Investors are often hesitant to acquire fractional units of bitcoin due to the psychological phenomenon of unit bias, favoring complete ownership. However, as per Gabor Gurbacs, an adviser at leading asset management firm VanEck, the approval of Bitcoin Exchange-Traded Funds (ETFs) presents a viable remedy to address this issue. He believes Bitcoin ETFs will help lift this psychological barrier and attract a broader investor base.

In a series of posts on social media platform X, Gurbacs noted that a large number of people are still unaware of the fact that it is possible to acquire fractional units of bitcoin and are flabbergasted by the $44,000 price tag of the digital asset.

“I was surprised that a good number of people didn’t know that one can own a fraction of a Bitcoin and even more frequently people didn’t want to own a fraction of a coin,” he said.

Bitcoin ETFs: Solving Investors’ Unit Bias Psychology

Gurbacs said that ETFs typically launch with a double-digit NAV, usually $25. He gave an example of a situation where a Spot Bitcoin ETF would trade at $44, adding that it would remove “3 zeros” from BTC’s price, solving the investors’ unit bias psychology.

“Suddenly Bitcoin exposure looks more affordable. Simplistic but unit bias psychology matters a lot. I think about this a lot,” said the VanEck advisor while noting that investors would feel a lot better about owning a full share of a Bitcoin ETF rather than owning 0.001 BTC.

Further, in a response to an X post from BitcoinNews, Gurbacs said:

“I do think about biases a lot. Perhaps the most useful tool to understand markers.”

Gurbacs also recently predicted that while the initial market reaction towards the Spot Bitcoin ETFs might be modest, the long-term implications could lead to trillions of dollars flowing into the Bitcoin sector. He compared BTC ETFs’ journey with gold ETFs, adding that Bitcoin’s journey could be even more accelerated due to its unique characteristics.

It is important to note that VanEck highlighted its commitment to the broader Bitcoin ecosystem by announcing the allocation of 5% of the profits generated from its proposed Spot BTC ETF application to Bitcoin Core developers.

Potential Impact on Investors’ Perception

The approval of a Spot Bitcoin ETF in the United States by the Securities and Exchange Commission (SEC) has been a topic of debate recently. Multiple asset management firms, including BlackRock, VanEck, and Grayscale, have submitted applications for Spot BTC ETFs.

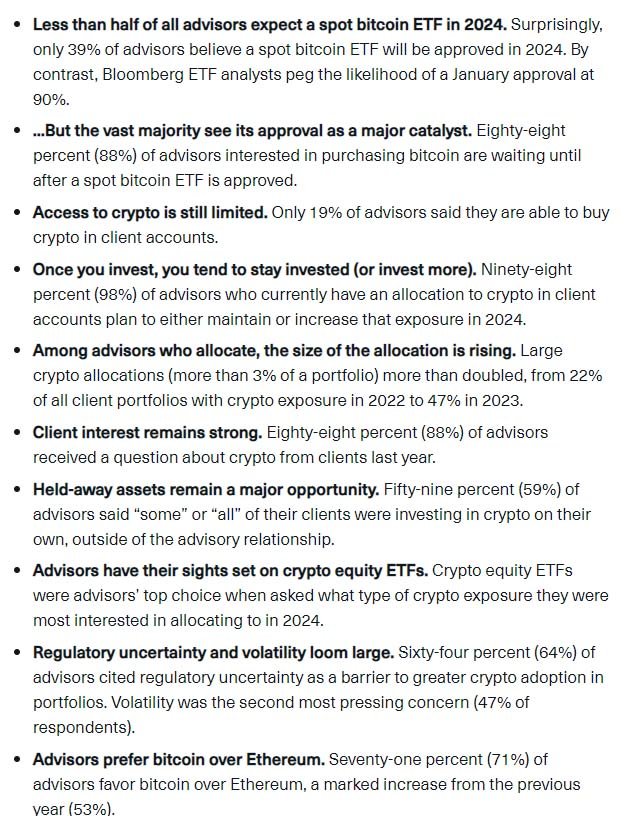

Interestingly, a survey published by ETF issuer Bitwise on January 4, in which 437 financial advisers participated, concluded that only 39% of the participants believe that a Spot Bitcoin ETF will be approved in 2024. Additionally, most of the advisers surveyed believe that a Spot BTC ETF will be approved eventually, with 22% stating that approval would come in 2025 and 24% answering “after 2025.”

When asked if they would purchase BTC before or after the approval, 88% of the participants said that they would only purchase bitcoin after the approval of a Spot ETF by the SEC.

As the debate on Spot Bitcoin ETF approval continues, Gabor Gurbacs’ advocacy for ETFs as a remedy to unit bias psychology presents a compelling argument. The potential impact on investor perceptions, coupled with industry insights and regulatory considerations, underscores the evolving landscape of bitcoin investments and the role that ETFs may play in shaping its future.