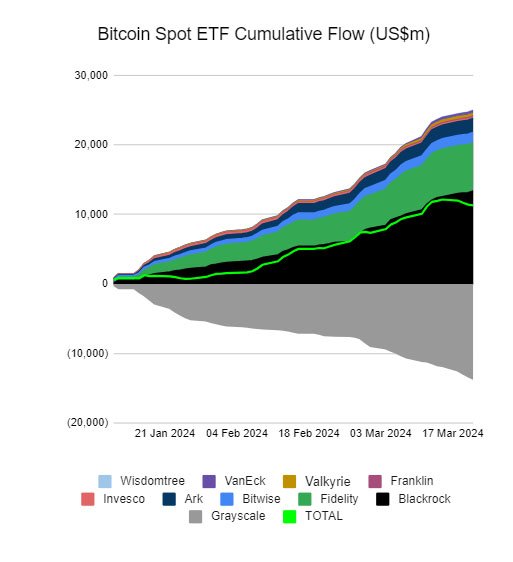

Despite the ongoing Bitcoin spot Exchange-Traded Fund (ETF) outflows, primarily driven by Grayscale’s Bitcoin Trust (GBTC), analysts believe that the trend might soon stabilize.

In a recent post on social media platform X, senior Bloomberg ETF analyst Eric Balchunas suggested that the significant GBTC outflows are largely attributed to bankruptcies within the digital asset industry, and might be nearing an end.

Grayscale’s Outflows Streak

Grayscale’s Bitcoin ETF experienced another significant day of outflows on March 21, with around $359 million exiting the fund, according to the data by BitMEX Research. This follows a week of substantial outflows, with $642 million on March 18 marking the largest single-day outflow on record.

The total outflows for GBTC this week amount to $1.8 billion, marking the fourth consecutive day of net outflows across all 10 Bitcoin ETFs. However, analysts remain optimistic that the worst of the outflows might be approaching an end, especially as bankruptcies within the industry settle.

Genesis’ Connection with GBTC Outflows

Balchunas noted that much of the outflow activity could be associated with firms like Gemini and Genesis, possibly purchasing Bitcoin with cash, which could be supporting the market.

As of March 21, Grayscale’s Bitcoin Trust’s assets under management totals $23.2 billion. This implies that the trust has lost 42.3% of its shares with a notable decline of $13.6 billion since its conversion to an ETF on January 11. Balchunas indicated that the worst of the outflows may soon be over, leaving primarily retail investors, stating:

“Takeaway: the worst is [probably] close to being over. Once it is, only retail will be left and flows should look more like the Feb trickle.”

Supporting this analysis, pseudonymous independent researcher ErgoBTC estimated that around $1.1 billion in GBTC outflows in recent weeks may have originated from bankrupt digital asset lender Genesis. They highlighted the correlation between outflows from GBTC and inflows into Genesis, explaining:

“Genesis is back from the dead, taking down more than ~16.8k BTC (+$1.1B) in the last few weeks to 2 new addresses. Likely these coins are primarily sourced from GBTC outflows.”

FTX’s Sell-off

WhalePanda, a pseudonymous market commentator, echoed similar sentiments, referring to a statement from Genesis on March 19 where it indicated that assets would be returned to creditors by selling GBTC shares for bitcoin. This aligns with Genesis’s court-approved plan to liquidate $1.3 billion worth of GBTC shares to repay its creditors.

Furthermore, WhalePanda mentioned the case of bankrupt digital asset exchange FTX, which recently sold 22 million GBTC shares, valued at nearly $1 billion, to liquidate its holdings entirely.

Meanwhile, bitcoin recently experienced a major correction, declining from its all-time high to the $61,000 mark. However, it has since rebounded and is currently trading near $63,000. This represents an 8.6% decrease over the week. Nonetheless, the digital asset remains around 24% higher than its value 30 days ago.

As the bitcoin community continues to navigate through these challenges, analysts and investors are anticipating signs of stabilization and potential market recovery in the near future.