Bitcoin (BTC), which had comfortably held a value above $40,000 until January 22, witnessed a sudden decline of 3.5% within the last 24 hours, marking a significant shift in the digital asset landscape.

This bitcoin drop had a major impact on futures traders, resulting in substantial losses. Coinglass reported that within the past 24 hours, BTC positions totaling $63 million were liquidated, with a predominant 80% of these positions being longs.

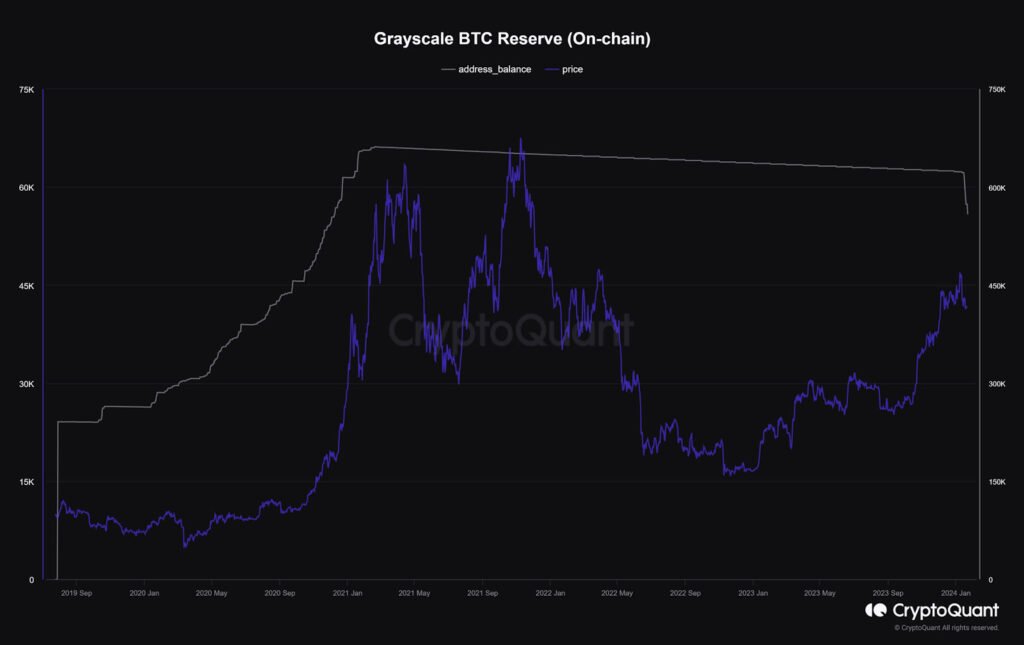

A major catalyst for this downturn stems from massive outflow of funds from Grayscale Bitcoin Trust. According to CryptoQuant’s data, a staggering 14,291 bitcoin were withdrawn from the fund on January 22, amounting to $570 million at current market prices.

Furthermore, reports indicate that the now-defunct digital asset exchange FTX has liquidated its stake in Grayscale Bitcoin Trust, selling around 22 million shares valued at nearly $1 billion, bringing its GBTC ownership to zero.

Notably, since January 11, Grayscale’s on-chain balance has plummeted by 66,000 BTC, predominantly being liquidated in the secondary market.

Drop in Interest

The decline in Bitcoin’s price has coincided with a notable decrease in discussions surrounding digital assets. Analyzing the Social Volume screen on Santiment, it is revealed that discussions about BTC fell by 35% compared to the period when the Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs.

Some prominent figures, including CNBC’s Jim Cramer, have labeled the ETF approval as a “sell-the-news” event, contributing to the overall negative sentiment.

Bitcoin Drop And Network Difficulty Decline

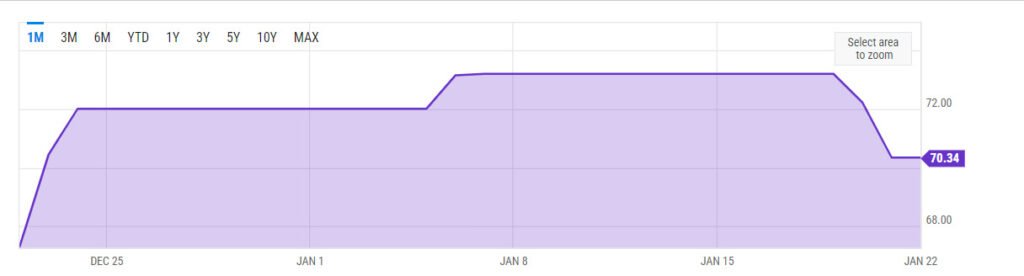

Adding to the challenges, Bitcoin Network difficulty experienced a significant drop of -3.90%, the largest negative correction since December 5, 2022. This drop was influenced by the curtailments of Texas miners due to extreme cold conditions, impacting the overall hashrate.

The current Bitcoin hashrate stands at 563.47 EH/s, with a mining difficulty of 70.34 T at block height 827,010. A lower hashrate can lead to decreased mining costs, pressing miners to set lower break-even price points, potentially influencing price trends.

Weighted Sentiment and Potential Rebound

Bitcoin’s weighted sentiment, measuring positive and negative comments about the asset, has slipped to 0.359, indicating a less optimistic average perception of BTC.

However, historical patterns suggest that after such declines, Bitcoin has the potential for a subsequent increase in value. Instances like the decline on November 30, 2023, when the weighted sentiment was almost the same as the current level, followed by a price increase to $44,080 on December 5, 2023, showcase the potential for a rebound.

Despite the current downturn, some market participants are positioning themselves for a potential rebound. Spot on-chain data indicates that a whale purchased $1.03 million worth of BTC just before it fell below $40,000, with another whale purchasing $600,000 worth of BTC as the price dropped further.

The recent Bitcoin price decline is multifaceted, with factors like Grayscale sell-offs, decreased interest, network difficulty drops, and sentiments affecting the market. While challenges persist, historical trends and market participant actions suggest the possibility of a rebound in the coming days.