Bitcoin is making waves on Wall Street as institutional investors increase their exposure through exchange-traded funds (ETFs).

Recent data shows that spot Bitcoin ETFs now hold over 1.24 million BTC, which is about 6% of the total circulating supply. This is a big deal for Bitcoin’s integration with traditional finance.

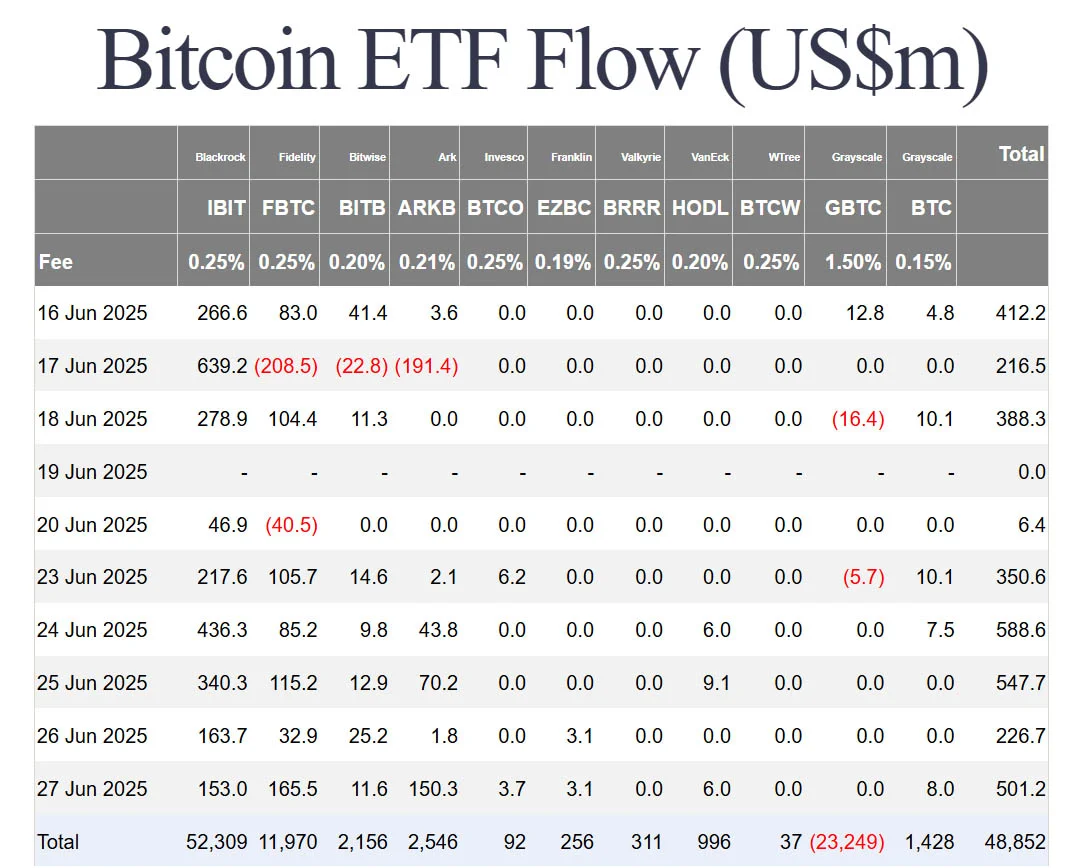

ETF giants like BlackRock, Fidelity and others are still buying bitcoin despite global tensions, high interest rates and market uncertainty.

These holdings have been growing since the launch of spot Bitcoin ETFs in early 2024 and reflect the growing institutional demand for the scarce digital asset.

Even during recent geopolitical turmoil, Bitcoin ETFs didn’t flinch. Over the last two weeks, as tensions escalated in the Middle East, ETFs had 10 straight days of inflows, according to Farside Investors.

“Institutional demand for Bitcoin doesn’t flinch easily,” said Ecoinometrics on social media platform X. “The streak is still intact and that sets the stage for Bitcoin’s upside potential to play out.”

Bitcoin ETFs didn’t break during global stress. That’s a change in investor behavior.

As Dragonfly data analyst Hildebert Moulie pointed out, ETF investors are no longer just speculating — they are allocating long-term. That means institutional investors now view bitcoin as a core portfolio asset.

Reports from CryptoQuant and other analysts show that the average purchase price for most ETF-held bitcoin is around $73,000, excluding Grayscale’s GBTC fund. They believe that’s the current key psychological and technical support level.

That’s important because many institutional investors are conservative. They typically aim for 40-50% profits before they sell. Given bitcoin is trading between $105,000 and $107,000, many ETF investors are getting close to that profit window.

But analysts say they are not in a rush to exit. The Market Value to Realized Value (MVRV) ratio — a metric to measure profitability — is at 1.43 for ETF holdings. That’s well below the historical peak of 3.7 which was seen before previous big sell-offs.

So there’s still room to grow before institutions feel pressure to take profits.

BlackRock still leads the ETF market with 695,829 BTC under management, controlling over 52% of all ETF-held bitcoin. Fidelity and other firms are also adding to the growing pool of BTC held in these regulated products.

With only 21 million BTC ever to exist and over 1.23 million BTC locked away in ETFs, supply is getting tight. If demand keeps rising this could lead to a supply shock.

The bitcoin in ETFs is essentially locked away, not available for trading on exchanges unless there are large outflows. That’s what makes this such a big structural shift.

Even with rising geopolitical risks and market volatility, ETF investors are calm.

As Bloomberg’s ETF expert Eric Balchunas said back in April, these holders have “stronger hands than most think”. He credits them for absorbing sell pressure from short-term holders and even from large liquidations like the FTX collapse.