The Bitcoin market has been bustling with activity, particularly among exchange-traded funds (ETFs). Recent data reveal a significant surge in Bitcoin ETF investments, showcasing growing institutional and retail interest despite the recent sell-off by the German government.

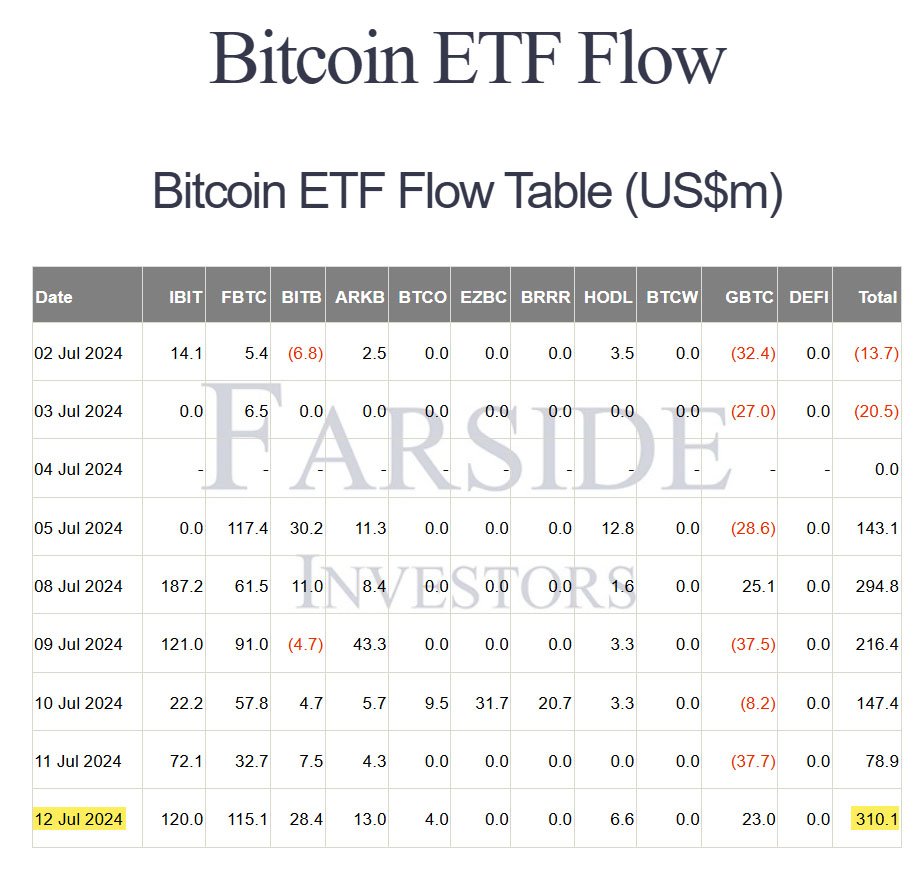

On July 12, Bitcoin ETFs in the United States saw their highest inflows in over a month. According to data from Farside Investors, these ETFs recorded more than $310 million in inflows.

BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with $120 million, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) following closely with $115.1 million.

Bitwise Bitcoin ETF came in third, with $28.4 million in inflows, and Grayscale Bitcoin Trust (GBTC) experienced a rare positive day with $23 million in new investments.

This influx marked the best-performing day for Bitcoin ETFs since June 5. Other ETFs, including VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF, also saw positive inflows, though to a lesser extent.

However, not all issuers benefited; ETFs from Hashdex, Franklin Templeton, Valkyrie, and WisdomTree did not register any inflows on that day.

The cumulative inflows for the week totaled a staggering $1.04 billion, reflecting a strong demand for Bitcoin-based investment products.

Over the past six months, these ETFs have amassed $15.8 billion in total investments, highlighting the growing confidence in Bitcoin as a legitimate financial asset. According to information from HODL15Capital, US ETFs now hold a record-breaking total of 888,607 BTC.

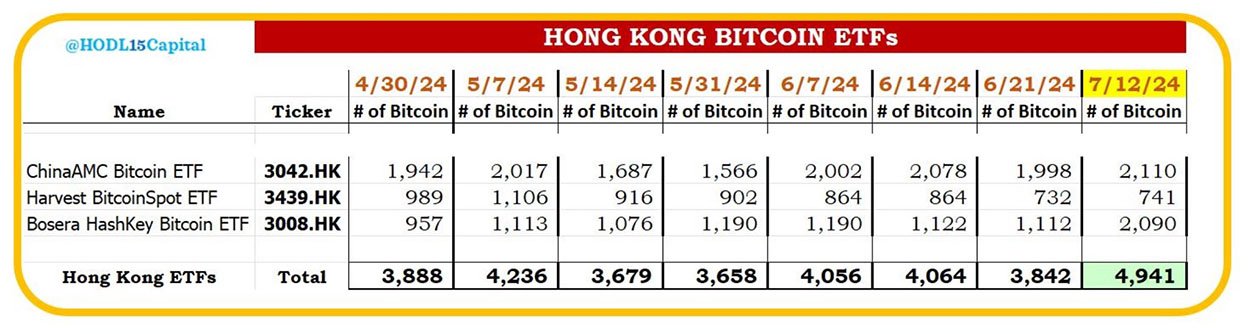

The interest in Bitcoin ETFs is not confined to the United States.

In Hong Kong and Australia, Bitcoin ETFs also saw significant inflows. Hong Kong’s Bitcoin ETFs accumulated 425 BTC over four consecutive days, amounting to roughly $24.5 million.

This steady influx suggests a growing appetite for bitcoin exposure among investors in the region, despite the market’s recent volatility.

Similarly, Australia’s Monochrome Bitcoin ETF (IBTC) has garnered attention, accumulating 83 BTC since its launch. This brings its total holdings close to 100 BTC. Additionally, DigitalX is set to launch another Bitcoin ETF in Australia, having recently received approval.

While Bitcoin ETFs were attracting investments, the German government was on a selling spree, liquidating its 50,000 BTC reserve.

The government had seized these bitcoin from the piracy website Movie2k and completed the liquidation on July 12. This massive sell-off included a final lot of 3,874 BTC sold to Flow Traders and 3,094 BTC shifted to an unmarked address.

Despite this significant offloading, the substantial inflows into Bitcoin ETFs helped stabilize the price of bitcoin. The market absorbed the selling pressure very well, showcasing the resilience and robust demand for the digital asset.

The inflows into Bitcoin ETFs have had a stabilizing effect on bitcoin’s price. As of July 12, bitcoin was trading above $58,000, sustaining gains from earlier in the week. This stability is notable given the recent price rollercoaster, with bitcoin recovering from a low of $54,424 earlier in the week.

Bitcoin’s price is currently showing signs of recovery, trading at $58,709 at press time, marking a 6.9% increase from its recent low. However, the digital asset still faces significant resistance at the $60,000 level and remains down 21.08% from its all-time high of $73,780.

Market analysts suggest that bitcoin could extend its gains by nearly 9% and rally to key resistance at $63,631.