As bitcoin’s price continues to fluctuate, so do the fortunes of Bitcoin Exchange-Traded Funds (ETFs). Recent developments in the price action of the asset and scene of Bitcoin ETFs shed light on the bitcoin market and its future outlook.

In the past days, the Bitcoin market has witnessed significant volatility, mirrored by fluctuations in the spot Bitcoin ETF landscape. From outflows to inflows and back again, these ETFs have been on a rollercoaster ride, reflecting the uncertainty and rapid shifts in investor sentiment. Grayscale’s Bitcoin ETF saw $166 million leave, as outflows continue post-conversion to an ETF on January 11th.

Bitcoin ETFs Outflows and Market Panic

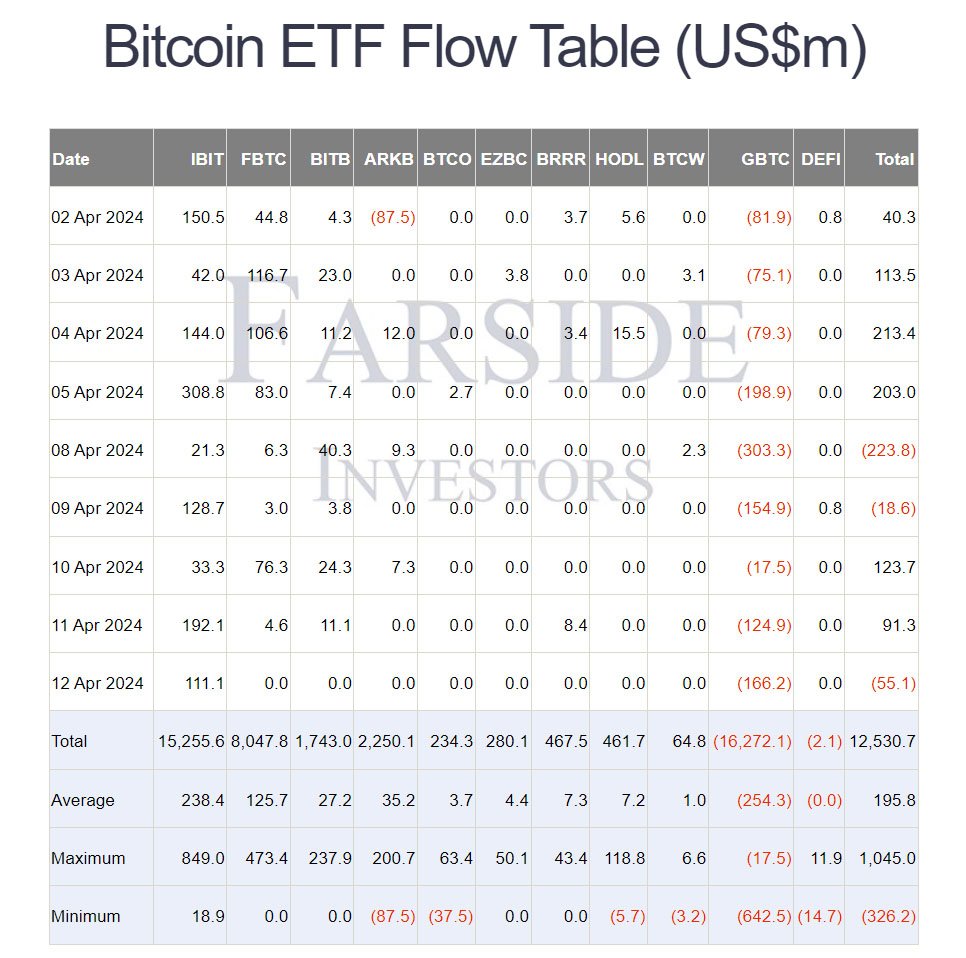

Reports indicate that US spot Bitcoin ETFs experienced a net outflow of $55 million amidst a particularly gloomy market day. This outflow, coupled with bitcoin’s drop to $62,000, triggered a substantial $920 million liquidation across the digital assets market. The departure of assets from Grayscale’s GBTC, amounting to $166 million, marked a significant trend of net outflows since its conversion to an ETF on January 11th.

Inflows and Contrasting Trends

Despite the market panic, there were contrasting trends observed among key players in the Bitcoin ETF landscape. BlackRock’s IBIT saw a notable net inflow of $111 million, indicating potential investor preference for this ETF. Fidelity’s FBTC remained neutral with a net inflow/outflow of zero, suggesting a balanced investor sentiment towards this offering.

The fluctuations in Bitcoin ETFs have had a direct impact on the broader digital asset market. The drop of bitcoin price to $62,000 triggered concerns among investors, leading to widespread liquidations totaling $920 million. However, amidst the market turbulence, there are indications that Hong Kong might approve ETFs directly investing in bitcoin, signaling a potential milestone for mainstream bitcoin acceptance and investment.

Optimism Amidst Uncertainty

Despite the challenges and uncertainties, there remains optimism about Bitcoin’s future trajectory. Grayscale’s CEO, Michael Sonneshein, remains optimistic, suggesting that the withdrawals from GBTC may have reached equilibrium and could slow down as Grayscale plans on decreasing its Bitcoin ETF fees. Moreover, some analysts anticipate a larger bull market for Bitcoin following the halving, despite concerns about its potential impact on short-term price movements. The ongoing withdrawals from the ETF market might also stem from a decrease in activity before the halving event.

The recent fluctuations in Bitcoin ETFs reflect the broader volatility and uncertainty prevailing in the Bitcoin market. While outflows from certain ETFs have triggered concerns, contrasting inflows and regulatory developments offer glimpses of hope for the future. As the market continues to evolve, investors are advised to stay informed and cautious amidst the ever-changing landscape of digital asset investments.