BTC’s recent rally to $65,000 has captured the attention of investors worldwide. However, amidst the excitement, analysts are urging caution, warning of a potential bitcoin correction in the near future. The insights provided by market experts explore what might lie ahead for the flagship digital asset.

Rapid Rise and Cautionary Notes

Bitcoin’s surge in the final week of February marked its best performance since 2020, climbing from around $50,000 to soar above $63,000. Despite this impressive rally, analysts like Yuya Hasegawa from Bitbank caution against the sustainability of such rapid price movements. Hasegawa remarks that the recent price action seems too quick and too big to be sustained over the next month.

He stated:

“Cash inflows into spot bitcoin ETFs appear to be accelerating and overwhelming these technical signals.”

Unrealized Profit Margins and Seasonal Risks

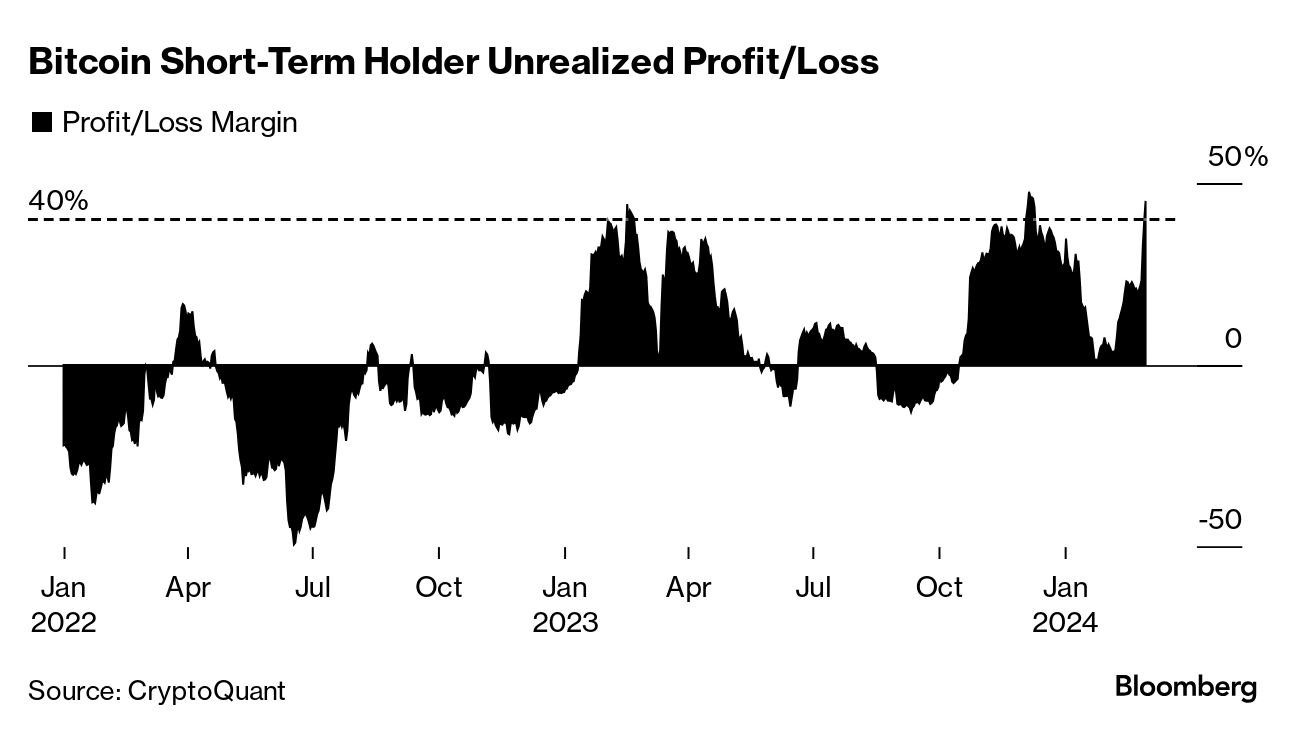

Data from CryptoQuant reveals that unrealized profit margins are nearing levels historically associated with corrections, currently standing at 32%. Analysts warn that a correction could be anticipated around the 40% mark.

Additionally, March introduces seasonal risks, prompting profit-taking for tax payments. David Duong from Coinbase notes:

“March tends to present seasonal risks in traditional capital markets, and the cryptocurrency market may not be immune from them… March will then mean grinding in a sideways pattern within a tight range before we see the next leg higher.”

Potential Market Dynamics and External Factors

The combination of more volatile price movements and increased trading volumes could signal a trend reversal. Hasegawa emphasizes the importance of caution, stating, “In the very short term, the price may move higher, but soon it will probably become difficult to continue as the market begins to develop a sense of caution, so we should tread carefully into March.”

External factors such as the conclusion of the Federal Reserve’s Bank Term Funding Program and concerns surrounding regional banks could influence bitcoin’s price action.

Hasegawa said:

“There is still a crisis spillover risk for small regional banks. Another banking crisis could cause the Fed to launch a brand new liquidity injection program, but if the crisis grows large enough to unsettle the equity market, it could also impact the crypto market,”

Historical Challenges and Optimism for 2024

March has historically been a challenging month for Bitcoin, with declines observed in six out of the last 11 years. However, despite these challenges, the outlook for 2024 remains optimistic. Factors such as increasing institutional adoption and favorable supply dynamics leading to the halving event contribute to this positive outlook. Duong predicts the possibility of reaching all-time highs in the first half of the year is higher than many would think.

He added:

“March will mean going back and forth in a sideways pattern within a narrow range before we see the next rise.”

Analysts’ Insights and Precautionary Measures

Analysts stress the importance of monitoring market conditions closely and exercising caution. Julio Moreno from CryptoQuant advises:

“Data shows unrealized profit margins are approaching extreme levels after last week’s rally. That indicator—currently at 32%—signals a price correction when it reaches about 40%.”

Hasegawa echoes this sentiment, emphasizing the need for investors to be patient and vigilant in the face of potential market fluctuations.

Bitcoin Correction Ahead?

As Bitcoin continues its upward trajectory, investors are reminded to tread carefully in the volatile landscape of the market. While the recent rally sparks optimism, analysts’ warnings of potential corrections serve as a reminder to approach investment decisions with caution. By staying informed and monitoring market dynamics, investors can navigate the challenges ahead and position themselves for long-term success in the ever-evolving world of digital assets.

Disclaimer: The information provided here is for informational purposes only and should not be considered as investment advice. Any investment decisions should be made after careful consideration of individual financial circumstances and consultation with a qualified financial advisor.