In a dramatic turn of events, bitcoin experienced a significant price crash, dropping below the crucial $50,000 mark before rebounding to $55,000.

This sudden bitcoin crash has sent shockwaves through the market, leading to substantial liquidations and sparking widespread concern among investors. Here’s a detailed look at the events leading to this financial upheaval and the factors contributing to it.

On August 5, 2024, bitcoin’s price plummeted to as low as $49,121, marking its lowest level since February. This decline was part of a broader market downturn that saw the entire digital assets market shed approximately $270 billion in value within 24 hours.

The total digital assets market capitalization fell from around $2.16 trillion to about $1.76 trillion, a staggering 17% drop. This marked the largest three-day sell-off in the market in nearly a year, wiping out over $500 billion from the market value.

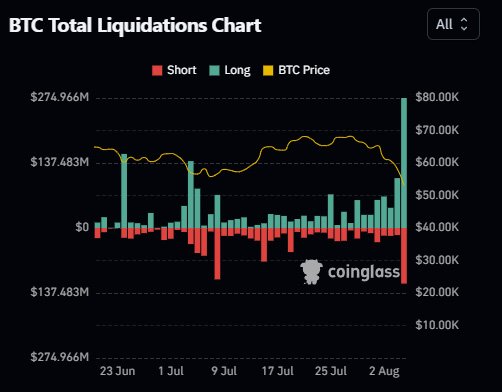

The sudden market downturn led to massive liquidations. Over $1.07 billion in leveraged positions were wiped out within 24 hours, with long traders—those who bet on rising prices—suffering the most.

Bitcoin long positions were particularly hard hit, with losses of $506.56 million since August 3.

According to CoinGlass data, the single largest liquidation involved a BTC-USD transaction worth $27 million on Huobi.

Several external economic factors contributed to this market chaos. A significant factor was the rising fear of a global recession, spurred by an increase in the U.S. unemployment rate to 4.3%, up from 4.1%.

This unexpected rise has heightened recession fears, causing investors to worry about the Federal Reserve’s response.

Anndy Lian, an intergovernmental blockchain expert, noted the increasing interconnectedness between traditional financial markets and digital assets. He stated:

“There is a growing connection between traditional financial markets and cryptocurrency markets, meaning that disruptions in one can lead to instability in the other.”

He added that the Federal Reserve may be “slow to respond with interest rate cuts,” and investors believe that adds to the chaos.

The broader market turmoil also saw significant losses in equities, particularly in Asia-Pacific markets. Japan’s Nikkei 225 fell by as much as 7%, driven by significant losses in Japanese banking stocks following a hike in interest rates by the Bank of Japan.

The central bank’s decision to raise its benchmark interest rate to the highest level in 16 years sent shockwaves through global financial markets.

Market analysts have offered various perspectives on the downturn. Markus Thielen, founder of 10X Research, pointed out that the U.S. economy appears weaker than initially believed, predicting a high likelihood of a 2025 recession.

He had warned on August 2 that if the stock market continues to decline, bitcoin prices could revisit the $50,000 level and potentially drop further.

10x Research predicted a bleak future for the Bitcoin market. They mentioned:

“Although Bitcoin has been in a gradual downtrend, marked by three tops and two bottoms, we anticipate the support line at $55,000 will break, potentially driving prices down to $42,000.”

Alex Kuptsikevich, a senior market analyst at FXPro, also suggested that bitcoin’s downtrend could extend to the $42,000 mark if it fails to find strong buyer support.

He said, “At its lowest point, Bitcoin dipped below its 50-week moving average. Without strong buyer support right now, it goes even lower, and it would trigger an even more active sell-off as it did in late 2021 and early 2022. If it doesn’t hold either, it’s worth preparing for a failure toward $42K.”

Meanwhile, Arthur Hayes, co-founder of BitMEX, speculated about significant market players potentially dumping their digital assets.

The market sentiment has drastically shifted from greed to fear. The Bitcoin Fear and Greed index dropped to 26% from last week’s 74%, indicating a sharp rise in market fear.

This shift reflects the growing concern among investors about the future direction of the market.

Despite the gloomy outlook, some analysts believe bitcoin could avoid further downside pressure if it manages to remain above the $51,000 mark.

The pseudonymous analyst “MoonCarl” emphasized the importance of this support level, stating, “BTC must get back above the support, otherwise we might dump to $45,000.”

However, Bitcoin’s dominance in the market has increased to 58%, its highest level since May 2021. This rise in dominance suggests that while the overall market is suffering, Bitcoin is consolidating its position relative to other digital assets.

The volatility in the market has also heightened security concerns. The FBI issued a warning about scammers exploiting the market crash to steal users’ funds.

The agency advised users to be cautious of unsolicited messages or calls indicating account problems and urged them to verify any issues through official channels.

This warning comes amid a significant increase in digital-asset-related fraud and hacking incidents. In the first half of 2024, hackers stole nearly $1.4 billion worth of digital assets, more than double the amount stolen in the same period in 2023.

The recent bitcoin crash and the broader market turmoil highlight the volatility and interconnectedness of global financial markets. With fears of a global recession, rising unemployment rates, and significant liquidations, investors are understandably anxious.

While some analysts hold a grim outlook, predicting further declines to levels as low as $42,000, others believe bitcoin can recover if it holds key support levels.

In these uncertain times, the words of Tristan Dickinson, CMO of Bitcoin scaling solution exSat Network, resonate:

“Bitcoin isn’t immune to global macro events. The 12% plunge in the Nikkei, coupled with dismal performances from the Dow Jones, S&P 500, and Nasdaq, is fueling global recession fears.”

He added, “August and September are historically weak months, suggesting potential sideways movement and further tests of Bitcoin’s support levels.”