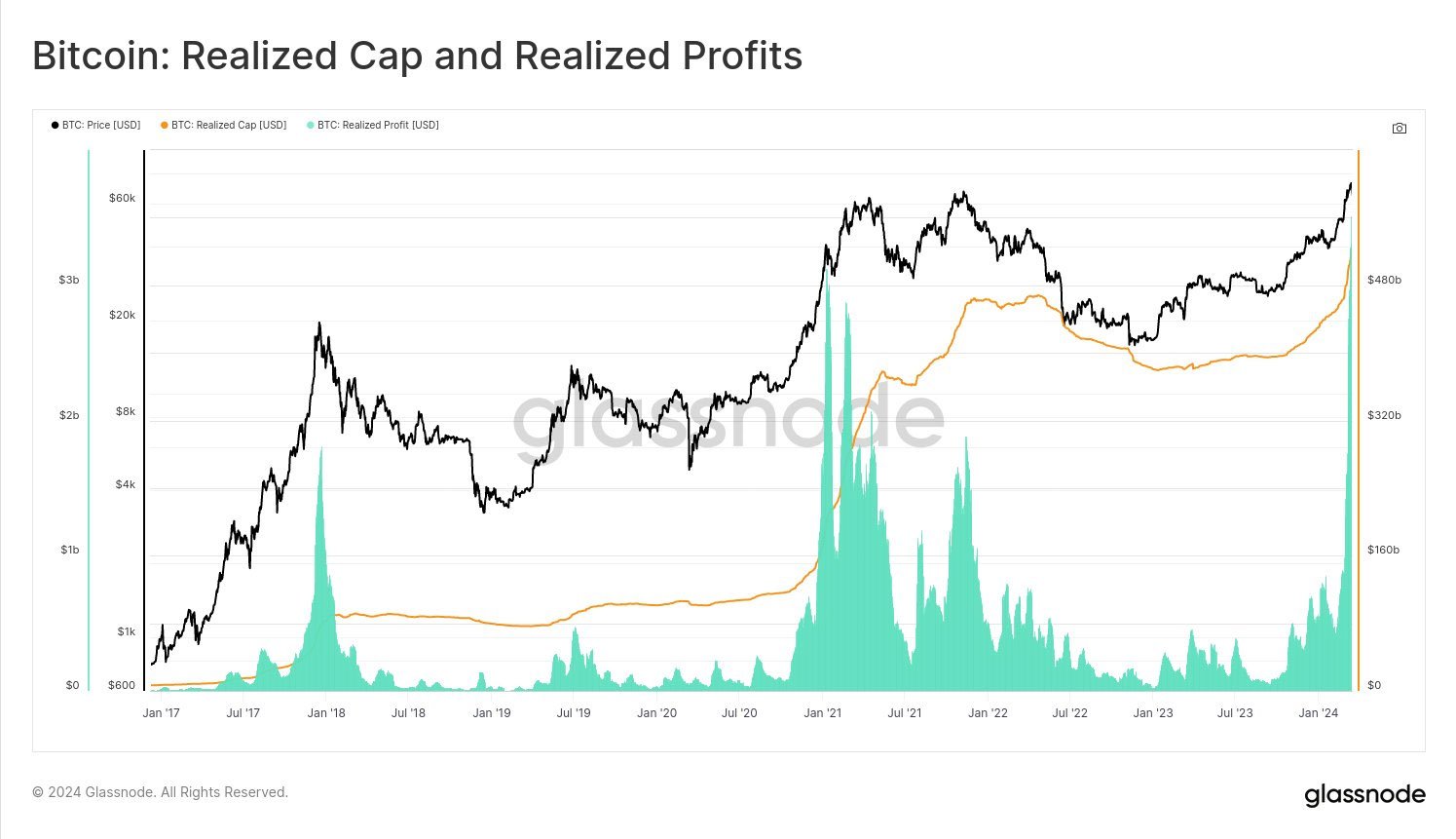

According to Check, this trend represents one of the most reliable patterns within Bitcoin market cycles. As HODLers capitalize on profit-taking opportunities, the realized profit metric experiences a surge, reflecting the revaluation of coins from lower to higher cost bases.

Notably, as the analyst explains, this indicates both sell-side activity and a measure of capital inflows into the Bitcoin market, underscoring the sustained vitality of the ongoing bull market.

‘Least Volatile Uptrends in History’: Glassnode

Despite the significant sell-side pressure exerted by long-term holders, bitcoin has demonstrated remarkable resilience. Following its plunge to a three-year low at $15,500 subsequent to the collapse of FTX in November 2022, Bitcoin embarked on a remarkable journey towards its all-time highs (ATH).

Even in the wake of a notable retreat over the weekend, with price trading around $62,800, bitcoin merely recorded a 13% decline for the week. Check describes this market as driven by spot demand, stating:

“This speaks to one of the most robust, spot demand driven BTC bull markets in history. Objectively one of the most robust, and least volatile uptrends in history.”

Ongoing Marketing Correction

Meanwhile, bitcoin’s value dipped below the $64,000 threshold in early trading on Tuesday, prompting a flurry of liquidations of leveraged positions. According to data from CoinGlass, the correction in price has resulted in significant long positions liquidation, totaling $135 million, on centralized exchanges.

Commenting on the ongoing correction phase, Check stated that it is healthy for the market to pause, correct, or consolidate at its current juncture, allowing stakeholders to digest recent movements.