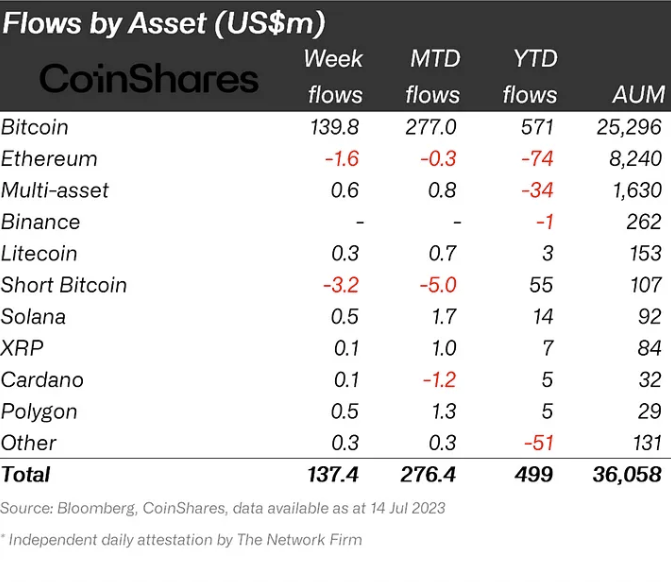

According to data from Coinshare, bitcoin overwhelmingly dominates new digital asset investments, accounting for an astounding 99% of the total investment’s inflow. Investors continue to show a strong preference for bitcoin as they channel their investments into the digital asset market.

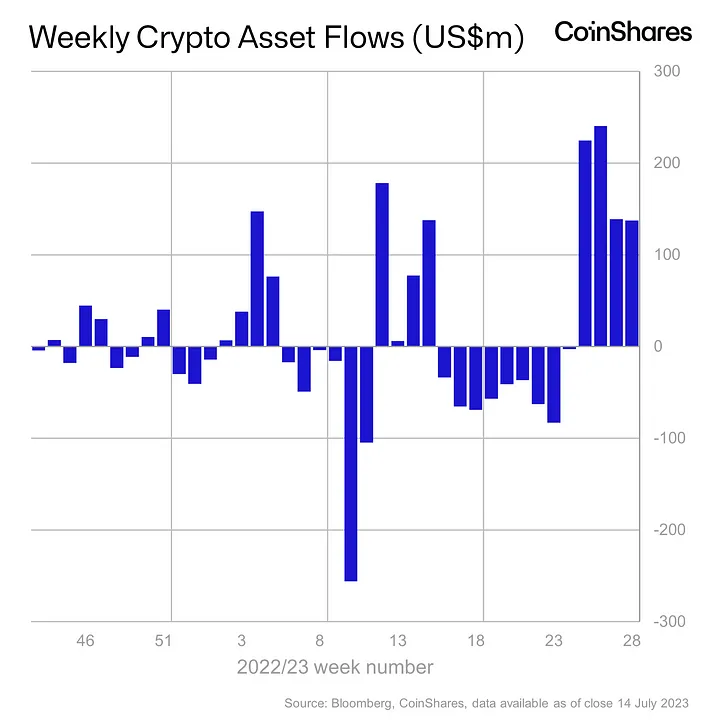

Last week, digital asset investment products witnessed a noteworthy influx of US$137 million.

Coinshare reports that after incorporating some late updates to the previous weeks’ data, the cumulative inflows over the past four weeks reached an impressive US$742 million, marking the most substantial consecutive run of inflows since the final quarter of 2021.

Of the total investment inflow to the digital asset market, bitcoin secures an overwhelming 99% share.

However, short bitcoin investment products faced their 12th consecutive week of outflows, losing US$3.2 million. As a result of this combination of price appreciation and outflows, the total assets under management for short bitcoin investments have plummeted from their peak of US$198 million in April to a mere US$55 million.

In terms of regional distribution, the inflows were predominantly concentrated in North America, with investments of US$109 million and US$28 million in the U.S. and Canada, respectively. Conversely, Europe experienced minor outflows overall, except for some slight inflows recorded in Switzerland.