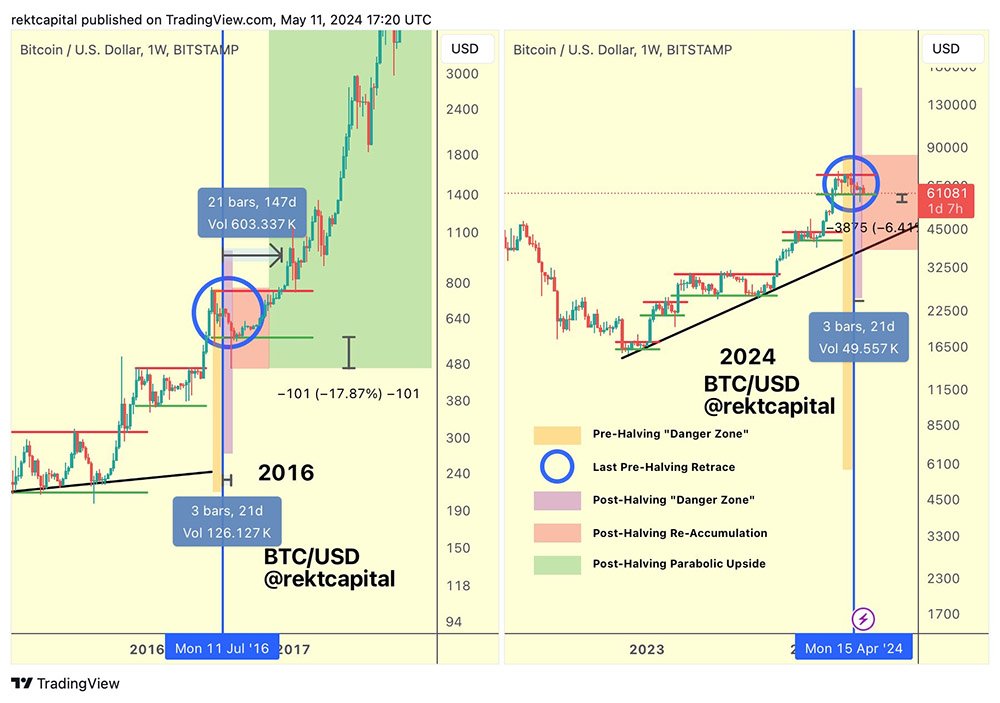

Bitcoin’s current price trajectory is displaying similarities to its behavior following the 2016 halving event. Comparing this halving with Bitcoin halving history, several indicators point towards a potential local bottom and significant price gains in the future, as outlined by multiple analysts.

Pseudonymous trader Rekt Capital took to social media platform X to highlight bitcoin’s “perfect” resemblance to its 2016 history, noting a downside wick below the current re-accumulation range.

The re-accumulation range is identified as any price below $61,081, with bitcoin recently trading below that mark. According to the analyst, this downside wick signals a potential local bottom.

Bitcoin Halving History: Rhyming With 2016 Data

Additionally, Rekt Capital pointed out that bitcoin is in its “last pre-halving retrace” stage, reminiscent of a period in 2016 that preceded a 48% surge just six months later, reaching $973.

According to the data from CoinMarketCap, bitcoin is currently trading at around $62,700, marking a decrease of around 4% over the past seven days.

Despite this recent dip, overall market sentiment remains relatively optimistic, with many investors viewing the current price level as an opportunity to accumulate more bitcoin before potential future rallies.

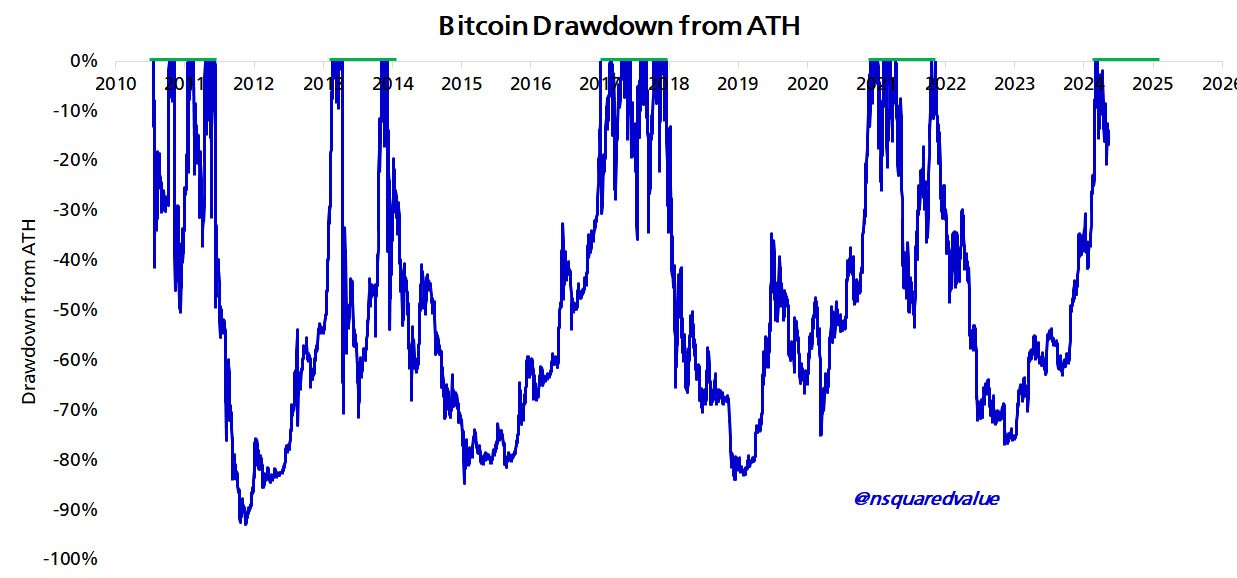

Meanwhile, Timothy Peterson, founder and investment manager at Cane Island Alternative Advisors, referred to the price drawdown from the all-time high (ATH) chart to make ambitious price predictions.

Notably, this chart measures the drop from the BTC price peak to its lowest point over a specific time frame. This implies that the digital asset is making a new all-time high when the chart stays at zero.

Peterson estimated that bitcoin’s price could increase up to six fold by the beginning of 2025, stating:

“Based on adoption and prior drawdowns, we can guesstimate that the peak value of this cycle would be between $175,000 – $350,000 in the next 9 months.”

Peterson based his predictions on bitcoin’s historical price behavior, particularly its tendency to surpass its previous all-time high after an average of 320 days. He suggested that this bull market might end in January 2025.

However, Peterson acknowledged the uncertainty inherent in predicting market trends, cautioning that these predictions are contingent on historical patterns repeating themselves.

Supporting the notion of a potential local bottom, another pseudonymous trader known as Daan Crypto highlighted the daily 100 moving average.

They suggested that bitcoin’s price might be “hovering around” its local bottom, drawing parallels to a similar formation observed after the approval of 11 spot Bitcoin exchange-traded funds (ETF) in January.

Following this approval, bitcoin’s price surged by 32% just a month later, reaching $51,730 on February 25.

Despite these positive indicators, analysts advised caution, noting that support levels can be temporary and that bulls need to demonstrate strength to sustain upward momentum.

The combined analyses suggest a cautiously optimistic outlook for bitcoin’s price in the near and medium terms, with signs pointing towards a potential local bottom and significant price appreciation ahead.