Bitcoin exchange-traded funds (ETFs) in the U.S. just had their biggest day of inflows in nearly three months, and investors are loving it.

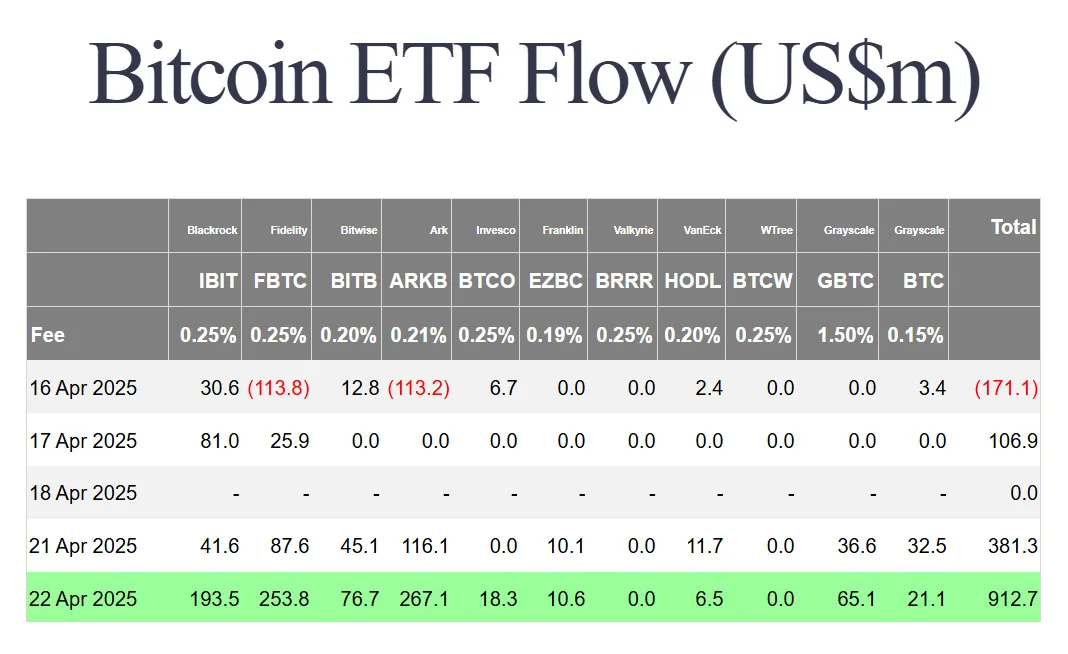

According to data from Farside Investors, U.S.-listed Bitcoin ETFs brought in $381.3 million on April 21, and $912.7 million on April 22.

That’s the biggest single-day inflow since January 17, 2025 when they pulled in over $1 billion. That was briefly after bitcoin started trading above $100,000.

ARK 21Shares Bitcoin ETF (ARKB) was the top performer with $267.1 million. Fidelity’s Wise Origin Bitcoin Fund (FBTC) was close behind with $253.8 million.

Grayscale’s products — Grayscale Bitcoin Trust (GBTC) and Bitcoin Mini Trust ETF (BTC) — brought in $86.2 million.

Bitwise’s BITB and BlackRock’s iShares Bitcoin Trust (IBIT) added $76.7 million and $193.5 million respectively. Smaller funds like VanEck’s HODL and Franklin Templeton’s EZBC saw positive movement, but at lower levels.

The sudden inflows come as the political temperature rises. Over the weekend, President Donald Trump harshly criticized Federal Reserve Chair Jerome Powell.

On his social platform, Truth Social, Trump wrote, “His dismissal cannot happen fast enough,” after Powell said interest rate cuts were off the table.

Reports are circulating that Trump’s team is exploring ways to remove Powell from office. This has spooked the traditional markets and investors are looking elsewhere.

Bitcoin has proved to be a nice escape hatch in moments like this. And experts say this is a big deal.

After weeks of lack of demand and even outflows — especially during the first half of April when Trump’s trade war threats sent global markets into a tizzy — institutional investors are back in the game.

Related: Bitcoin ETFs Face $1 Billion Outflows Amid US-China Trade Tensions

“This marks a significant improvement in investor sentiment,” said James Butterfill, Head of Research at CoinShares.

Kadan Stadelmann, CTO at Komodo, agrees. “Fiat currencies lack intrinsic value, and with confidence in the U.S. financial system deteriorating, investors are turning to assets like bitcoin,” he said.

“Bitcoin’s price has certainly held up considering the trade war scenario.”

On April 22, bitcoin’s price rose above $88,500, finally breaking the $90,000 barrier, up from its April 7 low of $74,773.

On April 21, U.S. stock markets closed down big after the Good Friday holiday. The S&P 500 was down 2.4%, the Nasdaq and Dow Jones Industrial Average both 2.5%.

The U.S. dollar also hit multi-year lows and investors are fleeing to alternative assets like gold and bitcoin.

This flow of capital shows in bitcoin dominance too, as the metric climbed to 64.4% on Tuesday morning, a level not seen since 2021.

Analysts believe that bitcoin is no longer a fringe asset but is now a “macro asset” that moves with the broader markets.

Bitcoin ETFs are now reacting to big economic and political events like traditional macro assets.

“Crypto used to move to its own beat, but now it’s dancing more to the rhythm of global markets,” said Anthony Georgiades, founder of digital assets VC firm Innovating Capital.