Bitcoin exchange-traded funds (ETFs) have reached an unprecedented milestone, collectively holding over 1 million bitcoin (BTC), a significant 5% of the total circulating supply of bitcoin worldwide.

This achievement marks a major development in the market, underscoring the growing mainstream acceptance of Bitcoin as a legitimate asset class.

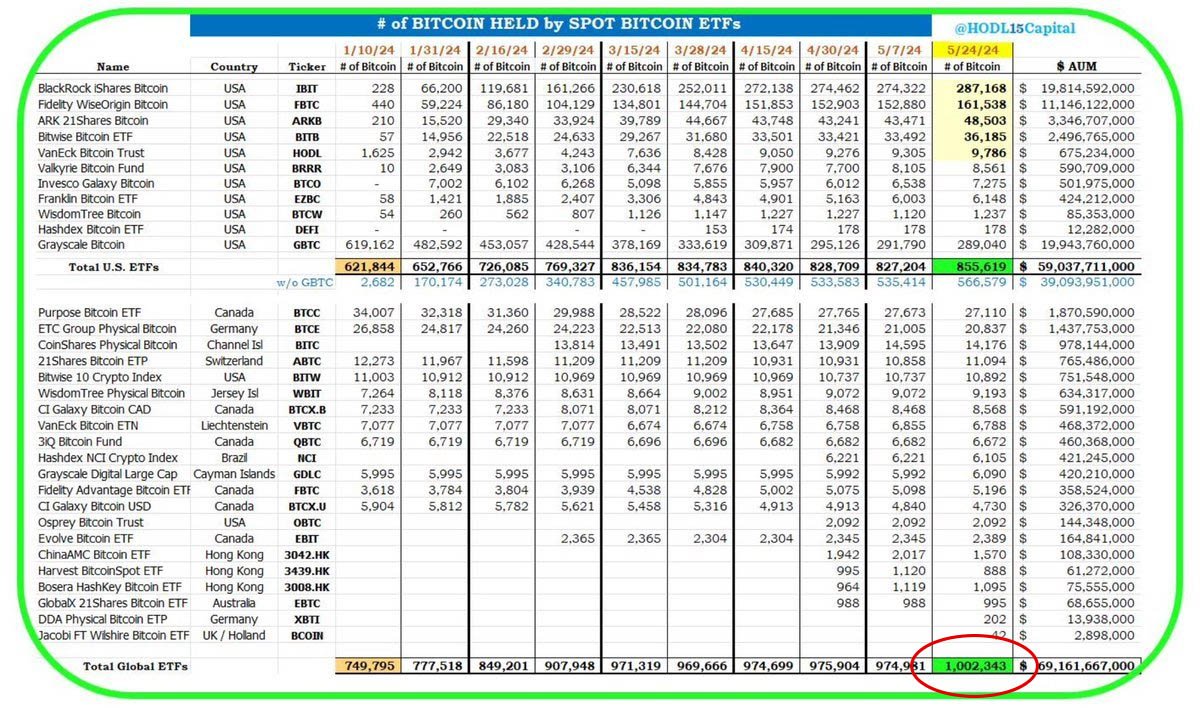

As of May 24, 2024, more than 30 Bitcoin ETFs together hold 1,002,343 BTC, valued at approximately $70.5 billion. The bulk of these holdings are concentrated within U.S.-based spot ETFs, which have quickly gained traction since their launch in January 2024.

Notably, the Grayscale Bitcoin Trust (GBTC) and BlackRock’s iShares Bitcoin Trust (IBIT) are the largest funds, with 289,040 BTC and 287,168 BTC, respectively. These two giants account for over half of the total bitcoin held by ETFs.

Michael Saylor, executive chairman of MicroStrategy, highlighted this significant milestone on X, emphasizing the substantial impact of these investment vehicles on the market.

While the U.S. dominates the ETF landscape, international participation is also notable. Canada’s Purpose Bitcoin ETF, the first to launch globally, holds 27,110 BTC, making it the largest Bitcoin ETF outside the United States.

Another significant international player is Germany’s ETC Group Physical Bitcoin Fund with 20,837 BTC.

In total, 32 Bitcoin ETFs across various countries hold these substantial bitcoin reserves, demonstrating the widespread appeal and adoption of Bitcoin ETFs.

According to data shared by HODL15Capital, these ETFs, including those in Sweden, Hong Kong, Germany, Switzerland, and Australia, have collectively absorbed over 1 million BTC.

The rapid growth of Bitcoin ETFs can be attributed to their appeal to large institutional investors. First-quarter reports revealed that over 20% of U.S. spot Bitcoin ETF exposure is held by institutions with over $100 million in total assets.

This includes hedge funds, banks, and even the state of Wisconsin’s pension fund. Such substantial institutional involvement indicates confidence in Bitcoin as a long-term investment.

Matt Hougan, Chief Investment Officer at Bitwise, discussed the potential of Bitcoin ETFs in a recent interview. He stated:

“I think long term these could be between one and five percent of the US ETF market, which is a $7 trillion market […] I think this is a multi-hundred billion dollar addressable market in the US alone.”

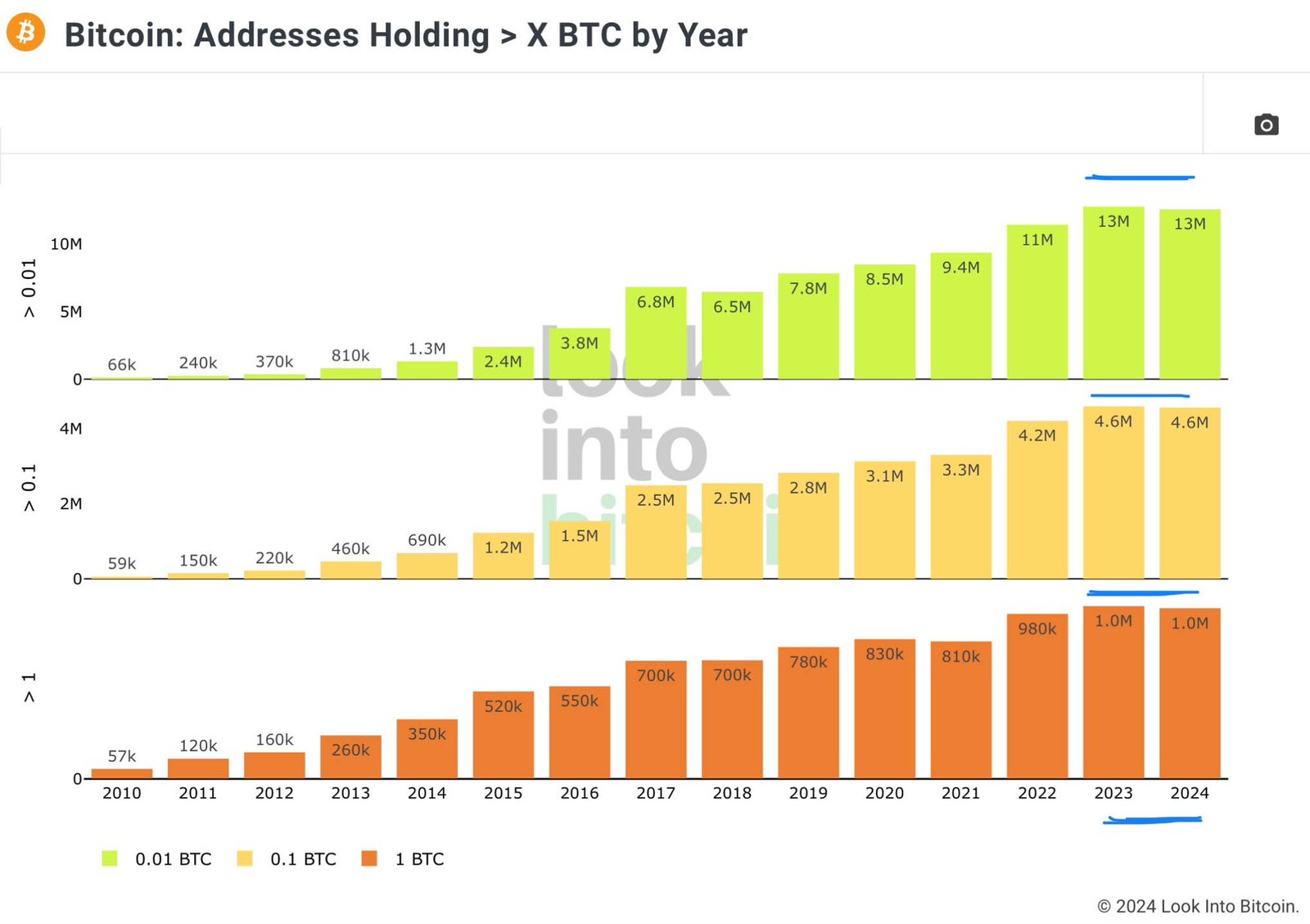

The collective growth of bitcoin held in ETFs raises questions about its impact on the broader market, particularly on bitcoin held in self-custody.

Some analysts suggest that the convenience and security offered by ETFs might be drawing investors away from traditional self-custody methods.

A chart shared by HODL15Capital showed no growth in self-custody from 2023 to 2024, mirroring a similar trend observed between 2017 and 2018.

Despite these dynamics, the growth in Bitcoin ETFs underscores the increasing demand for regulated investment vehicles that provide exposure to Bitcoin.

These products offer a familiar structure for investors, allowing them to include bitcoin alongside other securities within retirement or tax-advantaged accounts.

The rapid adoption of Bitcoin ETFs also brings challenges, particularly for funds like Grayscale’s GBTC. Since converting to a spot ETF in mid-January, GBTC has seen significant outflows, losing around 330,960 BTC, or 53% of its previous holdings.

However, it remains the largest fund holding bitcoin, valued at approximately $19.9 billion. BlackRock’s IBIT is rapidly catching up, and with steady inflows, it may soon surpass GBTC.

The competitive landscape of Bitcoin ETFs highlights the ongoing evolution of the market. With large players like BlackRock and Fidelity continuing to attract substantial inflows, the future of Bitcoin ETFs looks promising.

The achievement of over 1 million BTC in custody by Bitcoin ETFs has firmly established Bitcoin as a key component of the financial landscape.