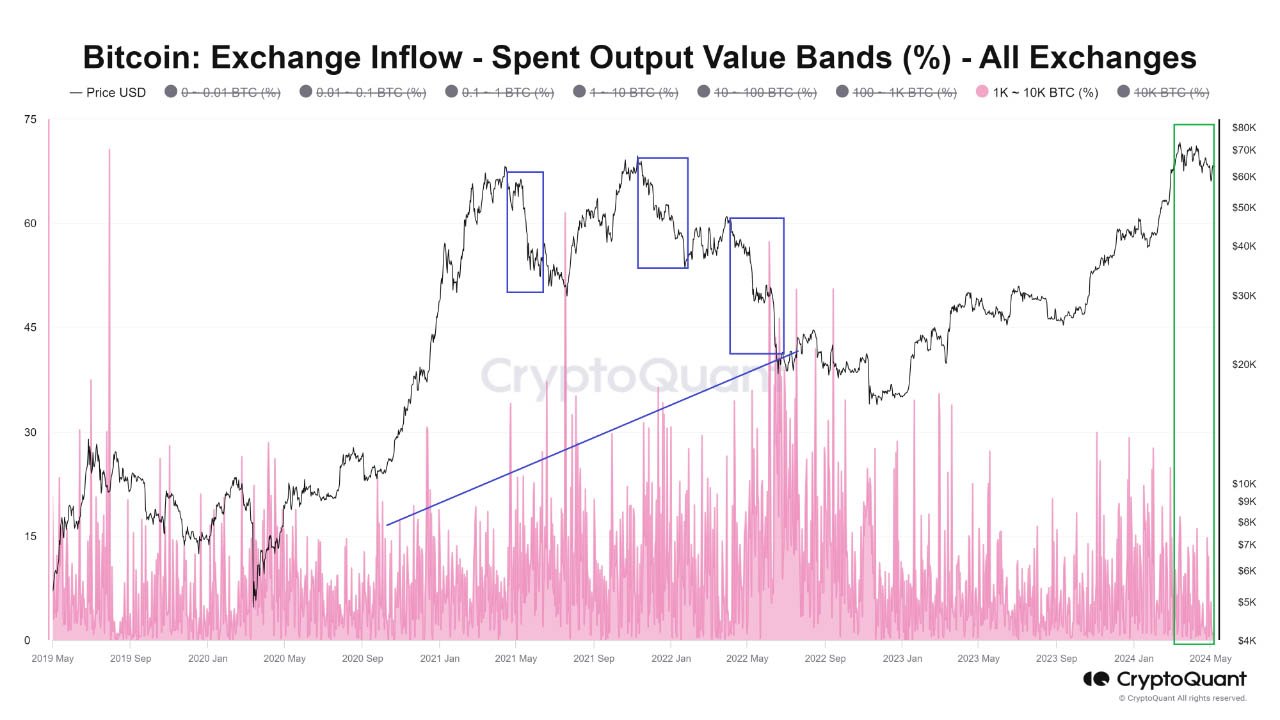

Bitcoin exchange inflows are reaching lows not seen in nearly a decade, according to the latest data from on-chain analytics platform CryptoQuant. Figures indicate a significant decline in daily BTC inflows since bitcoin’s all-time high of $73,800.

Notably, in April and May 2024, CryptoQuant observed some of the lowest daily inflows to major digital asset exchange accounts in the past 10 years.

On April 20, when BTC was hovering around the $64,500 mark, only 8,400 BTC flowed into exchanges. This flow is reminiscent of a time when bitcoin traded at less than $1,000 per coin in 2014.

Bitcoin Exchange Inflows: The Data

CryptoQuant tracks a broad range of both spot and derivative exchanges to compile its data. The numbers portray a substantial shift in sentiment among bitcoin holders this year, coinciding with an era of increased institutional involvement in bitcoin investment.

Despite short-term price volatility, including bitcoin’s recent dip to $56,500 on May 1, there has been a consistent appetite for increasing exposure to BTC.

Market observers are closely monitoring events associated with Bitcoin whale cohorts. Analysts noted that whales holding between 1,000 BTC and 10,000 BTC, which typically exert significant downward pressure on the market, have not been consistently participating in the current uptrend cycle.

However, Mignolet, a contributor to CryptoQuant, cautioned against over-reliance on whale watching for market predictions.

They suggested that whales might not be willing to sell yet as the market cycle has not ended. Additionally, there may be demand outside of exchanges, particularly in the OTC (over-the-counter) market, as Mignolet explains:

“There might be demand outside of exchanges, particularly in the OTC market, capable of absorbing large selling volumes even without deposits into exchanges post-ETF approval.”

Amid bitcoin exchange inflows plummeting to near-decade lows, investors are witnessing a notable rise in Satoshi-era whales in recent days. These long-standing holders of bitcoin, who accumulated their holdings during Bitcoin’s early days, are garnering attention as their activity increases.

Checkmate, the lead on-chain analyst at data firm Glassnode, pointed out that the new spot Bitcoin Exchange-Traded Funds (ETFs) are likely impacting the observed numbers.

He highlighted that data around these entities can be noisy, with ETFs and exchanges often masquerading as significant whale wallets. Checkmate stated:

“I can almost guarantee that the big ‘whale’ wallets you’re watching are ETFs and exchanges. There will be some actual whales yes…but as both buyers and sellers. Not once have I seen true alpha extracted from whale watching.”

Overall, the data suggests a significant shift in bitcoin holder behavior, with decreasing BTC inflows to exchanges indicating a stronger conviction to hold rather than sell.

The current market dynamics, including increased institutional involvement and the introduction of Bitcoin ETFs, are reshaping investor sentiment and influencing trading patterns in the digital asset space.