As the Bitcoin community eagerly anticipates the upcoming “bitcoin halving 2024” event scheduled for April 17, digital asset management firm Grayscale has provided insights into why this event differs fundamentally from its predecessors.

It has highlighted various factors, including the evolving regulatory landscape, challenges for miners, the impact of spot Bitcoin Exchange-Traded Funds (ETFs), and the additional fees provided by Bitcoin Ordinals transactions.

Grayscale on Bitcoin Halving 2024

Grayscale stated that the 2024 Bitcoin halving would bring challenges to miners in the short term, but in the longer run, “fundamental on-chain activity and positive market structure updates” will benefit the digital asset.

It stated:

“Facing reduced block reward revenue and high production costs, miners have prepared by raising funds through equity/debt issuances and selling reserves, in an attempt to mitigate short-term financial strains.”

Impact of Spot Bitcoin ETFs

The eleven spot Bitcoin ETFs approved by the United States Securities and Exchange Commission (SEC) in January would also positively impact the digital asset sector, said Grayscale.

The asset management firm said:

“The continued adoption of Bitcoin ETFs could significantly absorb sell pressure, potentially reshaping Bitcoin’s market structure by providing a new, steady demand source, which is positive to price.”

Grayscale claims that “Bitcoin is not just surviving; it’s evolving,” while adding that the “very structure of Bitcoin’s market is evolving” with the approval of spot ETFs from firms like BlackRock and Fidelity.

It also noted that the ETFs “create access to Bitcoin exposure for a greater network of investors, financial advisors, and capital market allocators,” which could further the adoption rate among institutional investors. As recently reported, the BlackRock spot Bitcoin ETF is currently among the top 0.2% of all Exchange-Traded Products (ETPs) that have been issued in the United States since the beginning of 2024. The success of the offerings from BlackRock and Fidelity remains unparalleled in the sector.

Related reading: Bitcoin ETFs Outperform Three Decades of U.S. Launches

Bitcoin Ordinals Generating Miner Income

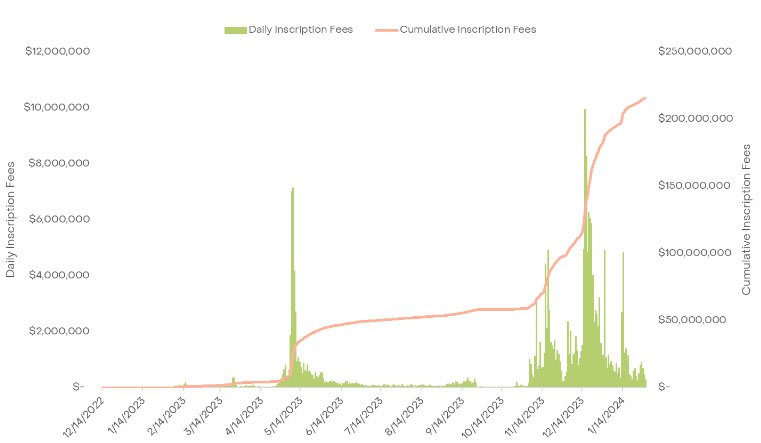

Grayscale said that the additional fees miners collected by confirming Bitcoin Ordinals transactions will also have a positive effect on the fundamentals of the digital asset, adding:

“With transaction fees from ordinals already constituting approximately 20% of total miner revenue, this emerging trend of ordinal activity presents a new path toward sustaining network security through increased transaction fees, for now.”

Notably, Bitcoin Core Developer Luke Dashjr recently slammed Ordinals for causing excessive network congestion. He added that Ordinals are “exploiting a vulnerability” in the Bitcoin Taproot update.

“Propelled by a surge in onchain activity, bolstered by significant market structure momentum, and underscored by its inherent scarcity, Bitcoin has shown its resilience,” Grayscale concluded.

While Grayscale presents a positive outlook, American financial services firm Cantor Fitzgerald warns of short-term profitability challenges for nine out of the 11 largest publicly traded bitcoin miners during the 2024 halving. The report from the firm predicted that only Singapore-based miner Bitdeer and United States-based CleanSpark would be profitable, while others would be drowning in losses.

In the meantime, bankrupt digital asset mining company Core Scientific has reported its exit from bankruptcy as bitcoin currently trades at $47,000. The company’s stocks were also relisted on Nasdaq.

Grayscale’s analysis sheds light on the multifaceted landscape surrounding the 2024 Bitcoin halving, leaving the community wondering about the potential market surprises this event may unveil.