The bitcoin market has experienced significant fluctuations recently, driven by escalating geopolitical tensions in the Middle East. As conflicts between Iran and Israel intensify, bitcoin’s status as a safe haven asset is being tested, and investors are responding with caution.

On October 1, the situation in the Middle East took a dramatic turn when Iran launched around 200 ballistic missiles toward Israel, following a series of Israeli strikes on Lebanon.

This sudden escalation in the Middle East tensions rattled financial markets, including bitcoin, which saw a sharp decline in value.

Within 24 hours, bitcoin’s price dropped over 6%, hitting a low of $60,300. This volatility marked bitcoin’s worst performance in over a month.

This turbulence disrupted what has historically been a strong month for bitcoin. October, often dubbed “Uptober” by Bitcoin enthusiasts, has traditionally seen price gains for bitcoin.

However, the current geopolitical instability has overshadowed these market expectations. Analysts at Presto Research noted the unusual nature of the situation, commenting that October is usually a bullish month for bitcoin, but geopolitical tensions are shifting investor behavior.

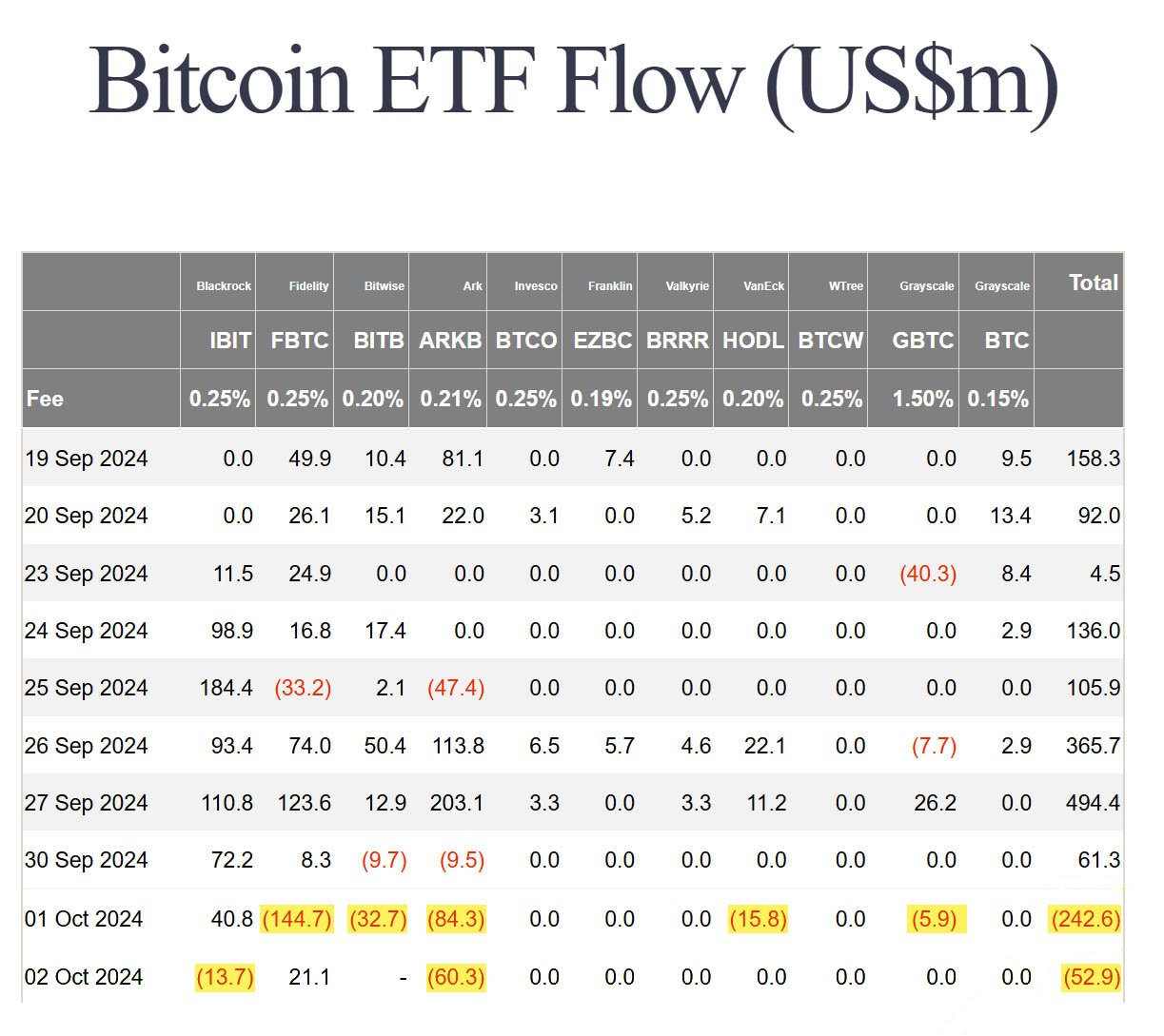

A key sign of investor unease has been the large outflows from U.S. spot Bitcoin exchange-traded funds (ETFs).

On October 1, Bitcoin ETFs saw nearly $243 million in outflows, according to data from Farside Investors. This marked the largest outflow in a month, with the previous significant withdrawal occurring on September 3, when $288 million left the funds.

These outflows came after an encouraging eight-day streak of net inflows, which had brought in $1.4 billion by September 27.

However, the rising tensions in the Middle East quickly reversed this trend, as investors seemingly sought assets they considered safe, like gold. Gold prices surged 1.4%, nearing a record high, while crude oil also jumped by 7%.

Fidelity’s Bitcoin ETF saw the largest hit, with $144.7 million withdrawn.

ARK Invest’s Bitcoin ETF followed, losing $84.3 million, while Bitwise’s ETF recorded $32.7 million in outflows. VanEck’s Bitcoin ETF and the Grayscale Bitcoin Trust saw smaller losses of $15.8 million and $5.9 million, respectively.

However, not all funds were impacted equally. BlackRock’s iShares Bitcoin Trust (IBIT) defied the broader market trend, recording $40.8 million in inflows on the same day.

This marked the 15th consecutive day of net inflows for the IBIT, which has been steadily gaining investor confidence since its launch in January.

This trend continued on the next day, with the investment vehicles losing another $52.9 million on October 2. On this, even BlackRock’s Bitcoin ETF saw outflows. IBIT lost $13.7 million, ending its 16-day streak of no outflows.

According to Farside Investors, IBIT has amassed over $612 million in net inflows since September 23, with its holdings now exceeding 367,122 BTC, valued at around $22.6 billion.

Despite this success, the overall picture for U.S. spot Bitcoin ETFs looks grim, with over $242 million in net outflows by the end of the day.

According to data from CoinGlass, more than $250 million in futures positions across all digital assets were wiped out in the last 24 hours. A significant portion of that amount—$200 million—came from long positions, where traders had anticipated that the prices of digital assets would rise.

Bitcoin’s sharp drop during the conflict has raised questions about its status as a “safe haven” asset.

Traditionally, safe haven assets like gold and government bonds tend to rise in value during times of geopolitical unrest, as investors seek stability. However, bitcoin, often touted as “digital gold,” did not follow this pattern.

On the day of Iran’s missile strikes, bitcoin plunged by over $4,000, while gold prices rose and oil surged in response to the conflict.

This contrasting movement has led to debates about whether bitcoin can truly serve as a safe haven asset during times of global uncertainty.

Some market observers suggest that bitcoin’s volatility, while attractive in times of optimism, may deter risk-averse investors during periods of geopolitical tension.

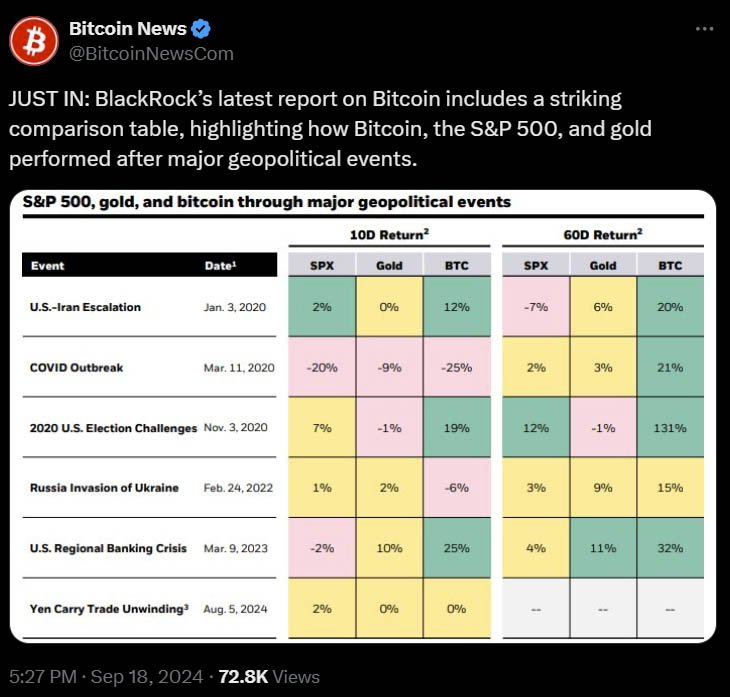

Despite initial downturns, bitcoin is expected to outperform other assets over time. A recent report by BlackRock reveals that in the 60 days following major geopolitical events over the past four years, bitcoin has consistently outperformed other investments, such as the S&P 500 and gold.

The Bitcoin Fear and Greed Index, which measures investor sentiment, also reflected this shift in attitude.

On October 1, the index dropped from a neutral level of 50 to 42, indicating heightened fear among investors. This marked the first significant move into the “fear” zone in weeks, signaling a more cautious approach from traders.

The future of bitcoin’s price and Bitcoin ETFs remains uncertain as the conflict in the Middle East continues to unfold.

Israeli Prime Minister Benjamin Netanyahu has vowed retaliation against Iran, stating, “Iran made a big mistake tonight, and it will pay for it.” This suggests that further escalation could be on the horizon, potentially leading to more volatility in global markets, including bitcoin.

Historically, bitcoin has experienced price corrections during times of geopolitical conflict.

Institutional investors, who had shown increasing interest in Bitcoin ETFs in recent months, may continue to pull back if tensions persist. Further outflows from Bitcoin ETFs are expected if the conflict escalates, as investors prioritize stability over potential gains.

However, it’s not all doom and gloom. Despite the recent setbacks, some analysts remain optimistic about Bitcoin’s long-term prospects.

BlackRock’s continued success with its iShares Bitcoin Trust indicates that institutional confidence in Bitcoin has not completely evaporated. While short-term sentiment may be cautious, bitcoin’s overall appeal as a hedge against inflation and economic uncertainty remains strong.