Blockstream CEO Adam Back recently said in a statement that Bitcoin (BTC) has the potential to skyrocket to $100,000 prior to the approval of a Bitcoin Spot Exchange-Traded Fund (ETF) by the United States Securities and Exchange Commission (SEC). He stated he believes major “biblical events” that happened in the recent years, have kept the price of bitcoin down.

In a recent interview, Back, who is widely known for pioneering the proof-of-work algorithm, noted that bitcoin is trailing below the historical price trend line of previous halving events. He pointed out that the recent failures in the digital asset sector could push price of bitcoin higher.

“I think Bitcoin could get to $100,000 even before the ETF and before the halving. But I certainly think the ETF shouldn’t be undervalued in its influence,” Back said.

It is also important to note that Blockstream, a prominent Bitcoin mining firm, officially unveiled its long-awaited application-specific integrated circuit (ASIC) miner, “Cyberhornet,” which is set to be launched in the third quarter of 2024.

Bitcoin Price Brought Down by ‘Biblical Events’

The Blockstream executive stated that based on previous Bitcoin cycles and halving events, the price of BTC is considerably lower than the widely accepted projections. He claimed that several factors caused this drop in the digital asset’s price, explaining:

“The last few years were like biblical pestilence and plague. There was COVID-19, quantitative easing, and wars affecting power prices. Inflation is running up people, and companies are going bankrupt.”

Back noted that similar effects can be seen in traditional markets and portfolio management. The executive said that because of these factors, fund management firms had to manage additional risks and losses that led to the sale of liquid assets.

He added:

“They have to come up with cash, and sometimes they’ll sell the good stuff because it’s liquid and Bitcoin is super liquid. It used to happen with gold, and I think that’s a factor for Bitcoin in the last couple of years.”

Bitcoin and the $100K Price Prediction

Back emphasized that Bitcoin would’ve already hit $100,000 if these macro events had not affected the price of the digital asset. Now that the industry-specific failures have been resolved, he predicts bitcoin will achieve higher highs as the 2024 halving event approaches.

Blockstream CEO added:

“The wave of the contagion—the companies that went bankrupt because they were exposed to Three Arrows Capital, Celsius, BlockFi, and FTX—that’s mostly done. We don’t think there are many more big surprises in store.”

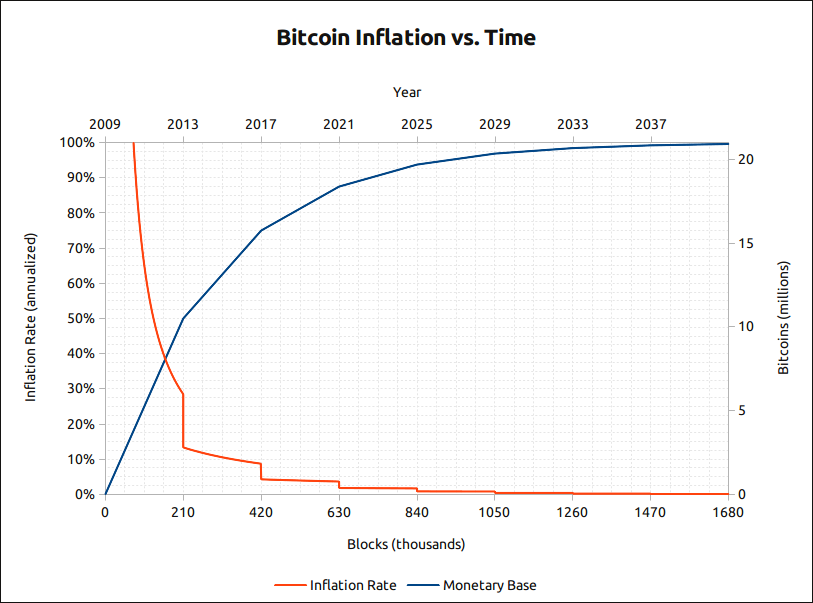

Back also mentioned prominent Bitcoin trader PlanB’s Bitcoin stock-to-flow (S2F) model as a reference point for the Bitcoin price surge in 2024. He explained that the S2F model suggests that investors bought huge quantities of BTC prior to halvings and sold their holdings in the 18 months following the drop in block rewards.

“People thought it was a bit of a crazy assertion that we might get to $100,000 pre-halving because I said it when the price was around $20,000,” Back said.

Various experts and analyses are providing a spectrum of predictions for Bitcoin’s future value. Optimistic forecasts, such as Standard Chartered Bank’s prediction of $100,000 by the end of 2024, suggest a milder bullish trajectory. Conversely, Harvard professor Kenneth Rogoff remains skeptical, asserting that Bitcoin is more likely to be worth $100 than $100,000 in a decade.

The consensus, however, leans towards massive positive growth, with predictions ranging from hitting $100,000 in the short term to even reaching $1 million by 2030. While short-term fluctuations may occur, the overall sentiment suggests a bullish outlook for Bitcoin’s value in the coming years.