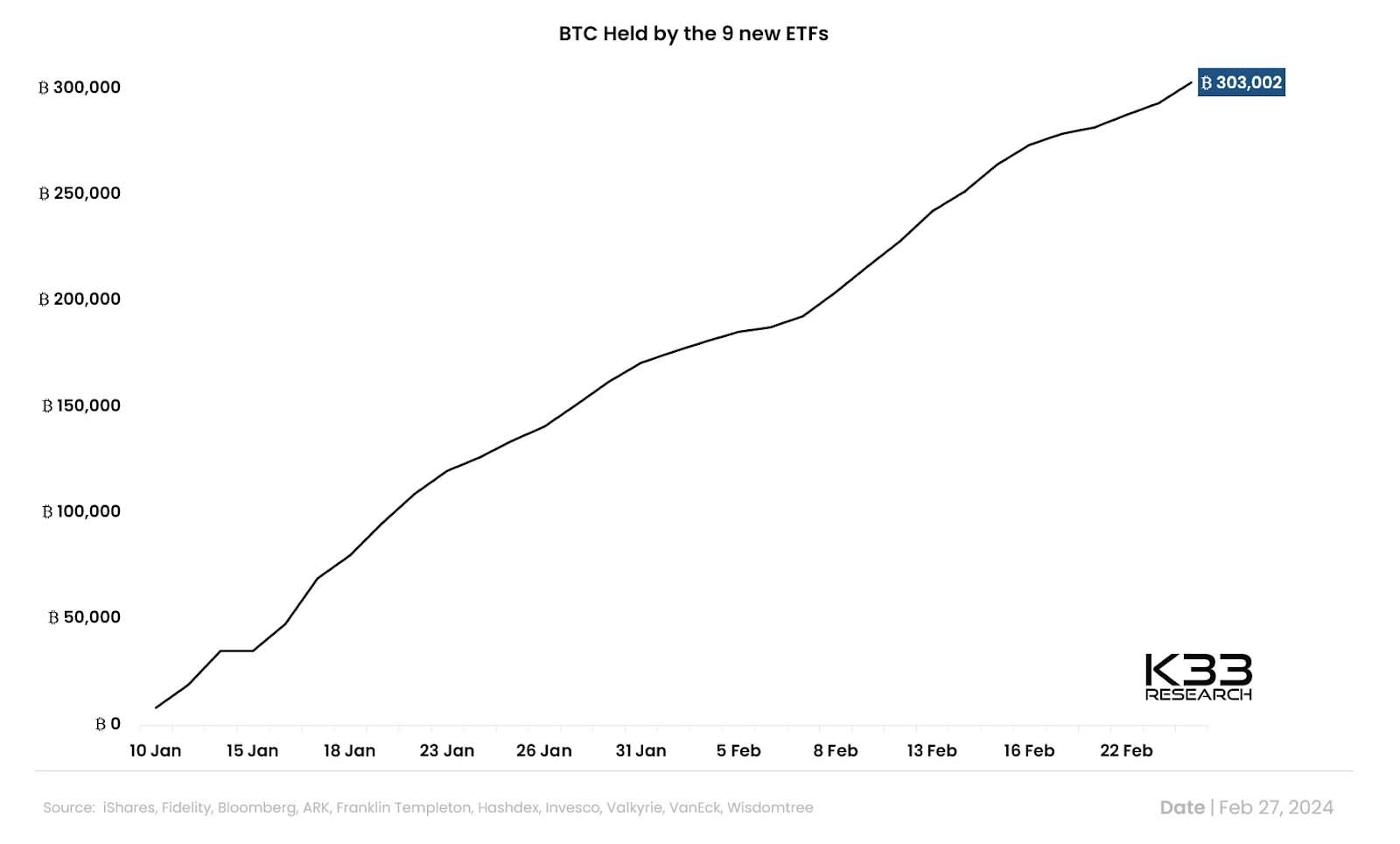

Amid the rising demand, the nine recently launched U.S. spot bitcoin Exchange-Traded Funds (ETFs) have rapidly accumulated over 300,000 BTC, valued at a staggering $17 billion, within less than two months of their public debut.

According to data by K33 Research, bitcoin ETFs, namely BlackRock (IBIT), Fidelity (FBTC), Bitwise (BITB), Ark Invest 21Shares (ARKB), Invesco (BTCO), VanEck (HODL), Valkyrie (BRRR), Franklin Templeton (EZBC), and WisdomTree (BTCW), have garnered immense popularity among investors.

BlackRock and Fidelity Lead

As of the latest market close, the total bitcoin holdings of these spot ETFs constitute almost 1.5% of the entire supply of 21 million BTC. Notably, this surpasses the holdings of major entities such as MicroStrategy, Tether, and all public bitcoin miners combined.

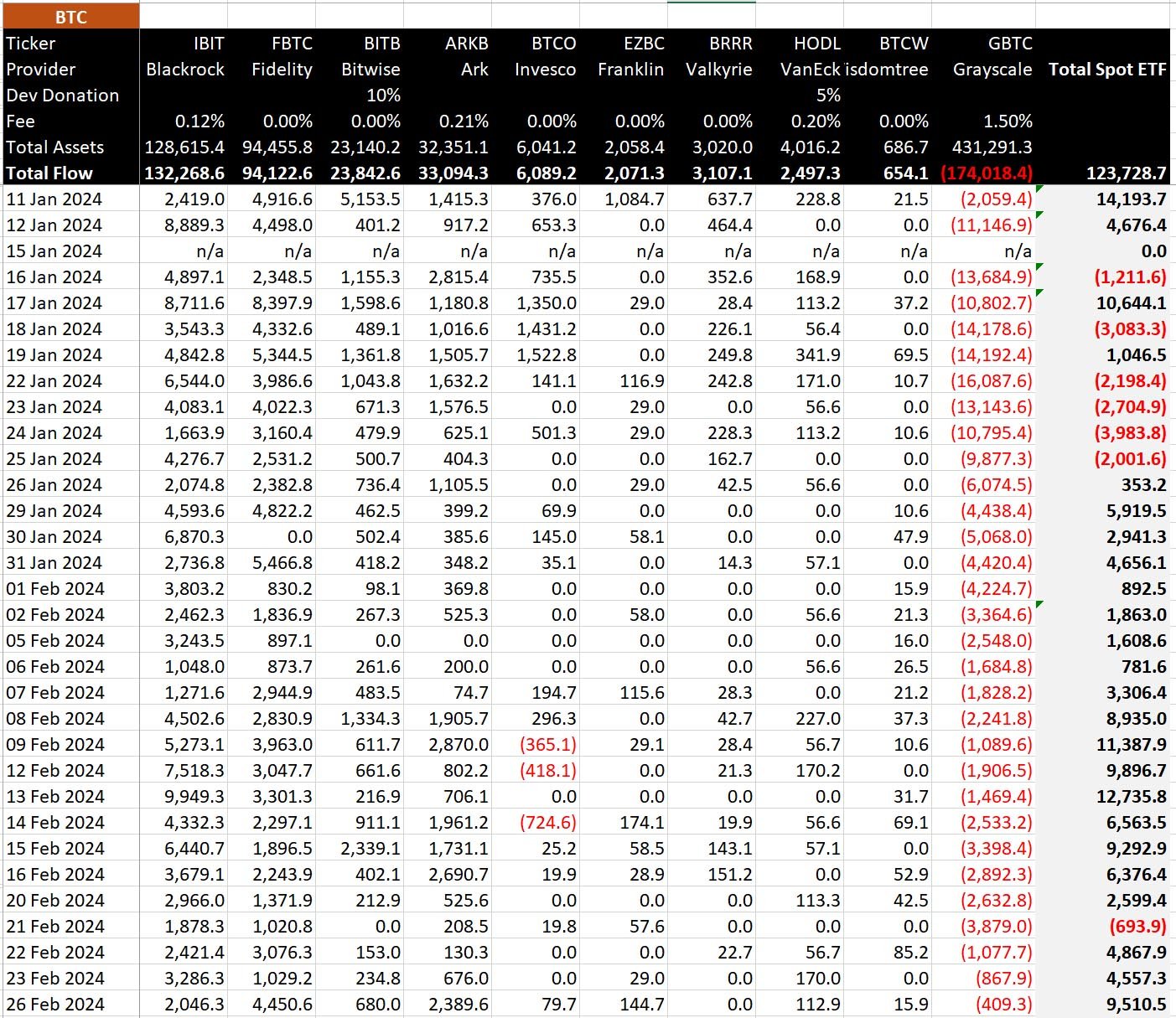

BlackRock’s IBIT spot bitcoin ETF takes the lead, managing over 128,000 BTC ($7 billion) out of the total 300,000 BTC. Fidelity’s FBTC follows closely by accumulating more than 94,000 BTC ($5 billion).

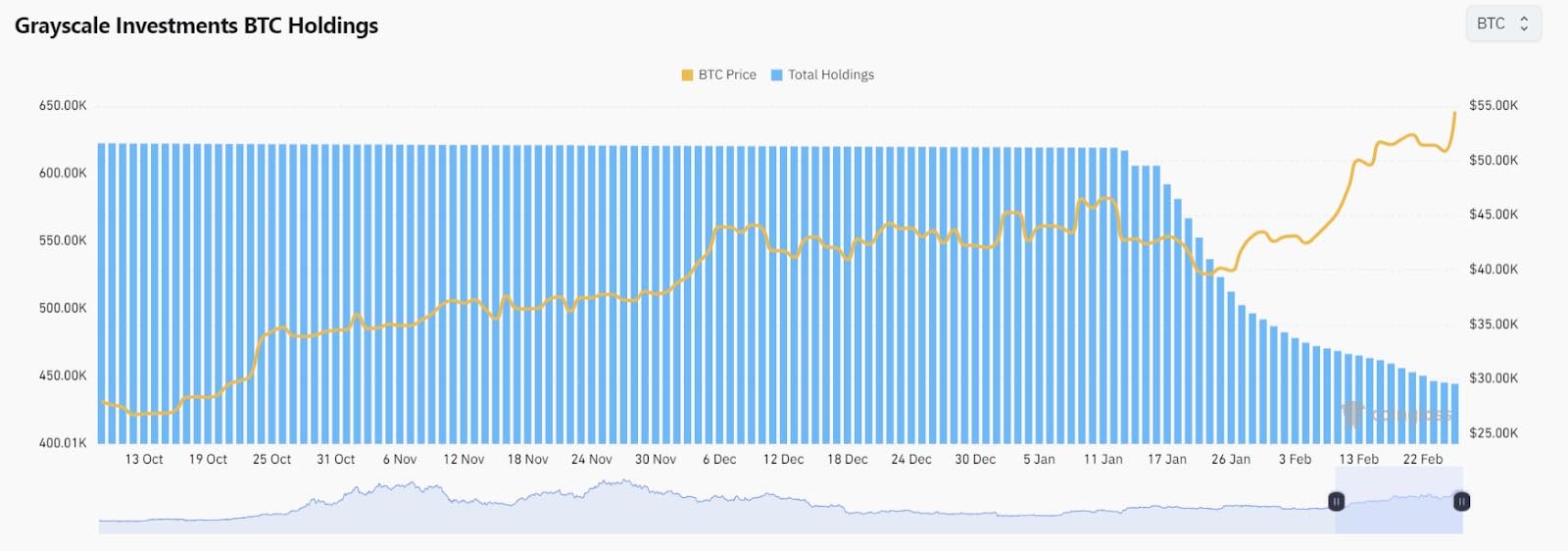

Meanwhile, the assets held by Grayscale’s converted GBTC fund have experienced a decline of over 28%, dropping from approximately 619,000 BTC ($35 billion) to 444,000 BTC ($25 billion) since the launch of the new ETFs on January 11.

Net Inflow in Spot ETFs

Meanwhile, the collective net inflows into all U.S. spot bitcoin ETFs have surpassed an impressive $6 billion mark, with a substantial spike of nearly $520 million recorded on February 26 alone. According to BitMEX Research, this is the highest single-day net inflow in a two-week period.

Fidelity’s FBTC dominated Monday’s inflows, attracting $243.3 million, with Ark Invest 21 Shares’ ARKB securing the second position with $130.6 million worth of inflows.

Moreover, Grayscale’s higher-fee converted GBTC product witnessed an interesting shift, experiencing its lowest outflows since its conversion, with only $22.4 million leaving the fund. This is a significant reduction from prior trading days and a fraction of the total $7.5 billion in outflows it has experienced so far.

Bitcoin ETFs’ Highest Trading Volume Day

The ETFs also marked their highest trading volume day on Monday, reaching $2.4 billion, surpassing the previous record of $2.2 billion set on the inaugural trading day. Bloomberg analyst, Eric Balchunas stated:

“It’s official..the New Nine Bitcoin ETFs have broken all time volume records today with $2.4b, just barely beating Day One but about double their recent daily average.”

Leading the volume charts, BlackRock’s iShares Bitcoin Trust recorded $1.29 billion, closely followed by Fidelity’s Wise Origin Bitcoin Fund at $576 million.

Growing Demand and Limited Supply

The sustained net inflows into spot Bitcoin ETFs, coupled with the diminishing outflows from GBTC, indicate a robust market demand. This surge in demand, against a backdrop of a diminishing bitcoin supply—especially with the upcoming Bitcoin halving in less than two months—has contributed to a bullish scenario for BTC prices.

While miners add a total of 900 new BTC to the daily supply, spot Bitcoin ETFs are witnessing net inflows of nearly 8,000–9,000 BTC on each trading day, further depleting the available supply.

As a result, Bitcoin reached a new yearly high of over $57,000 on February 27. Interestingly, the digital asset now stands only 20% below its all-time high of nearly $69,000. Bitcoin’s market capitalization has also breached the $1.1 trillion mark, highlighting the growing interest and confidence in the digital asset.