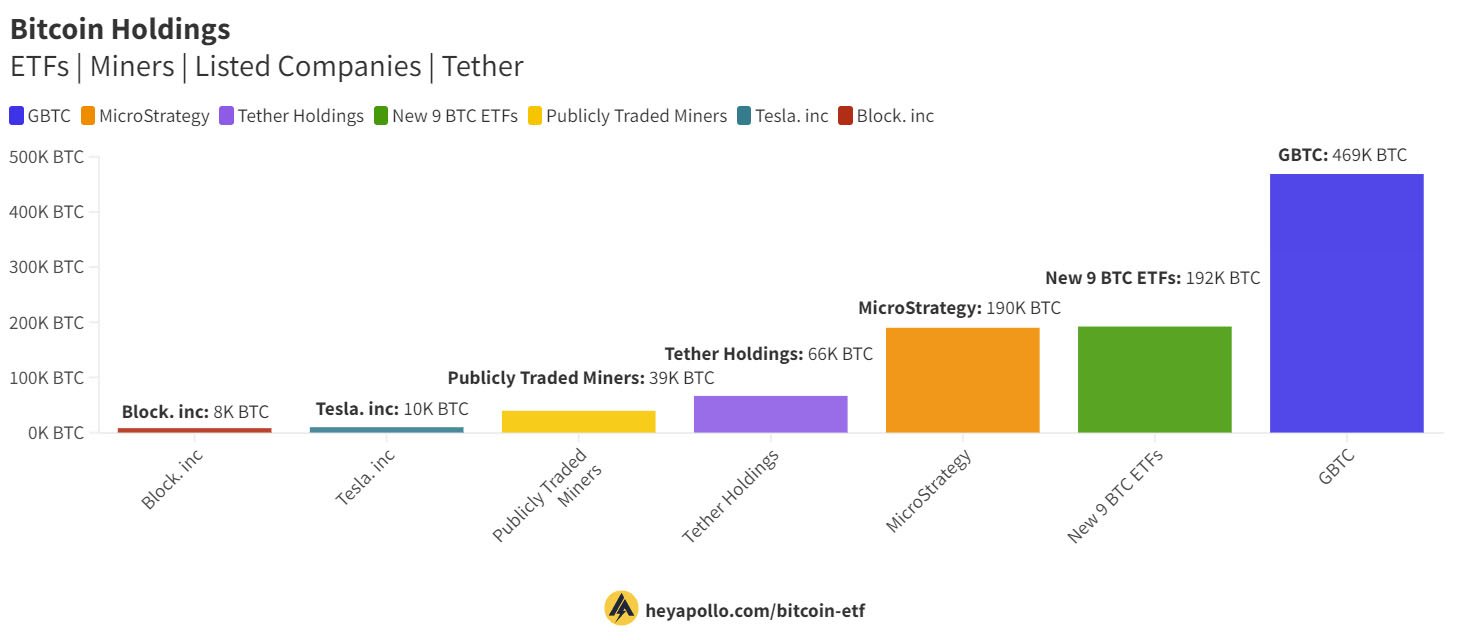

Bitcoin Exchange-Traded Funds (ETFs) have been making significant waves in the Bitcoin market, surpassing even MicroStrategy Bitcoin holdings. The new bitcoin investment vehicles have effectively surpassed MicroStrategy’s 3-year stacking spree in less than a month.

Spot Bitcoin ETFs Gain Momentum

In recent weeks, spot Bitcoin ETFs have seen a surge in popularity, attracting billions of dollars from investors seeking exposure to bitcoin without the hassle of directly purchasing and storing the digital asset. These ETFs, excluding Grayscale’s GBTC, have quickly amassed over 192,000 Bitcoins, according to data from Apollo.

BlackRock and Fidelity Lead the Pack

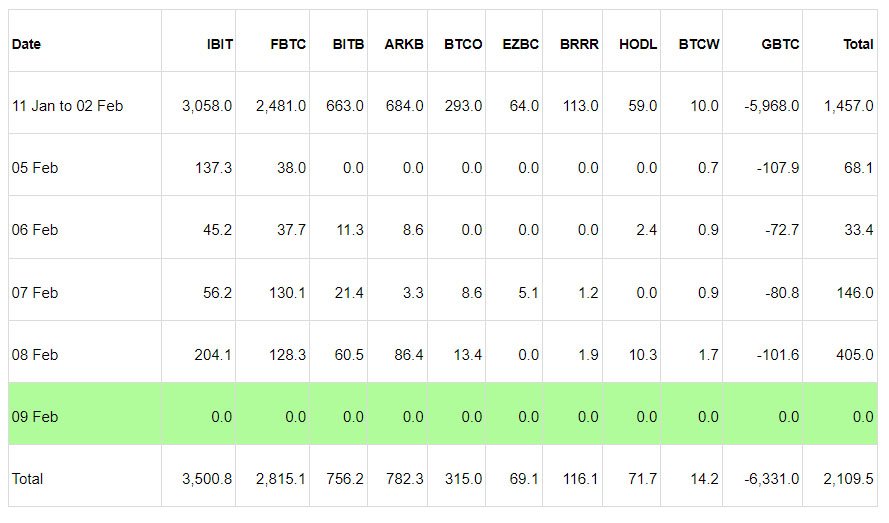

Leading the charge in the world of Bitcoin ETFs are industry giants like BlackRock and Fidelity. BlackRock’s IBIT Bitcoin ETF, in particular, has recorded impressive daily trading volumes, surpassing even Grayscale’s Bitcoin Trust.

Fidelity’s FBTC fund also secured a spot among the top performers, further highlighting the growing interest in Bitcoin ETFs among institutional investors. Farside Investors data shows BlackRock (IBIT) led with over $204M inflows on February 8, while Fidelity (FBTC) followed with nearly $128M.

Bloomberg Intelligence expert James Seyffart noticed this rise, stating:

“Big volume day for $IBIT. Total volume over $1 billion for the group.”

He added:

“Should have been more clear. Crossing $1 billion isn’t that big of a deal for the #Bitcoin ETFs. It’s a tick up from recent days but still far below the first couple weeks of trading.”

MicroStrategy Bitcoin Holdings: Challenges Ahead?

The rapid growth of these Bitcoin ETFs poses a challenge to traditional holders like MicroStrategy. While MicroStrategy has long been recognized as one of the largest holders of Bitcoin, the combined holdings of the new ETFs now exceed those of the corporate giant. This shift signifies a changing landscape in bitcoin ownership, with ETFs increasingly dominating the market.

As reported earlier by BitcoinNews, MicroStrategy’s January bitcoin acquisition has been far lower than the previous months, sparking debates on whether the company has decided to slow down on its usual trend.

GBTC Faces Outflows

Grayscale’s Bitcoin Trust (GBTC), once a dominant player in the market, has been experiencing significant outflows in the recent month. Investors seem to be flocking towards spot Bitcoin ETFs, drawn by lower fees and greater flexibility. This trend further underscores the growing preference for ETFs over traditional investment vehicles like trusts.

Caroline Mauron, co-founder of Orbit Markets, believes the reduced outflows from Grayscale will spark Bitcoin’s rise. She foresees the halving event’s narrative boosting Bitcoin above $50,000 soon.

Analysts Weigh In

Analysts remain optimistic about the future of Bitcoin ETFs despite concerns about concentration and centralization. Markus Levin, head of operations at XY Labs, notes that while concentration of coins held by entities like MicroStrategy and ETFs may raise eyebrows, it does not pose a significant risk to the Bitcoin Network. With only 21 million bitcoin ever to exist, ETF issuers now collectively hold roughly 1.8% of the total supply.

Levin Stated:

“Over time, we have seen bitcoin become an increasingly more distributed network in terms of the number of holders and their coins […] It could become an issue if too much BTC ends up becoming highly concentrated in any one country or company, but even with the likes of MicroStrategy and these ETFs, the concentration of coins held by these entities is not a risk to the Bitcoin Network.”

Entrepreneur and writer Fred Krueger anticipated Bitcoin ETFs’ holdings surpassing MicroStrategy’s, and wrote on January 8:

“It will have taken less than 30 days for the New9 to overtake MSTR in Bitcoin Holdings,”

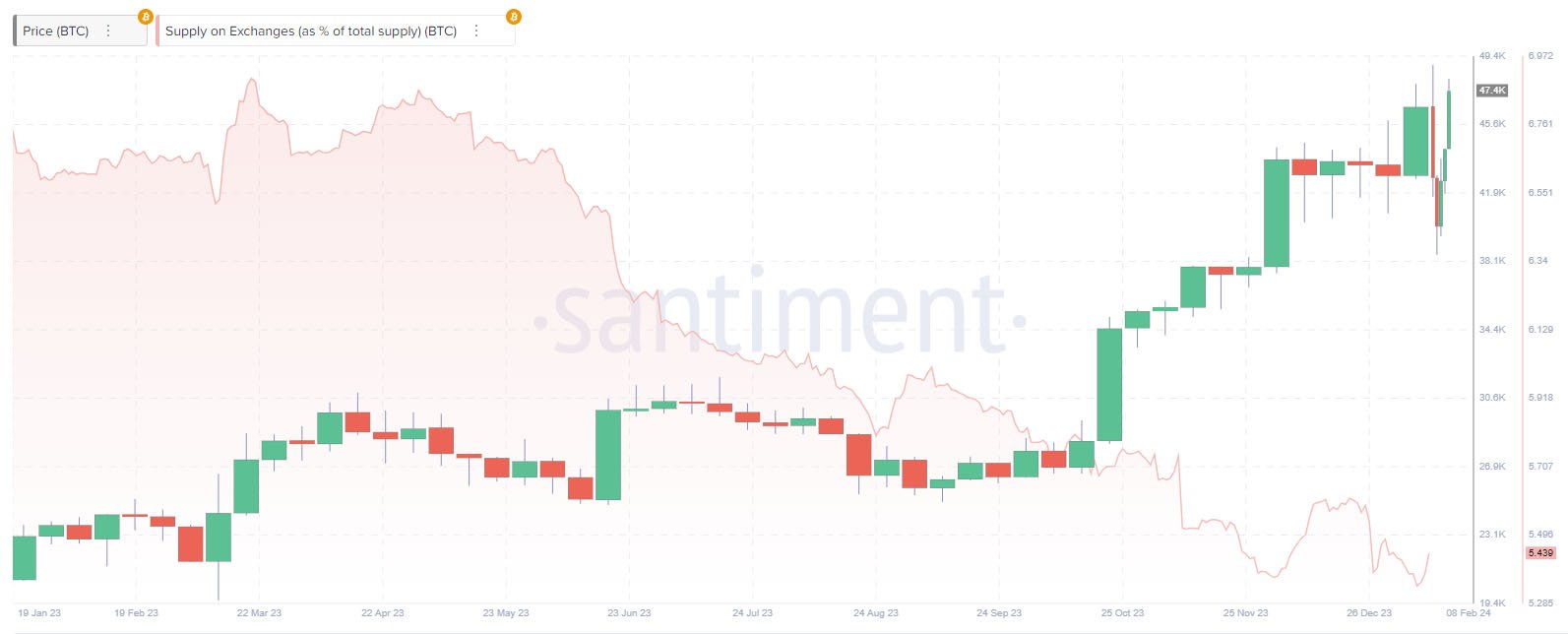

The data from Santiment, a market intelligence and analytics platform, is interesting too. Santiment highlights that very recently, a substantial amount of bitcoin has been withdrawn from exchanges, totaling 25,305 BTC valued at $1.1B. According to Santiment, exchange-held bitcoin is at its lowest in six years, at 5.3% of total circulation.

Santiment tweeted:

“#Bitcoin’s price dominance has continued to grow over #altcoins, as its market value surged as high as $45.5K today. Traders remain skeptical toward the asset for a 3rd straight week. This is the lowest ratio of $BTC on exchanges since December, 2017.”

Impressive Performance

The performance of Bitcoin ETFs has been nothing short of impressive. Within just one month of their launch, ETFs like IBIT and FBTC have amassed assets totaling around $3 billion each, placing them at the top of the league among ETFs by assets. This rapid growth highlights the increasing mainstream acceptance of Bitcoin as an investment vehicle.

Bloomberg Analyst Eric Blachunas highlighted:

“Here’s a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list.”

Looking Ahead

As Bitcoin ETFs continue to gain traction, the landscape of bitcoin investments is likely to undergo further transformation. With institutional investors pouring billions into these funds, Bitcoin’s role as a store of value and hedge against inflation is becoming more pronounced. As we look ahead, it’s clear that Bitcoin ETFs will play a pivotal role in shaping the future of finance.