Bitcoin investors are facing a wave of anxiety as the leading digital asset’s price has dropped below $54,000, sending market sentiment into “extreme fear.”

The decline marks a continuation of a broader sell-off that has been impacting the market since bitcoin failed to stay above the critical $60,000 level.

On Saturday, the Bitcoin Fear and Greed Index, which measures market sentiment, dropped to a score of 23 out of 100, indicating “extreme fear” among investors. This is a stark contrast to earlier in the year when the index indicated “greed” as bitcoin reached new highs.

Over the last 14 years, market sentiment has fluctuated, with extreme fear occurring in only 4 of those years. The index fell to about 6 when bitcoin’s price dropped below $18,000 in 2022 following the collapse of the well-known digital asset exchange FTX.

In a post on X dated September 6, analyst and CryptoQuant contributor Axel Adler mentioned that the index dropped to 17 when bitcoin’s price declined to $49,000, stated:

“During the mining ban in China, the index dropped to 10%. The maximum drop to 6% occurred during the Luna crash. HODL.”

The recent plunge in bitcoin’s price to $53,700 has been attributed to several factors.

Analysts point to weak U.S. job data as a major reason for the decline, as it raised concerns about a potential economic slowdown. Fewer jobs were added in August than expected, prompting investors to move away from riskier assets like bitcoin.

Bitcoin’s price may continue to fluctuate, and additional drops could occur if the economic conditions don’t improve in the near future.

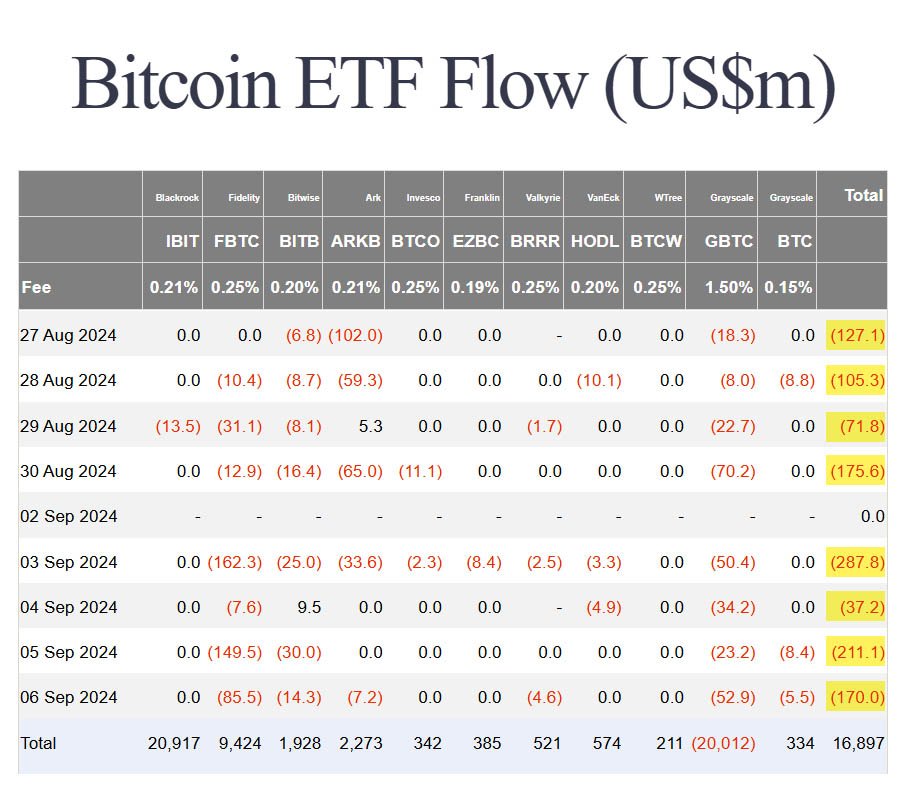

The sell-off has also been fueled by lower capital inflows into Bitcoin exchange-traded funds (ETFs).

U.S. Bitcoin ETFs saw outflows of $170 million and $211 million in the past couple of days, with Fidelity’s FBTC alone experiencing nearly $150 million in withdrawals on Thursday.

This trend suggests a weakening of investor confidence, which could continue to exert downward pressure on bitcoin’s price.

This dip into “extreme fear” comes amid fears of a September correction that could push bitcoin even lower.

Arthur Hayes, co-founder of BitMEX, recently predicted that bitcoin might drop below $50,000 over the weekend, further amplifying concerns among market participants.

While some analysts like Hayes have a bearish outlook, others see potential for a bullish turnaround. Analyst MetaShackle recently highlighted a “massive” cup and handle pattern forming on bitcoin’s chart. According to him:

“There has never been a formation like this in the history of crypto, and it’s sure to be an incredible run to levels that will shock the world.”

A cup and handle pattern is considered a bullish signal in technical analysis. It forms when the price trends downward and recovers to create a “u” shape, followed by a smaller downward drift that forms the handle. If this pattern holds, it could mean bitcoin is gearing up for a significant rally.

Another analyst, Rekt Capital, noted in a Sept. 6 post on X that the ongoing correction is consistent with past Bitcoin halving bull cycles.

He added: “Bitcoin is down -6.19% for the month of September. This approximately matches the September single-digit downside experienced in 2022, 2021, 2020, 2018 and 2017. This downside is not out of the ordinary.”

The analyst also suggested that this might lead to increased downward pressure in the short term, before things start looking better.

In the meantime, analysts at Bitfinex have cautioned that a possible drop below $50,000 might occur before the actual bull market begins.

They mentioned that “This is not an arbitrary number, but based on the fact that the cycle peak in terms of percentage return reduces by around 60%–70% each cycle, and the average bull market correction has reduced as well.”

Seasoned analyst Benjamin Cowen shared on X that this September is mirroring trends from past Septembers. He pointed out that bitcoin’s price has already dropped by 8.16% this month.

He added :“The avg. return of BTC in September is -6.3%. So far this month, BTC’s return is already -8.16%. The only time in the last 5 years where the Sep. monthly return was worse than this was 2019 (-13.91%). If BTC closes the month at this price, it would be a fairly typical September.”

Despite some optimistic predictions, the market remains volatile.

Analyst Justin Bennett has warned that bitcoin could be heading towards $53,000 if it fails to hold key support levels.

He noted that there could be a short-term bounce in the price, possibly reaching between $52,000 and $53,000, before a more significant downturn potentially drives it down to $48,000.

There were major liquidations, with more than $71 million being liquidated within a 24-hour period, including $36.71 million worth of bitcoin positions, according to data from CoinGlass.

While the market sentiment remains bearish, some experts believe there are several catalysts that could potentially trigger a recovery for bitcoin.

Investor Lark Davis remains optimistic, suggesting that the next six months could be pivotal for bitcoin. Davis noted that the upcoming fourth quarter has historically been a bullish period for BTC.

He also points to the possibility of rate cuts by the U.S. Federal Reserve. If the Fed decides to implement a cut of 25 basis points, it could create a more favorable environment for the bitcoin market. Davis mentioned that this could act as a significant catalyst for BTC’s price.

Related: Fed Rate Cuts Could Lead to Major Price Swings for Bitcoin

Another factor that might influence bitcoin’s recovery is the upcoming U.S. election, just 60 days away. Former President Donald Trump has indicated plans to support Bitcoin by loosening regulations, which could boost investor confidence.

Bitcoin’s recent drop below $54,000 and the market’s “extreme fear” sentiment show the ongoing volatility and uncertainty in the bitcoin space. As concerns over a potential economic slowdown grow and key support levels are tested, the future of bitcoin’s price remains uncertain.

For now, traders and investors are watching closely, bracing for what could be a pivotal moment in bitcoin’s price history.