The highly anticipated Bitcoin halving 2024 event, scheduled for April 20, has sparked a flurry of interest and speculation in the Bitcoin community. As the countdown to the halving continues, experts are cautioning that the market may be underestimating the event’s long-term impact on bitcoin’s price.

Historical Trends

Historical data surrounding previous Bitcoin halving events reveals intriguing patterns that suggest short-term dips followed by significant long-term gains. Bitwise Asset Management highlights that in the month immediately following past halvings, bitcoin prices experienced modest drops. However, the subsequent year saw exponential growth. For example, after the 2012 halving, bitcoin saw a meager 9% increase in the month post-halving, only to skyrocket by a staggering 8,839% over the following year.

Bitwise wrote:

“The data is limited but the picture reveals an intriguing pattern.”

Bitcoin Halving 2024: Market Sentiment

Despite historical evidence pointing towards long-term bullishness, there are concerns regarding short-term market sentiment. Industry experts warn of potential challenges in the immediate aftermath of the halving. Markus Thielen, head of research at 10x Research, anticipates a significant miner sell-off post-halving, which could exert downward pressure on the markets. Fred Thiel, CEO of Marathon, believes that the anticipated rally following the halving has already been factored into current prices.

Interest in the upcoming Bitcoin halving has reached an all-time high, according to Google Trends data. Searches for the phrase “Bitcoin halving” peaked with a popularity score of 100, indicating unprecedented levels of interest. Despite a slight decrease in interest following the peak, searches remain exceptionally high. This surge in interest reflects growing anticipation and curiosity surrounding the event.

Expert Analysis

Bitwise Asset Management emphasizes the importance of considering the long-term impact of the halving, stating: “The market prices in the short-term impact of the halving but underestimates the long-term impact.” This sentiment is echoed by other analysts who highlight the potential for short-term price drops followed by significant long-term gains.

Crypto.com CEO Kris Marszalek suggests that Bitcoin could face selling pressure before the halving event, yet remains optimistic about its long-term prospects. He acknowledges short-term risks but believes the halving will ultimately benefit the market.

He said:

“Over a longer period, the halving will make a substantial difference and is a positive development for the market.”

Ripple CEO Brad Garlinghouse anticipates a doubling of market value of digital assets in the current year. He attributes this growth to spot ETFs and Bitcoin halving, emphasizing the impact of institutional investment through ETFs on market dynamics.

He told CNBC earlier in this month:

“I’m very optimistic. I think the macro trends, the big picture things like the ETFs, they’re driving for the first time real institutional money,”

Market Corrections and Predictions

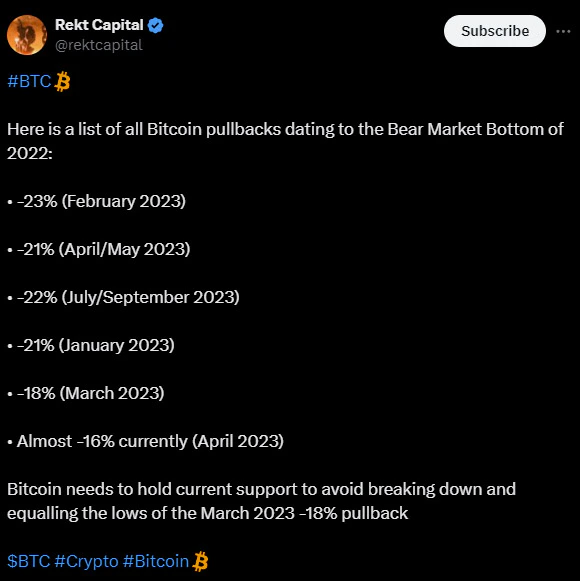

Market indicators suggest the possibility of further corrections in the short term. Trader and analyst Rekt Capital has highlighted several significant pullbacks since the 2022 bear market bottom, with corrections ranging from 18% to 23%. Currently, the market has corrected by 16%, indicating the potential for further declines.

Conclusion

As the Bitcoin halving approaches, the market is bracing for both short-term volatility and long-term potential. While historical trends indicate a pattern of short-term dips followed by significant gains, market sentiment and external factors may influence price movements in the near future. Experts urge investors to consider the broader implications of the halving and remain vigilant amid market fluctuations.

In summary, while the immediate aftermath of the halving event may see some turbulence, the long-term outlook for Bitcoin remains optimistic, driven by factors such as increased institutional interest and growing adoption. As the Bitcoin ecosystem continues to evolve, the halving serves as a reminder of the asset’s unique supply dynamics and its potential to redefine the future of finance.