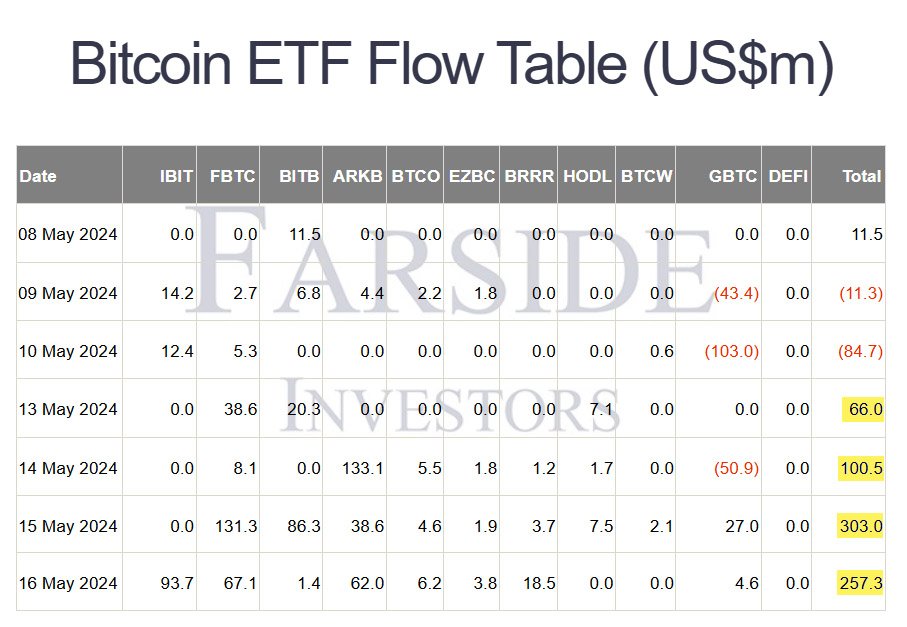

The U.S. spot bitcoin exchange-traded funds (ETFs) experienced a significant surge in investor interest today, reporting a total daily net inflow of $257.3 million on Thursday May 16th. This marks the fourth consecutive day of net inflows for bitcoin ETFs.

According to data from Farside Investors, BlackRock’s IBIT attracted the largest inflow of $93.7 million. This surge is particularly notable given that IBIT has seen minimal to no inflows over the past three weeks.

Fidelity’s FBTC fund also saw substantial inflows, bringing in $67.1 million, while Ark Invest’s ARKB reported net inflows of $62 million. Valkyrie’s bitcoin ETF also reported inflows, with $18.5 million moving into the fund.

Meanwhile, Grayscale’s GBTC, which had been experiencing large net outflows since its conversion from a trust structure to an ETF in January, recorded a meagre net inflow of $4.64 million. Other funds from Bitwise, Franklin Templeton, Invesco, and Galaxy Digital also netted smaller, single-digit inflows.

These consecutive days of net inflows coincide with Wall Street’s first quarter 13F reporting season, where major financial players disclosed their stakes in spot bitcoin ETFs.

The filings revealed that institutional interest in these funds was greater than anticipated. More than 700 different entities have disclosed holdings in bitcoin ETFs, a stark contrast to the usual two to three holders for newly launched ETFs.

As of March 31, Morgan Stanley held over $270 million in spot bitcoin ETFs, while Millennium Management disclosed an enormous stake of $1.94 billion across five bitcoin funds.

The State of Wisconsin Investment Board also revealed substantial holdings, with $163 million invested in BlackRock and Grayscale’s funds.

Eric Balchunas, Bloomberg’s senior ETF analyst, noted that 414 holders have reported holding BlackRock’s IBIT. He wrote on X that having even 20 holders as a new ETF is significant, making IBIT’s achievement particularly “mind-boggling.”

The diverse range of holders of these ETFs includes hedge fund managers, investment advisors, private equity firms, pension funds, brokerages, banks, trusts, insurance companies, holding companies, and family offices.

Balchunas emphasized the uniqueness of IBIT’s rapid adoption and broad holder base. He stated:

“Normally you don’t see this long list of holder types until years after launch and with mega liquidity — which IBIT already has.”

The diverse range of investors and substantial stakes held by several financial giants reflect the maturation of the bitcoin ETF market, suggesting a promising future for these investment vehicles.

Despite the consistent inflows, the overall trading volume of bitcoin ETFs remains lower than the record levels observed in March. However, the 11 spot bitcoin ETFs in the U.S. have accumulated a total of $12.40 billion in net inflows so far.