After the Bitcoin halving 2024, a complex interplay of factors could influence the market. While the reduction in newly mined bitcoin may lead to a potential shortage, the increasing involvement of ETFs adds another layer of complexity.

Short-Term Traders vs Diamond Hands

Bitcoin long-term holders, also known as “Diamond Hands”, remain optimistic due to their belief in its transformative technology and fixed supply, which they anticipate will drive value appreciation over time.

They see Bitcoin as a hedge against fiat currency devaluation and view its expanding adoption as a testament to its growing utility. Additionally, the maturation of Bitcoin’s market infrastructure enhances user’s confidence, facilitating easier access and fostering a more robust ecosystem for long-term growth.

Wallets that HODL bitcoin are in a consistent upward trend despite price action, holding more than 50% of the current bitcoin circulating supply.

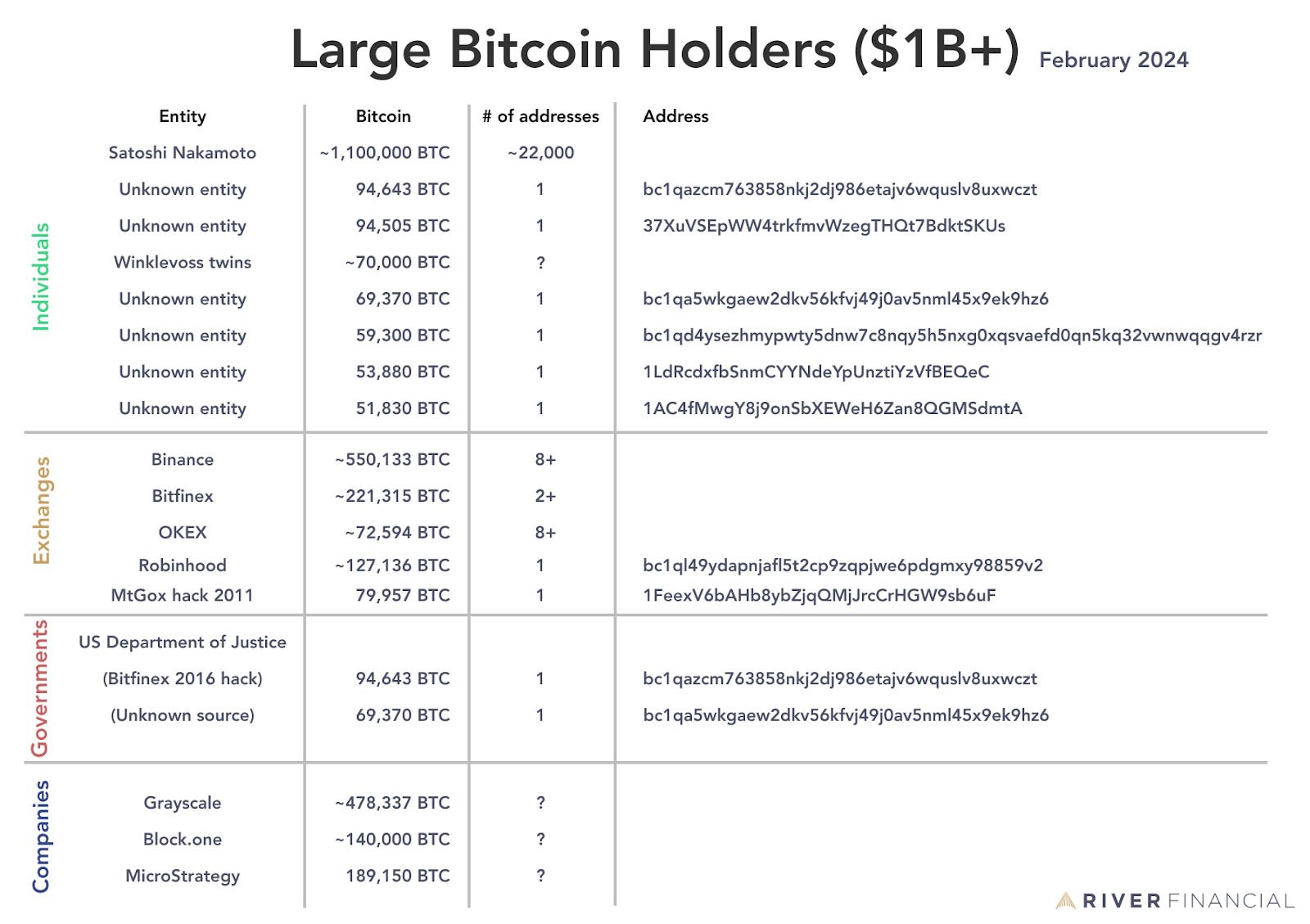

Companies and Nation States

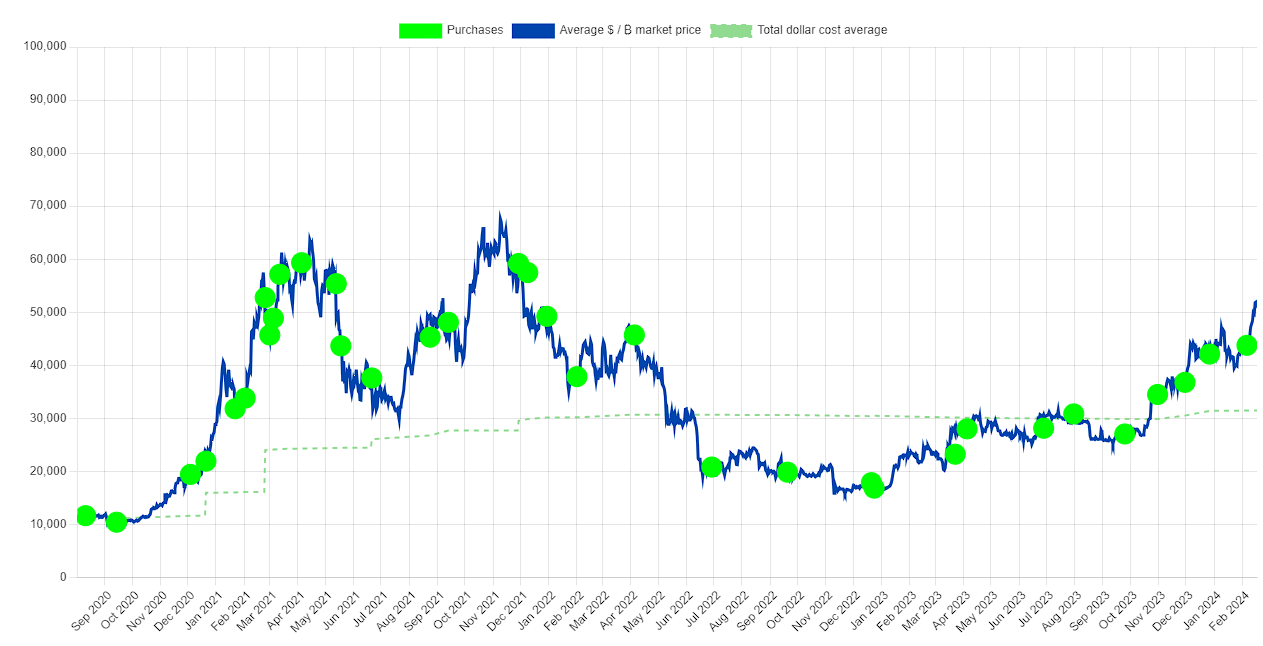

MicroStrategy, spearheaded by CEO Michael Saylor, has initiated the new year with a robust surge in bitcoin acquisitions. In January 2024 alone, the company bolstered its holdings with the purchase of 850 bitcoin.

The consistent pattern of bitcoin acquisitions indicates that Saylor and MicroStrategy are consistently adding to their holdings every month, occasionally with brief intervals of one or two months between purchases. Currently, MicroStrategy holds 190,000 bitcoin as Michael Saylor reported on his X account.

Nation states are also buying bitcoin for their reserves. Countries like El Salvador disclose their buy marks and holdings. El Salvador now possesses 2,762 bitcoin as Forbes reports.

Other Small countries like Montenegro are in the works for having bitcoin in their reserves.

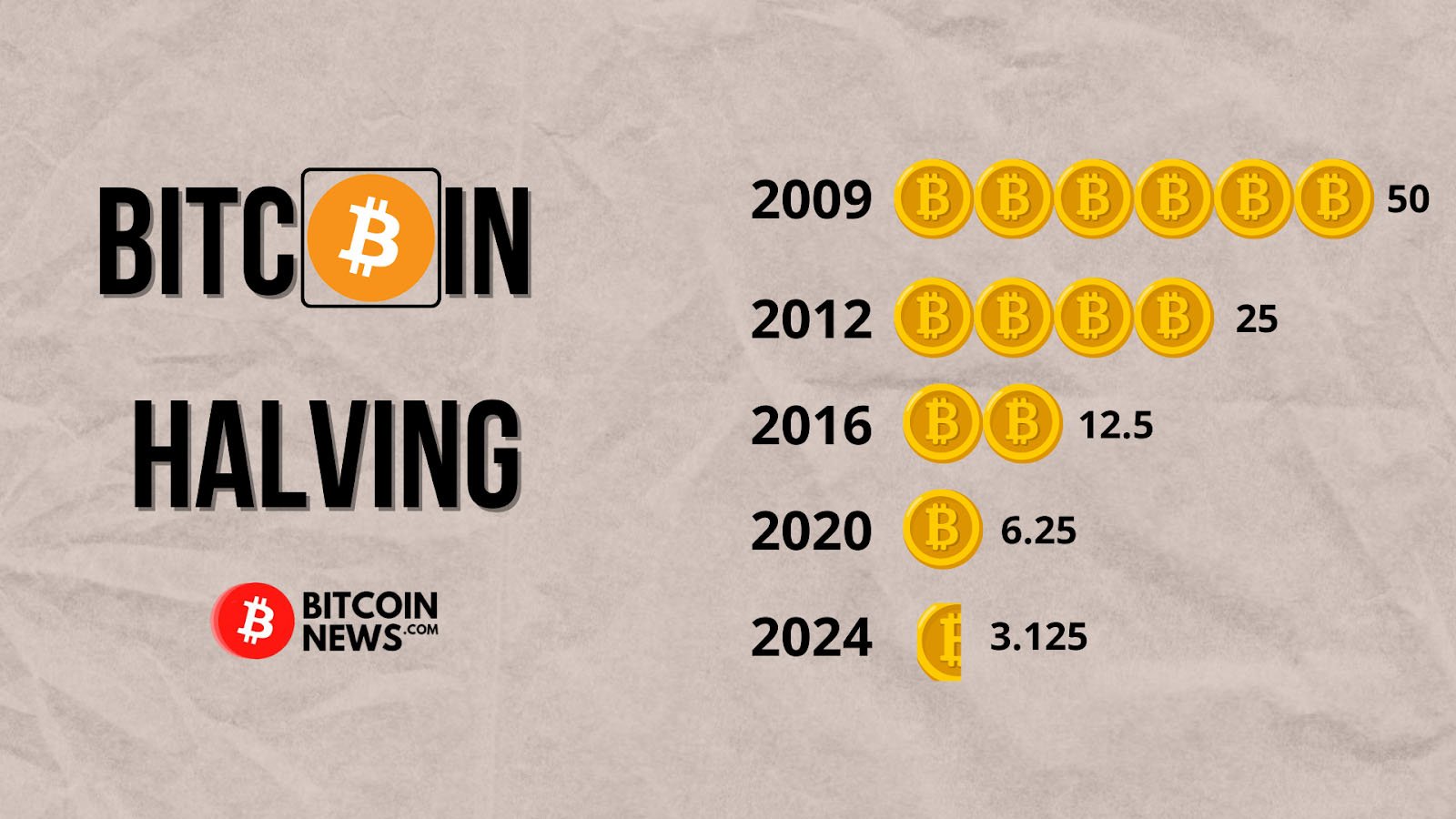

Bitcoin Halving 2024 and Supply

Bitcoin Halving is an event programmed into the Bitcoin protocol that occurs approximately every four years or 210,000 blocks. During this event, the reward that miners receive for confirming transactions and securing the network is halved.

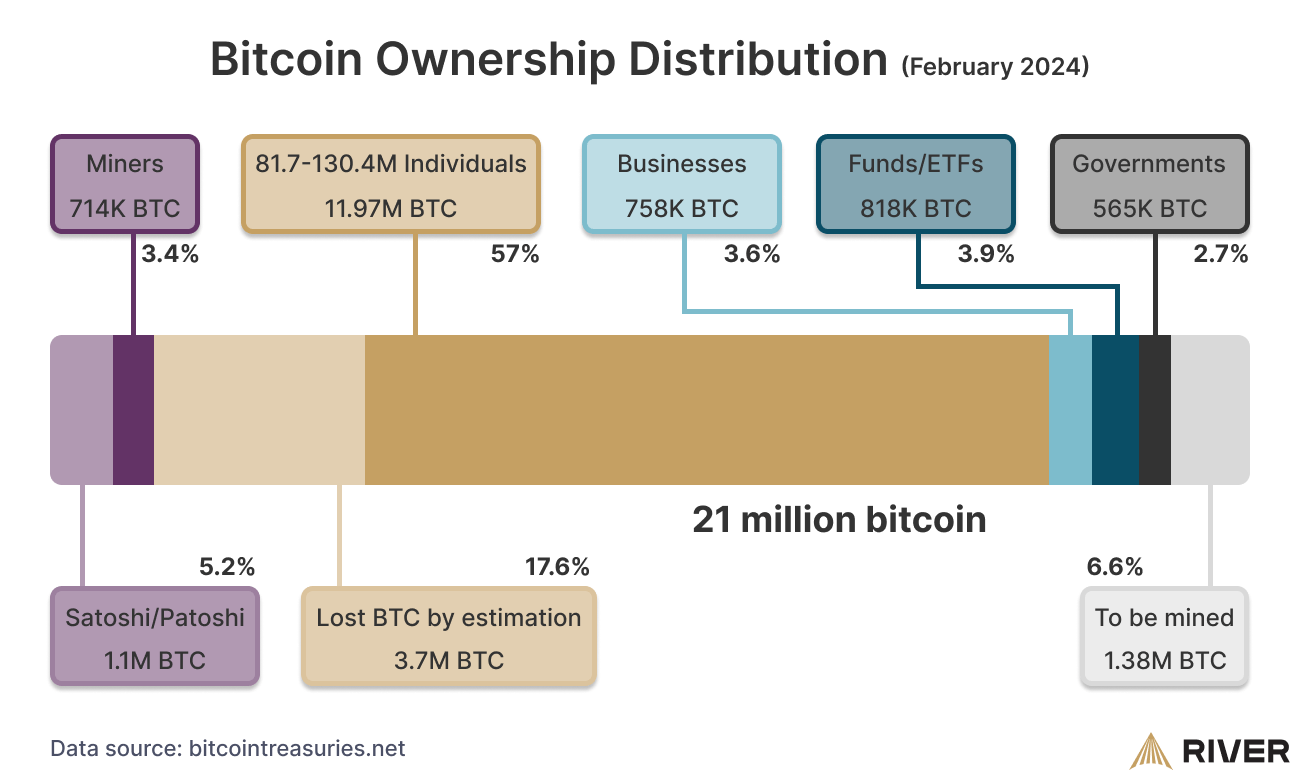

This reduction in rewards ultimately decreases the rate at which new bitcoin is created, enforcing scarcity. The purpose of the Bitcoin Halving is to control the inflation rate of Bitcoin and ensure that the total supply remains limited to 21 million, making it a deflationary asset over time.

Before the halving event, around 900 bitcoin will be mined each day. Following the halving, this rate decreased to about 450 bitcoin mined daily. Based on these figures, it’s estimated that after April 20th, 2024, approximately 114,750 bitcoin will be mined each year, or around 14,343 bitcoin each month until the next halving, expected by 2028.

ETFs And Bitcoin’s Mined Supply

A Bitcoin ETF, or Exchange-Traded Fund, is a type of investment fund that tracks the price of bitcoin and allows individuals and institutions to gain exposure to Bitcoin without needing to own or store it themselves directly. Instead, users can buy shares of the ETF, representing ownership of the underlying bitcoin held by the fund.

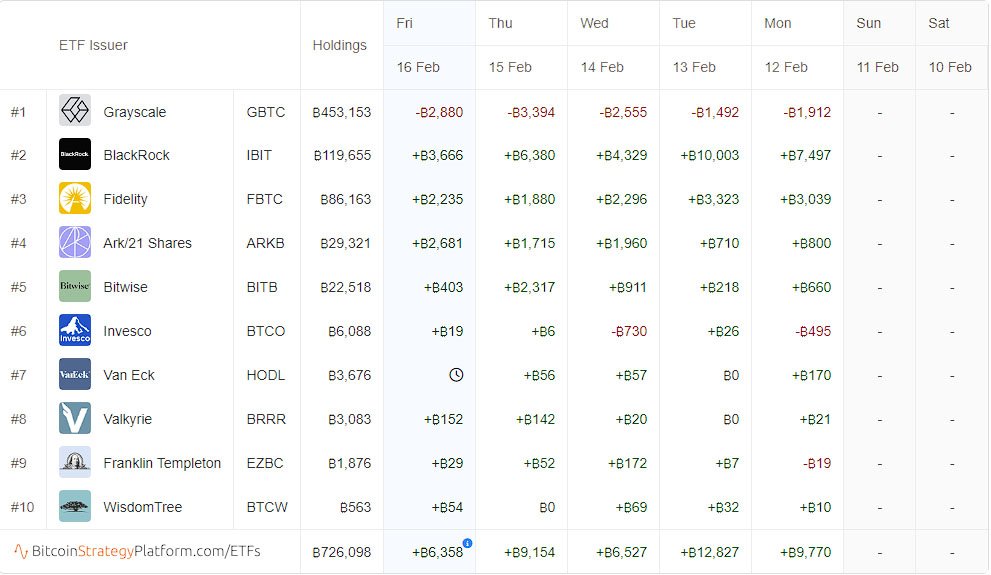

The current landscape of the Bitcoin market is witnessing significant shifts, with Bitcoin ETFs holding a total of 726,090 bitcoin at present. Concurrently, there are substantial outflows from the Grayscale Bitcoin Trust (GBTC), dispersing its bitcoin holdings among other ETFs.

Investment researcher and founder of Lyn Alden Investment Strategy, Lyn Alden, shared her insights on the potential implications of a Bitcoin ETF during an interview on the “What Bitcoin Did” podcast. Alden delved into the multifaceted impacts that a Bitcoin ETF could have on the market and beyond.

Conclusion

Approximately 1.85 Million bitcoin are held on exchanges, as reported by CoinGlass. This confluence of factors, including the involvement of large companies, nation-states, long-term holders, the halving mechanism, and the surge in ETF activity, presents a perfect storm scenario for a severe bitcoin shortage.

As larger entities such as ETFs continue their aggressive purchasing spree, there’s a looming risk of scarcity for other major players in the industry. Exchanges may resort to limiting withdrawals or imposing significantly higher fees to manage the strain on available bitcoin reserves. Consequently, smaller exchanges might find themselves priced out of the market due to the dwindling circulation of bitcoin.

As the bull market drives up on-chain bitcoin fees, the shortage could worsen for smaller retailers and individuals. This underscores the critical importance of layer 2 solutions like the Lightning Network, which can alleviate congestion on the Bitcoin network and facilitate more efficient and cost-effective transactions.