Bitcoin Exchange Traded Funds (ETFs) in the United States continue to absorb astonishing amounts of bitcoin, sparking renewed optimism in the market.

Over the first week of June, these ETFs acquired nearly two months’ worth of Bitcoin mining supply, a significant development that has caught the attention of investors and analysts alike.

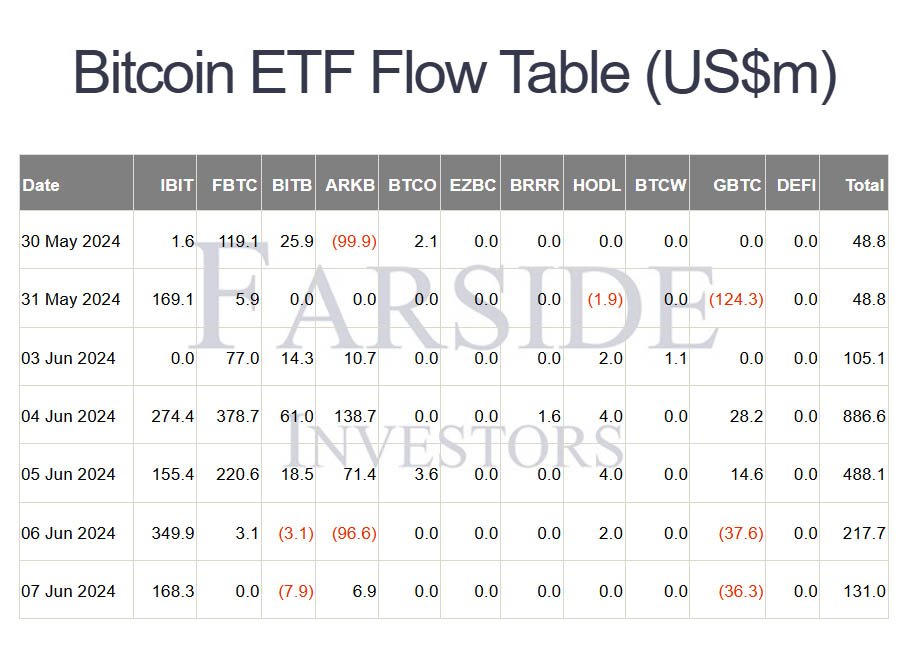

Between June 3 and June 7, US spot Bitcoin ETFs acquired approximately 25,729 bitcoin. This amount is notably eight times the 3,150 BTC mined during the same period, according to data from HODL15Capital.

The total inflow during this week amounted to $1.83 billion, a figure that underscores the growing interest in these financial products.

This acquisition spree is almost as much as the 29,592 BTC purchased throughout the entire month of May, making the first week of June the largest week of buying since mid-March. During that time, bitcoin reached a new all-time high of $73,679.

The growth of Bitcoin ETFs is particularly impressive when compared to gold ETFs.

Nate Geraci, President of The ETF Store, noted that Bitcoin ETFs now have nearly 60% of the assets under management (AUM) that gold ETFs have accumulated over 20 years, despite Bitcoin ETFs being only five months old.

Bitcoin ETFs have experienced rapid growth in a brief timeframe, demonstrating significant demand and investor interest in Bitcoin as a financial asset.

Among the various Bitcoin ETFs, BlackRock’s Bitcoin ETF (IBIT) has emerged as a standout performer. Recently, IBIT surpassed Grayscale’s Bitcoin Trust (GBTC) to become the largest spot Bitcoin ETF in the United States.

As of now, IBIT holds nearly $20 billion in bitcoin.

The recent positive momentum for Bitcoin ETFs has continued for 19 consecutive days, with net inflows totaling $131 million on June 7 alone.

This streak reflects a growing confidence among investors in these financial products, despite the recent fluctuations in the bitcoin market.

The surge in ETF inflows has coincided with significant price movements for bitcoin. On June 5, bitcoin briefly touched $71,093, marking the first time it crossed the $71,000 threshold since May 21.

However, despite these inflows, bitcoin’s price has struggled to maintain this high, reflecting the complex dynamics of the market.

According to Charles Edwards, founder of Capriole Investments, the ETF flow is not sufficient to overcome the broader selling pressure in the market.

Similarly, trader Christopher Inks pointed out that bitcoin’s price is influenced by various factors, including spot and futures ETFs, and options trading. The price at any given moment is influenced by the combination of all these factors, rather than just a single one.

Despite the price volatility, there is a strong sense of optimism among market participants.

Robert Kiyosaki, author of “Rich Dad Poor Dad,” is particularly bullish, predicting that bitcoin could reach $350,000 by August 25. Kiyosaki’s confidence in Bitcoin stems from his skepticism about the current US leadership and its economic policies.

Other analysts are more conservative but still optimistic. Jelle, an independent trader, believes that bitcoin could breach its all-time high if the positive ETF inflows continue.

The recent approval of spot-based Bitcoin ETFs is seen as a potential catalyst for broader institutional adoption.

This sentiment is supported by the fact that short-Bitcoin positions have seen outflows for the third consecutive week, totaling $5.3 million. This trend indicates a growing belief among investors that bitcoin’s price is poised for a rise.

Macroeconomic factors have also played a crucial role in the recent influx of funds into Bitcoin ETFs.

Weaker-than-expected US economic data has fueled anticipation of potential interest rate cuts by the Federal Reserve, historically seen as favorable for riskier assets like bitcoin.

The recent surge in ETF inflows and the positive market sentiment suggest a potentially bullish period for bitcoin. As the market navigates the evolving regulatory landscape and potential interest rate cuts, the future of Bitcoin ETFs looks promising.