In a surprising turn of events, Bitcoin exchange-traded funds (ETFs) have witnessed unprecedented inflows despite a volatile market.

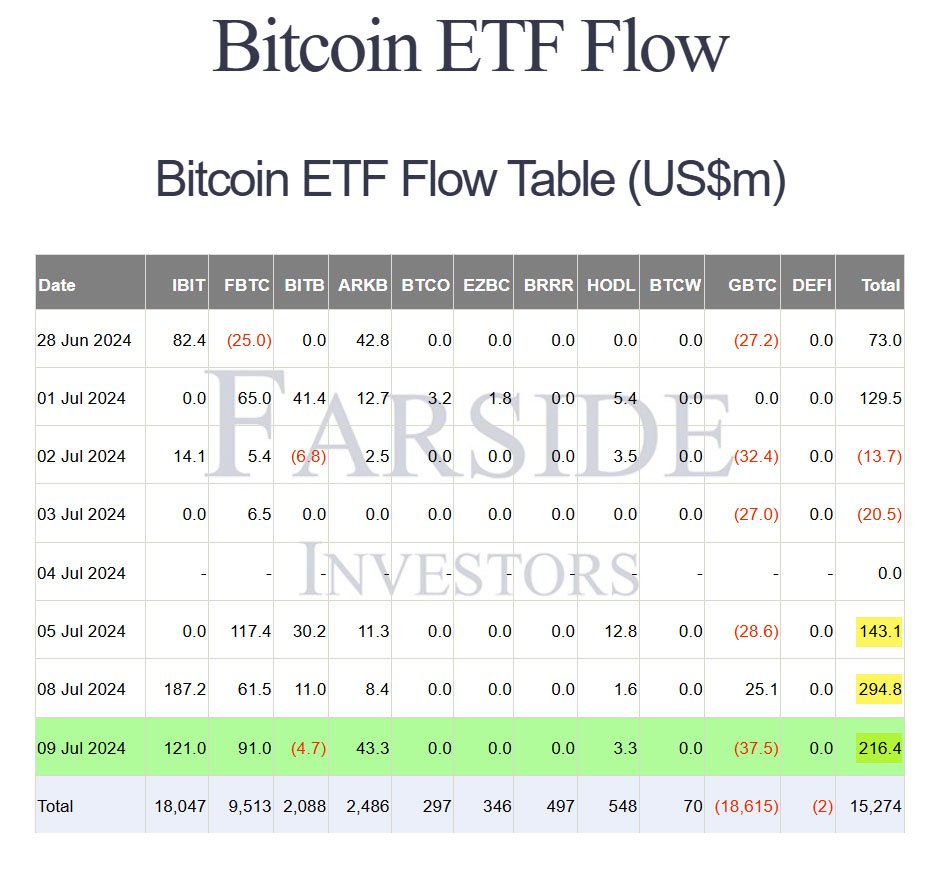

On July 8, U.S.-based spot Bitcoin ETFs recorded a staggering $295 million in net inflows, marking the largest single-day capital movement in over a month.

This surge in Bitcoin ETF inflows highlights a renewed confidence among institutional investors in the long-term potential of Bitcoin.

The recent influx of capital into Bitcoin ETFs is notable given the broader market conditions. Over the past few weeks, bitcoin’s price has seen significant declines, dropping as low as $53,600 on July 5.

Despite this, the 11 Bitcoin ETFs collectively attracted $294.8 million on July 8. This trend continued on July 9, as the investment vehicles attracted another $216 million in funds.

This sustained inflow of capital underscores a growing belief among investors that the current dip presents a buying opportunity.

On July 8, BlackRock’s iShares Bitcoin Trust ETF (IBIT) led the charge with an inflow of $187.2 million, followed by Fidelity’s Wise Origin Bitcoin Fund, which saw $61.5 million in inflows.

Grayscale’s Bitcoin Trust also had a rare positive day, attracting $25.1 million. These figures suggest that institutional investors are capitalizing on the lower prices to strengthen their positions.

The influx of funds into Bitcoin ETFs comes at a time of significant market anxiety.

The German government recently sold off over $915 million worth of bitcoin, and there are looming concerns about the potential market impact of the Mt. Gox creditor repayments, which could release an additional $8.5 billion worth of bitcoin into circulation.

Despite these factors, institutional investors seem undeterred. Charlie Morris, Chief Investment Officer at ByteTree, remarked:

“So many investors still don’t own bitcoin, and that underpins the long-term bull case. This supply storm will soon pass.”

His sentiment reflects a broader optimism that current market pressures are temporary and that bitcoin’s long-term prospects remain strong.

Since their launch, Bitcoin ETFs have become a popular investment vehicle for those looking to gain exposure to bitcoin without directly holding the asset.

These funds have consistently traded at a premium, driven by strong institutional demand. Even during market downturns, Bitcoin ETFs have demonstrated remarkable stability.

On July 8, despite the broader market sell-off, none of the U.S.-based Bitcoin ETFs recorded any exits.

This indicates that investors are not only holding their positions but are also actively increasing them. The stability provided by these ETFs is seen as a safe haven amid market volatility.

Despite the German government’s massive sell-off, it still holds 23,964 BTC, worth approximately $1.38 billion, according to Arkham Intelligence data. Concerns about the possible dump of this amount adds to the market anxiety.

Regardless of these concerns, bitcoin’s price shows signs of recovery, climbing to $58,413 at the time of writing, recording a 4.25% increase in the past couple of days.

This uptick suggests that the inflows into Bitcoin ETFs might be providing some stabilization to the market. Analysts believe that the current buying spree by institutional investors could signal a forthcoming market rally.

A report from CoinShares states:

“… With recent price weakness prompted by Mt Gox and the German Government selling pressure likely being seen as a buying opportunity […] volumes in Exchange Traded Products (ETPs) remained relatively low at US$7.9 billion for the week.”

This perspective is shared by many in the investment community, who view the current market conditions as an opportune moment to buy.

Nevertheless, Bitcoin ETFs have played a crucial role in stabilizing the market during turbulent times.

The substantial inflows seen on July 8 are a testament to the confidence investors have in these financial instruments. By consolidating significant positions during market downturns, investors help cushion market shocks and stabilize bitcoin’s value.

Institutional investors are increasingly viewing market dips as strategic buying opportunities, strengthening their positions in anticipation of a long-term recovery.

Related: Kiyosaki Says He Will Be Happy If Bitcoin Crashes

Bitcoin ETFs are not just booming in the U.S. markets.

Blockchain-focused asset manager DigitalX has recently obtained regulatory approval to introduce its spot Bitcoin ETF in the Australian market, making it the second Bitcoin ETF to be traded on the Australian Securities Exchange (ASX).

The DigitalX Bitcoin ETF, trading under the ticker BTXX, will launch on July 12. According to an April report from Bloomberg, Australian fund manager Betashares is also requesting approval to introduce a Bitcoin ETF on the ASX.

The influx of capital into Bitcoin ETFs has broader implications for the digital asset market.

It signals a renewed confidence in Bitcoin’s long-term potential, despite short-term volatility. This trend could encourage more investors to consider Bitcoin ETFs as a viable investment option, further promoting the adoption of these financial products.

Moreover, the continued inflows into Bitcoin ETFs could help stabilize bitcoin’s price, reducing the impact of large-scale sell-offs. If this trend persists, it could lead to greater market maturity and increased investor confidence in this new asset class.