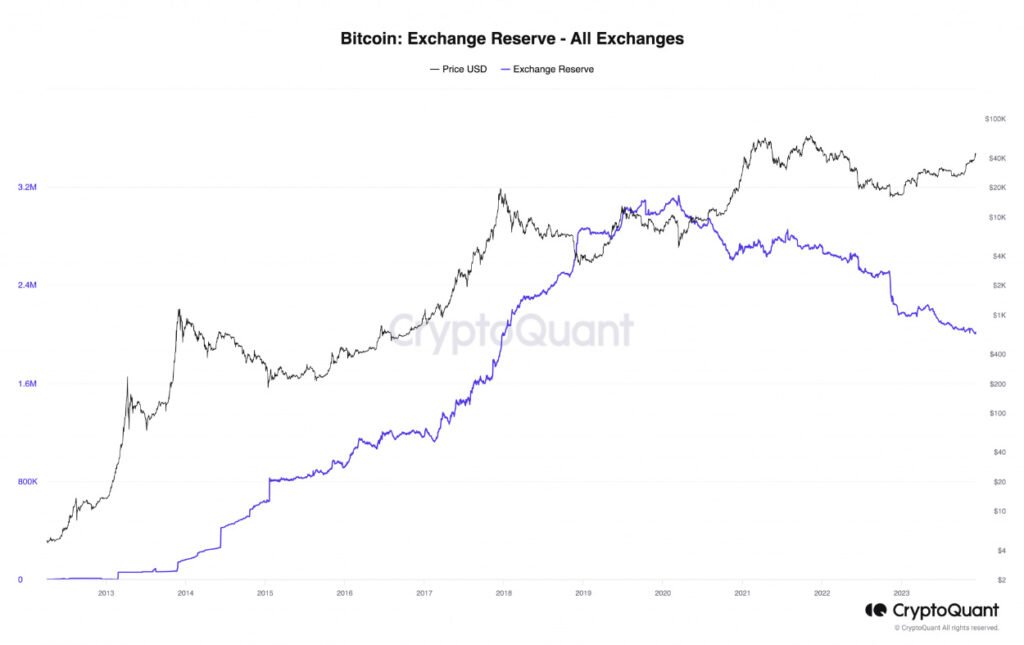

Recent data from CryptoQuant highlights a significant shift in the world of Bitcoin, as bitcoin exchange reserves hit a six-year low. This decline, witnessed since 2020, has sparked curiosity, praise, and often concern among investors and analysts.

Factors Driving the Decline

Several factors have could have contributed to this dwindling supply. Turmoil in the industry, notably the FTX collapse, and increased regulatory scrutiny, particularly from the SEC, have shaken investor confidence. Consequently, there’s been a surge in embracing self-custody solutions, where individuals take direct control of their assets.

This shift towards self-custody signifies a belief among investors that Bitcoin is more than a tradable commodity—it’s a lasting asset worth retaining. Despite reaching an 18-month high of $44,000, long-term holders are resolute in retaining their holdings in anticipation of future profitability.

Challenges Faced by Investors

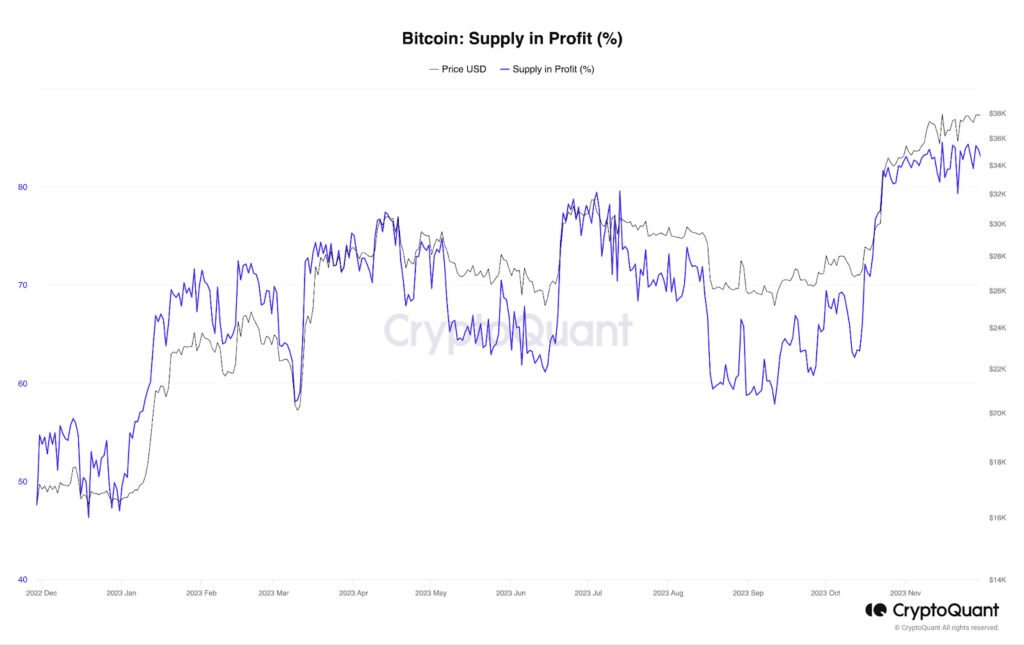

However, this steadfastness comes with challenges. Some investors who entered the market 2-3 years ago have been facing ongoing losses with an average realized price of $45,000. Despite this, the overarching trend continues to tilt towards perceiving Bitcoin as a valuable long-term asset.

The decline in Bitcoin’s exchange reserves has implications. It could significantly impact market liquidity as fewer coins are available for trading. A shallower order book might pose challenges for executing large orders efficiently, potentially leading to huge price spikes.

Bitcoin Exchange Reserves: Bullish Signal or Cause for Caution?

The recent report published on CryptoQuant suggests that Bitcoin’s supply on centralized exchanges is at its lowest in six years, resembling the 2017 numbers. It could potentially signal a bullish trend for Bitcoin. The report states:

“We are in the 45th month of diminishing supply.”

Report also predicts a surge to $50,000 – $53,000 in early 2024 based on Metcalfe price valuation metrics.

Balancing the Optimism

However, caution is advised. As Bitcoin enters a bullish trend, 86% of the circulating Bitcoin supply is now in a profitable state, suggesting a possible short-term correction ahead.

Related reading: Bitcoin SOPR — Understanding a Key Metric in Profitability

Market analysts also highlight critical support levels at $42,700, signaling stability. However, breaches below this point could pave the way for a possible downward trend towards $38,000. Conversely, a bullish trend might see Bitcoin aiming for next target of $47,300.

The Long-Term Outlook

The decline in exchange’s Bitcoin supply signifies a broader shift towards a long-term holding strategy. While this offers benefits to individual with direct control over their funds, its impact on market liquidity warrants close attention.

Many predictions have surfaced since bitcoin started its bull run earlier in October. The numbers vary widely, from Max Keiser‘s prediction of $375,000, to Bloomberg‘s foresight of $500,000, and Samson Mow‘s target of $1 million per coin.

According to the charts, the majority of bitcoin holders are currently in profit. A report on CryptoQuant by analyst “IT Tech” states:

“The cohort that invested in BTC 2-3 years ago, for instance, is still grappling with an average realized price of $45,000, resulting in an ongoing average loss.”

Summary

Bitcoin’s diminishing supply on centralized exchanges reflects a shift in investor sentiment, indicating belief in Bitcoin as a long-term asset. As the industry adapts to these changing trends, the implications on liquidity and trading dynamics remain crucial. Caution is advised, as engaging in the current market and its aspects require consideration from all quarters of the Bitcoin ecosystem.

While Bitcoin continues its ascent, the evolving landscape demands a balance between long-term optimism and cautious consideration of potential market fluctuations for short-term traders.