In the race for the U.S. Securities and Exchange Commission’s (SEC) nod on Spot Bitcoin Exchange-Traded Funds (ETFs), a marketing war has erupted among asset managers vying for approval. With anticipation high, the SEC’s delay has set the stage for potential approvals, amplifying the spotlight on these digital asset products.

In recent weeks, asset management firms Hashdex and Bitwise have intensified their promotional efforts through engaging ad campaigns. Hashdex’s advertisement, reminiscent of the skepticism around emerging technologies in the 1980s, cleverly draws parallels between the initial doubts surrounding home computers and the current sentiment towards Bitcoin’s disruptive potential.

In a peek into conversations about computers that happened decades ago, its stated in the interview:

“It’s amazing to me the tremendous impact that the home computers have had on everyone, And yet it seems the people I’ve talked to say that it takes you longer to do something by putting it into a computer and calling it up again than if you just kept simple records yourself in the house.”

Then the ad concludes that “Understanding disruptive innovation takes time,” and that “Bitcoin’s time has arrived.”

Hashdex has previously advertised Bitcoin before. The company released another promotional content on X platform on December 20th.

“Stocks aren’t crypto. Fixed income isn’t crypto. Precious metals? Nope. Not crypto either,” it says. “Your bitcoin investment deserves a crypto-focused firm.”

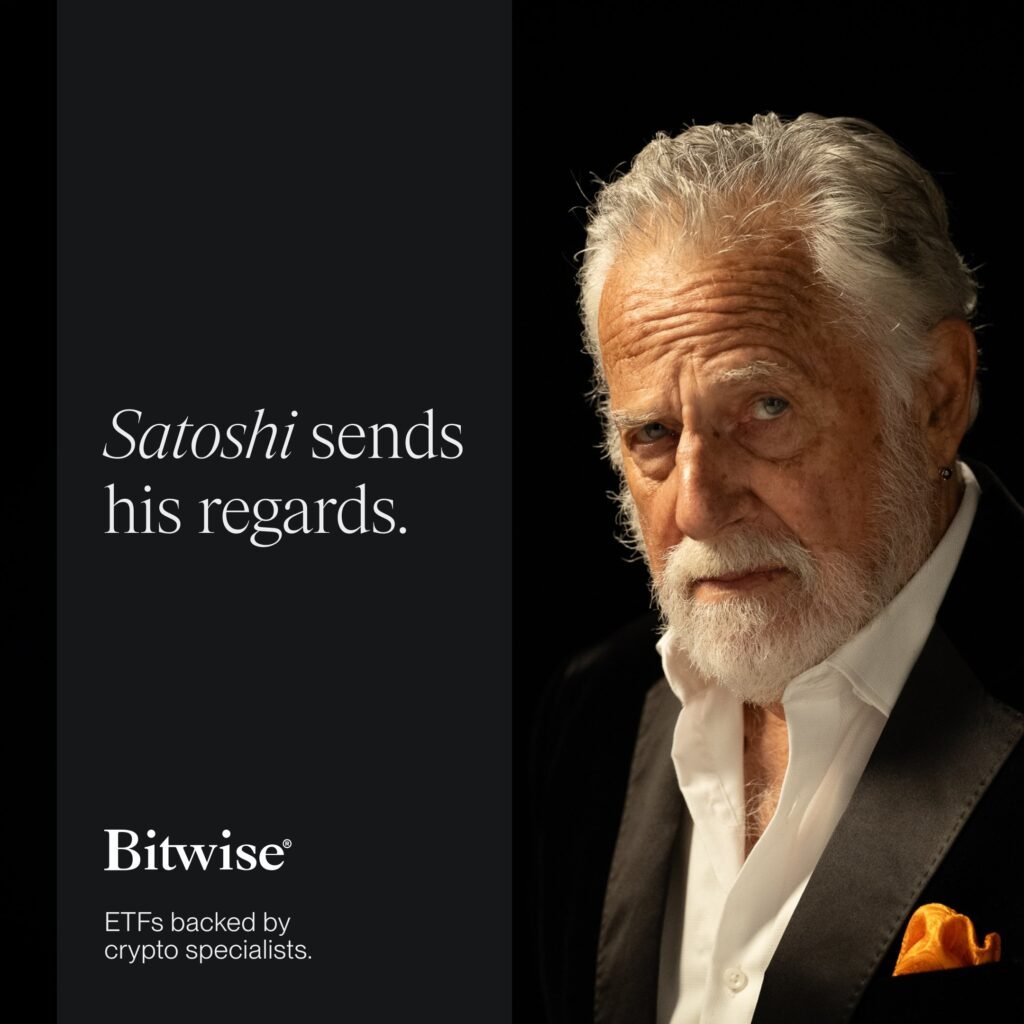

Meanwhile, Bitwise roped in actor Jonathan Goldsmith, famed for his role as “Most Interesting Man in the World” persona, to advocate for Bitcoin, capturing public attention and sparking discussions about the future of Bitcoin ETFs.

Anticipation Builds Amid SEC’s Delays

As the SEC deliberates on the approval of Spot Bitcoin ETFs, the financial world awaits its decision. Although the SEC has greenlit investment vehicles tied to digital asset futures, the awaited approval for Spot BTC ETFs on U.S. exchanges remains pending.

Analysts speculated the possibility of multiple approvals in January, igniting hope for a breakthrough in the regulatory landscape. The delay in the SEC’s decision, setting a December 29 deadline for amendments, hints at potential simultaneous approvals to streamline the process for various applicants.

The Marketing Blitz and Investor Focus: Hashdex Ups the Ante

Hashdex has upped its marketing efforts, highlighting the importance of investor education amid the Bitcoin market frenzy. Its recent ad campaigns emphasize the significance of choosing issuers with extensive experience in handling ETFs across diverse markets, aiming to steer investor focus toward thematic asset management in the digital asset space.

Chris Glendening, Hashdex’s head of marketing, stated:

“We believe investors will gravitate towards thematic asset management experience with a sole focus on digital assets and bitcoin, with extensive experience running bitcoin ETFs in several markets,”

Bitwise and Competitors

Bitwise says in its ads that it offers “ETFs backed by crypto specialists.”

Bitwise’s assertive campaign, “backed by crypto specialists”, accentuates the competitive landscape. Traditional finance giants like Invesco, Fidelity, and Franklin Templeton join the fray against smaller, more digital-asset-focused entities like Bitwise, VanEck, and Valkyrie.

Public perception plays a pivotal role as experts weigh in on the advertisements. Bloomberg ETF analyst Eric Balchunas praised Hashdex’s campaign, noting the resonance it evokes among a generation that once doubted the potential of computers and the internet.

The Road Ahead: Regulatory Hurdles and Industry Confidence

The SEC’s strategic delay, aligning potential approvals by setting deadlines for amendments, hints at an imminent breakthrough for Bitcoin ETFs. Despite the absence of explicit approval, a multitude of ETFs awaits the SEC’s nod, with most final decision dates set for March, while ARK Invest‘s bid awaits a January 10, 2024 decision.

As the Bitcoin world and traditional finance collide in this regulatory arena, the industry braces for potential landmark approvals that could reshape the landscape of digital asset investments.

While the SEC’s delay fosters anticipation, the advertising battle among firms reflects a broader attempt to shape investor perception, ultimately influencing the future of Bitcoin ETFs in the U.S. market.