Bitcoin, the leading digital asset, faced a tumultuous turn of events as its price plummeted to a weekly low of $65,000, causing significant distress among investors. This bitcoin crash, marking a setback after a period of remarkable gains, sparked a flurry of liquidations exceeding $500 million.

Market Turmoil

The digital assets market was rattled by the sharp decline in bitcoin prices, with altcoins also experiencing substantial losses. Many altcoins plunged by more than 30%. The broader altcoin market mirrored bitcoin’s downward trajectory, amplifying unease among investors.

Bitcoin Crash Causes Liquidation Avalanche

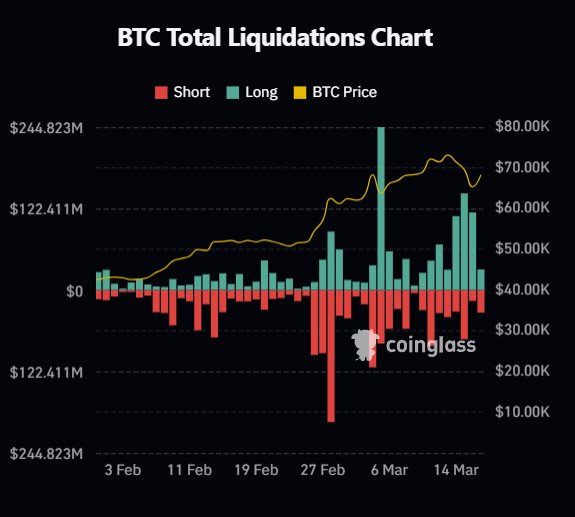

The price correction led to a surge in liquidations, with over 151,000 traders facing margin calls within 24 hours. Bitcoin’s dominance in the market was evident, as it accounted for the majority of total liquidations, amounting to over $140 million on Thursday. Long traders bore the brunt of the losses, with over $111 million liquidated during that timeframe.

According to Coinglass data, long traders lost $370 million during the 3-day price decline, while short sellers lost $120 million.

Analyst Warnings

Market analysts, including Markus Thielen, CEO of 10x Research, sounded alarm bells, warning of further downside risks for Bitcoin. Thielen’s prediction of a potential drop to $63,000 sent a sobering message to investors, urging caution in navigating the current market environment. Concerns about Bitcoin’s market structure, including low trading volumes and liquidity, exacerbated the risk of sharp price corrections.

Whales Withdraw

Amidst the price surge, Bitcoin whales withdrew a considerable quantity of BTC from exchanges, seeking to realize profits. Over 21,000 BTC was withdrawn in a week, with a staggering $752 million withdrawn in a single day, marking the highest single-day withdrawal since May 2023. The mass withdrawal had swift implications, leading to a notable crash in bitcoin prices.

BTC Price Extends Decline

Bitcoin’s price fell below the $65,000 level, indicating a plunge of over 13% from its all-time high of $73,836. Despite the recent downturn, Bitcoin’s 1-month gains stood at over 25%. However, the latest trend was catalyzed by massive long liquidations, totaling over $400 million within the last 4 days.

Trader Skew highlighted key bidding areas on major exchanges, pinpointing interest zones between $60,000 and $64,000.

He added:

“Majority of the selling has been driven by takers (market selling). Constant spot selling since $74K especially from coinbase & binance.”

Futures Gap and Potential Rebound

As Bitcoin lurched towards $60,000, market analysts eyed the potential for an early-week comeback. The widening gap in CME Group’s Bitcoin futures market between $69,135 and spot price could provide impetus for relief, aligning with historical precedent.

Bitcoin’s sharp decline to $65,000 triggered significant market upheaval, with massive liquidations and heightened investor unease. While analysts warn of further downside risks, some remain optimistic about potential rebounds fueled by institutional investments and historical market patterns.

Market Outlook

Despite the bearish sentiment, some market observers remained optimistic, citing ongoing buying from United States spot Bitcoin Exchange-Traded Funds (ETFs). Thomas Fahrer, CEO of Apollo, highlighted the potential for institutional wealth allocation to BTC, suggesting a positive outlook for the digital asset in the coming months.

He stated:

“Yes, this is Bear Trap, Waves of liquidity are going to rain down on the Bitcoin ETFs. Real money hasn’t even started allocating. If a 1B Hedge Fund position sent BTC tumbling 10%, how high do you think 150B from advisers is going to send it?”