In a groundbreaking development in the world of bitcoin investments, newly launched spot Bitcoin Exchange-Traded Funds (ETFs) have rapidly amassed over 500,000 Bitcoin (BTC) within just 54 trading days. This rapid rise in bitcoin ETF inflows underscores the growing institutional interest in bitcoin and marks a significant milestone in the evolution of the market.

Bitcoin ETF Inflows: Rapid Accumulation

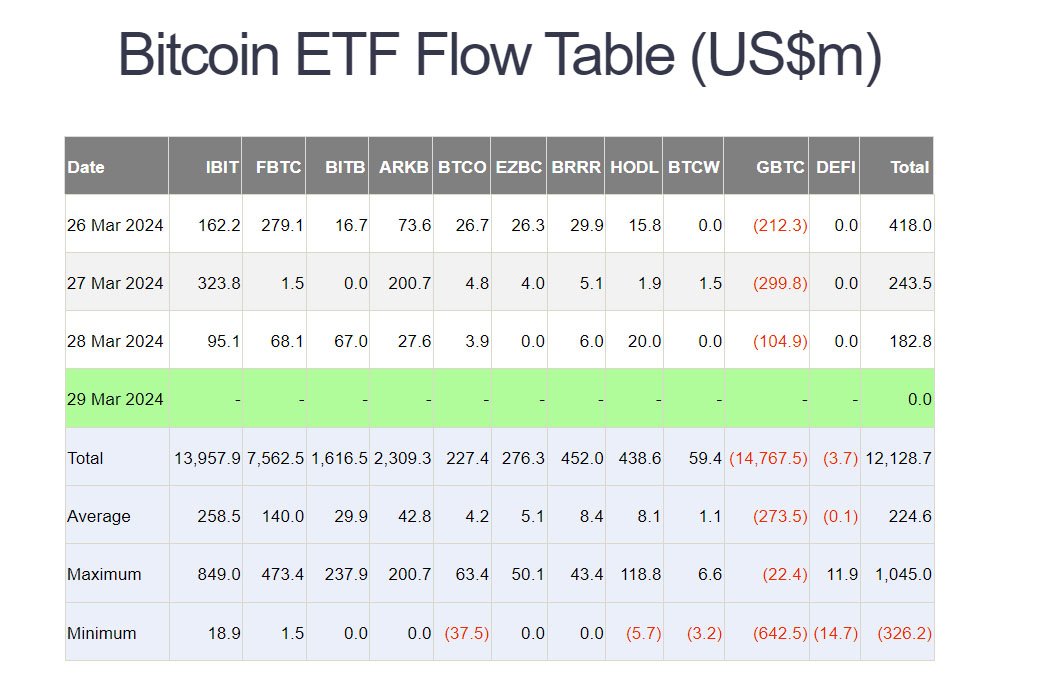

Since their launch in January 2024, nine new spot Bitcoin ETFs have collectively acquired 500,000 BTC, valued at an astonishing $35 billion. This rapid accumulation has been fueled by a series of significant inflows, with Thursday witnessing a massive influx of $287.7 million, according to data from Apollo.

The surge in Bitcoin ETF holdings highlights a growing appetite among institutional investors for exposure to bitcoin. HODL15Capital, a prominent investment firm, emphasized the significance of this milestone, stating:

“The new Bitcoin ETFs purchased more than 500,000 Bitcoin (worth $35 Billion USD) in just 54 trading days.”

Impact on Circulating Supply

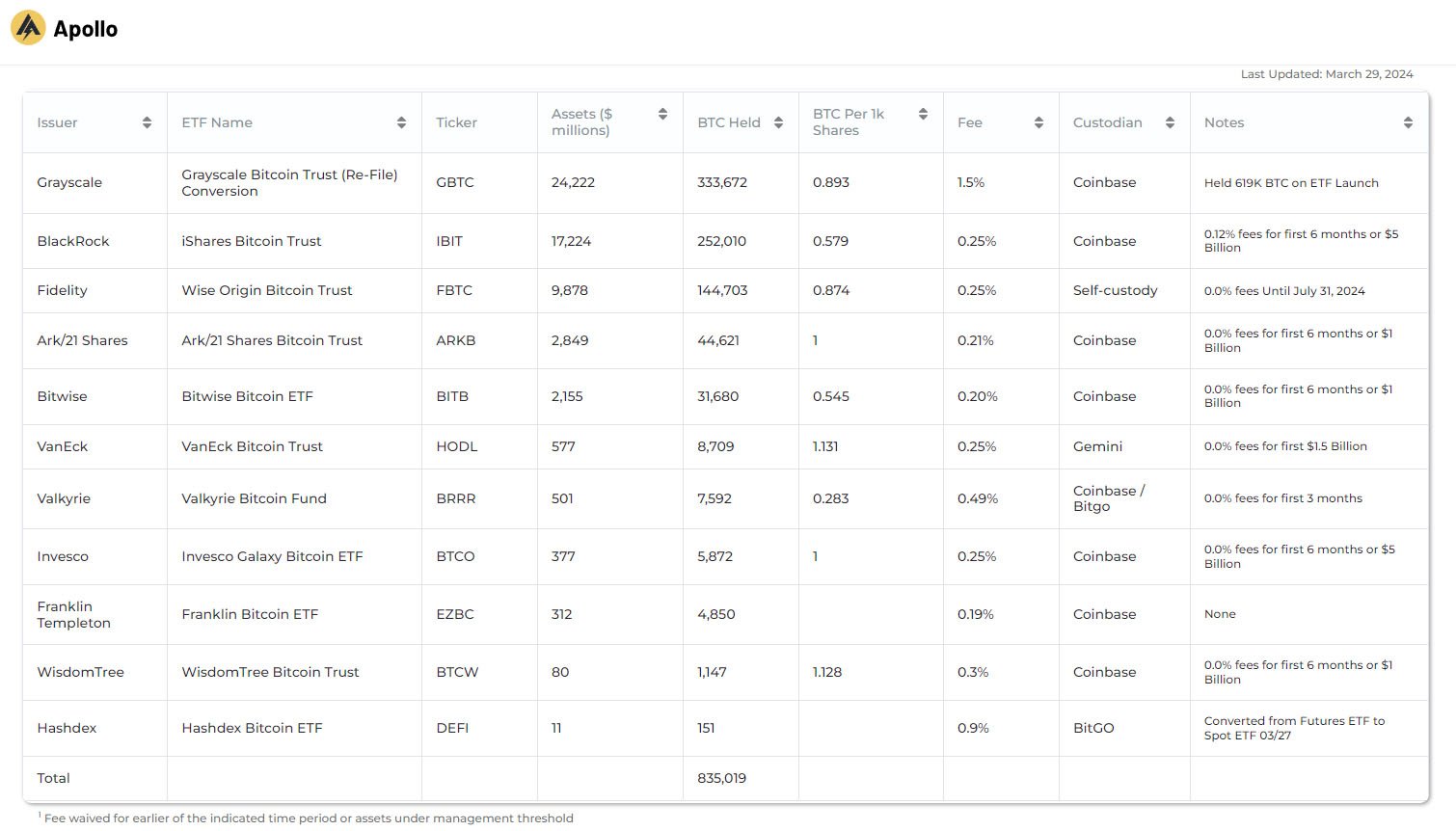

The BTC holdings of these ETFs now constitute 2.54% of the circulating supply, reflecting a substantial presence in the market. Furthermore, when considering all spot Bitcoin funds in the United States, including Grayscale, the total BTC holdings amount to 835,000, representing nearly 4% of the entire supply.

After a period of outflows starting from March 18, ETF inflows rebounded significantly this week, totaling $845 million. This reversal indicates renewed investor confidence and interest in Bitcoin ETFs, despite recent market fluctuations.

Key Players in the ETF Market

BlackRock’s IBIT fund emerged as a frontrunner in attracting inflows, receiving $95 million on March 28. Fidelity and Bitwise also witnessed substantial investments, each receiving around $67 million. Notably, Ark 21Shares experienced a significant inflow of $27.6 million following a surge of $200 million the day before.

While Bitcoin ETFs witnessed substantial inflows, Grayscale’s GBTC fund experienced outflows amounting to $105 million, the lowest since March 12. Since its conversion to a spot ETF in mid-January, GBTC has shed approximately 284,846 BTC, raising concerns among investors.

Conclusion

The rapid accumulation of Bitcoin by spot ETFs, coupled with the rebound in ETF inflows, underscores the increasing institutional interest in bitcoin. Despite the recent corrections in bitcoin price, the market continues to show resilience and potential for further growth in the coming months.

In the words of BlackRock’s CEO Larry Fink:

“The company’s spot Bitcoin ETF is experiencing unprecedented growth, making it the fastest-growing ETF ever.”

This sentiment reflects the optimism and confidence prevailing among investors in the digital asset space.