The recent developments in Bitcoin spot Exchange-Traded Funds (ETFs) have caught the attention of investors and experts alike. Samson Mow, a renowned advocate for the ascent of Bitcoin to $1 million, has weighed in on the significant outflows witnessed from these investment vehicles.

Record Net Outflow

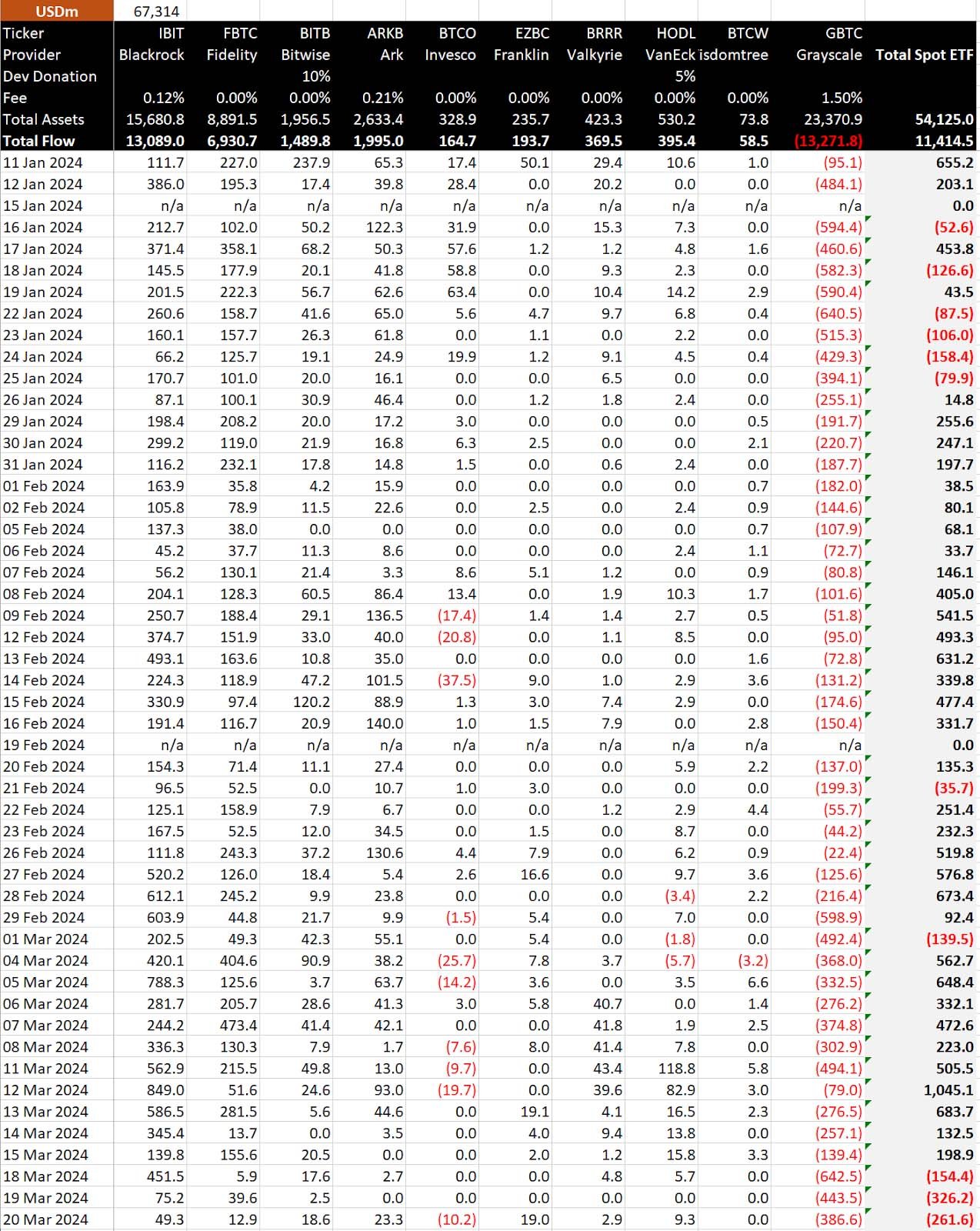

Over the span of just three days, a staggering $742 million has left the 10 bitcoin spot ETFs, marking the highest outflow since their introduction in January. This abrupt reversal in sentiment contrasts sharply with the massive demand that had recently propelled bitcoin to its all-time high.

According to BitMEX Research, the ETFs experienced consecutive outflows of $154 million, $326 million, and $262 million on Monday, Tuesday, and Wednesday respectively. These outflows were predominantly driven by significant withdrawals from the Grayscale Bitcoin Trust (GBTC), totaling $1.47 billion over the three-day period.

The trust has been experiencing consistent outflows since the Securities and Exchange Commission (SEC) approved the conversion of GBTC into a spot ETF, alongside the launch of ten spot Bitcoin ETFs on January 11. High fees imposed by Grayscale compared to its competitors have further exacerbated investor exits.

Notably, BlackRock’s IBIT, the leading Bitcoin ETF, witnessed a drastic decline in daily inflows on March 20, plummeting to $49.3 million, the lowest figure recorded over the past 18 trading days. In response to these developments, Samson Mow remains optimistic, suggesting that these outflows will eventually reverse.

Massive Inflows Soon: Samson Mow

Addressing concerns regarding bitcoin’s price trajectory on social media platform X, Mow emphasized the fundamental drivers of bitcoin’s value, citing its inherent scarcity and persistent demand, disregarding short-term sentiment fluctuations.

In addition to commenting on Bitcoin ETFs, Mow expressed his views on the potential approval of ETFs based on Ethereum’s spot trading price. Despite anticipation in the market, Mow reiterated his belief that Ethereum could be deemed a security by the SEC.

The self-proclaimed bitcoin maximalist warned against the approval of Ethereum ETFs, fearing it could pave the way for similar approvals for other “shitcoins”. He stated:

“So it looks like the SEC doesn’t want to approve 20,000 shitcoin ETFs, so Ethereum will be deemed a security (it obviously is).”

Bitcoin Market Trend

Meanwhile, bitcoin has experienced over 6% surge in US trading following signals from the Federal Reserve hinting at potential interest rate cuts, which buoyed various asset classes.

Despite the recent rally, industry experts, including Chris Weston, Head of Research for Pepperstone Group, underscored the need for sustained momentum to further propel the digital asset market.

As per the latest data, bitcoin is currently trading around $65,000, significantly up from its recent drop. Bitcoin has seen a notable decline from its March 14 all-time high as the countdown to the halving, where mining rewards are halved, enters its final month. Historically, bitcoin has experienced declines leading up to halving events, a trend that seems to be repeating in the current cycle.