Bitcoin has been making waves in financial circles with bold predictions of reaching the $1 million mark in the next decade. Renowned on-chain analyst Willy Woo is at the forefront of these forecasts, outlining a path for bitcoin to become global reserve currency, pushing this monumental valuation.

In his statements and analyses, Woo expresses strong confidence in Bitcoin’s trajectory, foreseeing it as a future reserve currency and a catalyst for significant global changes.

He predicts that bitcoin’s value will easily climb to $1 million within the next ten years, a sentiment echoed by other prominent figures in the Bitcoin space.

Bitcoin as Global Reserve Currency

Woo emphasizes the transformative impact of such a milestone, envisioning a scenario where Bitcoin becomes a reserve currency and central bank corruption faces scrutiny.

He anticipates that wars will become financially unaffordable in a Bitcoin-dominated future, leading to a shift in geopolitical dynamics.

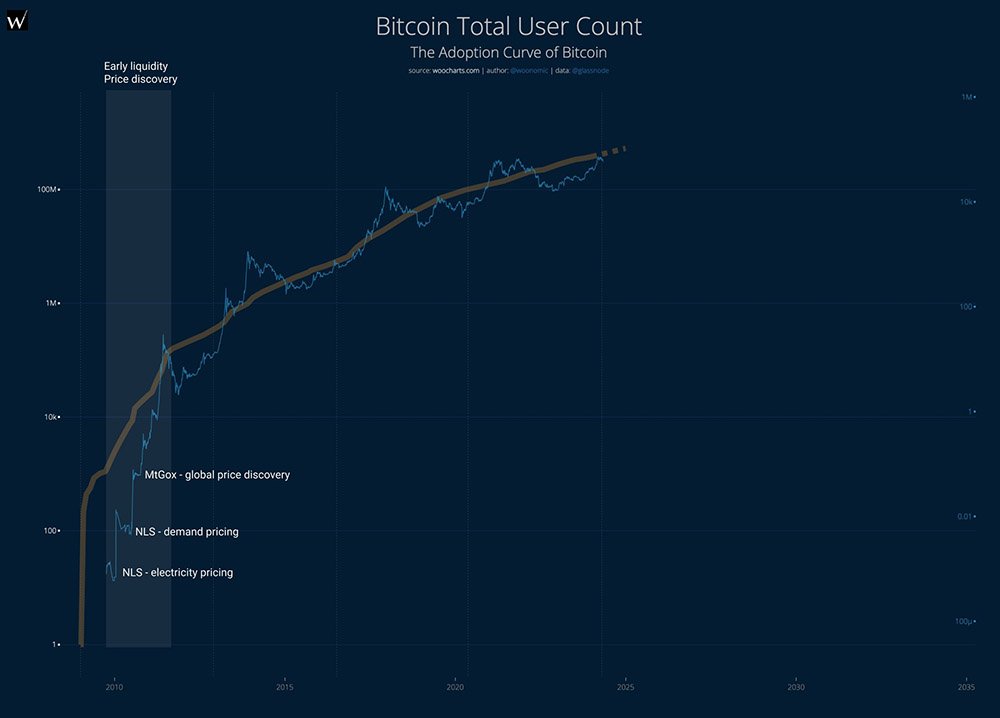

One of the key drivers behind Woo’s prediction is the increasing institutional acceptance and adoption of Bitcoin.

Recent movements towards the approval of spot Bitcoin ETFs globally signal a growing legitimacy for the digital asset. Woo believes that this institutionalization will pave the way for bitcoin’s ascent to $1 million.

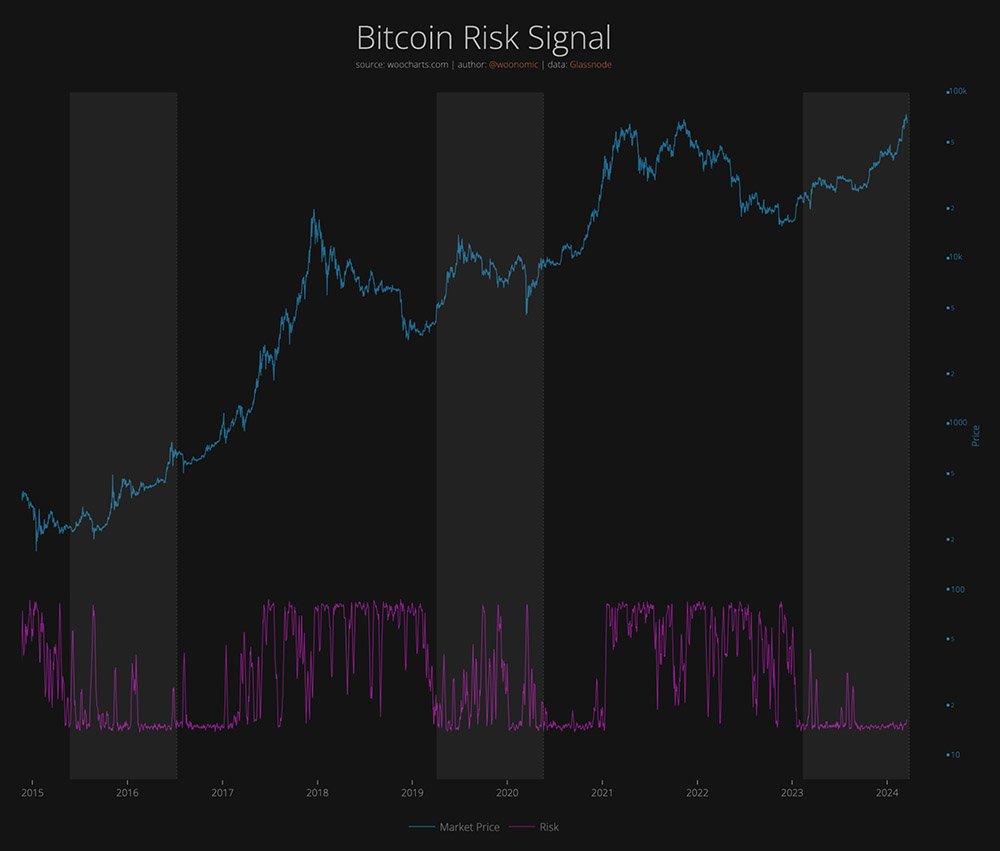

Moreover, Woo points to specific financial indicators and network flow trends that support his bullish outlook for Bitcoin.

By analyzing the relationship between network flows and price actions, he identifies patterns that historically precede a price increase. Recent data suggests an uptick in network flows, indicating a potential rise in bitcoin’s value.

He noted on May 11: “Bitcoin risk signal printed a lower high, this is nearly always bullish.”

He highlighted the changes in market flows on May 9, adding:

“Early signs, if I squint *just right*, that flows into the Bitcoin network are picking up again. Probably needs another week to confirm this trend reversal properly. Lighter blue is the net flows from US Spot ETFs.”

Woo’s optimism is tempered with caution, acknowledging the unpredictable nature of bitcoin’s journey towards high valuations. Despite present volatility, he advises investors to consider the long-term potential of Bitcoin, urging them to monitor both immediate fluctuations and long-term trends.

While Woo’s prediction may seem ambitious, it is grounded in his analysis of Bitcoin’s fundamental strengths and the evolving landscape of global finance.

He believes that Bitcoin’s role as a disruptor in traditional financial systems will only grow stronger in the coming years, driving its value to unprecedented heights.

In addition to Woo’s analysis, other experts in the field share similar sentiments. Jack Dorsey, the co-founder of Twitter and Square, expects Bitcoin to surpass the million-dollar mark by 2030. Dorsey envisions a future where bitcoin’s value continues to grow, challenging traditional fiat currencies.

Despite some skepticism from critics, Woo remains steadfast in his conviction that bitcoin’s path to $1 million is clear.

He highlights the potential for Bitcoin to become a global reserve currency, replacing traditional fiat currencies like the US dollar.

This vision of a decentralized financial system resonates with many in the Bitcoin community who see Bitcoin as a hedge against inflation and government manipulation of currency.