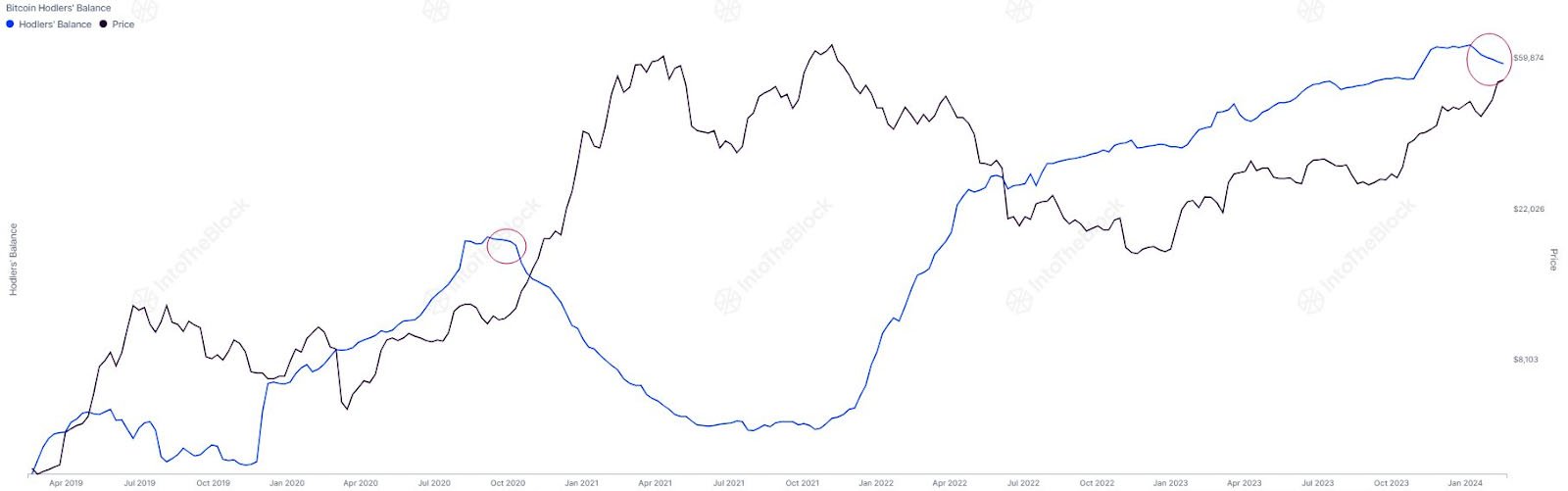

Long-term bitcoin investors, commonly known as “hodlers” in the community, have recently caught the attention of market analysts. The trend reveals that these seasoned investors have been gradually selling their bitcoin holdings, totaling around 200,000 BTC since the beginning of the year.

Notably, this selling from their collective balances marks nearly 3 months of consecutive net decreases.

Hodlers’ Behavior During Bull Markets

This intriguing development, shared by market intelligence platform IntoTheBlock on X, has sparked discussions about its implications and the potential impact on the broader digital asset market. However, historical patterns indicate that these investors usually tend to engage in profit-taking activities during such upward trends.

Notably, IntoTheBlock states that this consistent decrease in bitcoin holdings is a “typical hodler activity during bull markets.” It revealed that the last bull market witnessed a similar trend, with BTC hodlers reducing their holdings by around 15%. However, as we currently roam in the dawn of this bull run, the reduction accounts for around 1.5% of their total BTC holdings.

Whales’ Rising Accumulation

The steady selling activity from long-term holders has been counterbalanced by significant accumulation by various investor groups. According to Ki Young Ju, CEO of CryptoQuant, bitcoin inflows into accumulation addresses have reached a record high of 25,300 BTC, indicating a strategic effort by major holders to accumulate bitcoin well in advance of anticipated price increases.

These addresses are characterized by multiple features such as no outgoing transactions, holding balances exceeding 10 BTC, and consistent activity for over seven years. Moreover, the bullish trend aligns with increased buying activity among whales, characterized by substantial holdings, accumulating over 100,000 BTC, equivalent to $5 billion, in just ten days.

These big fish have accumulated around $13 billion worth of bitcoin in 2024, as BitcoinNews reported.

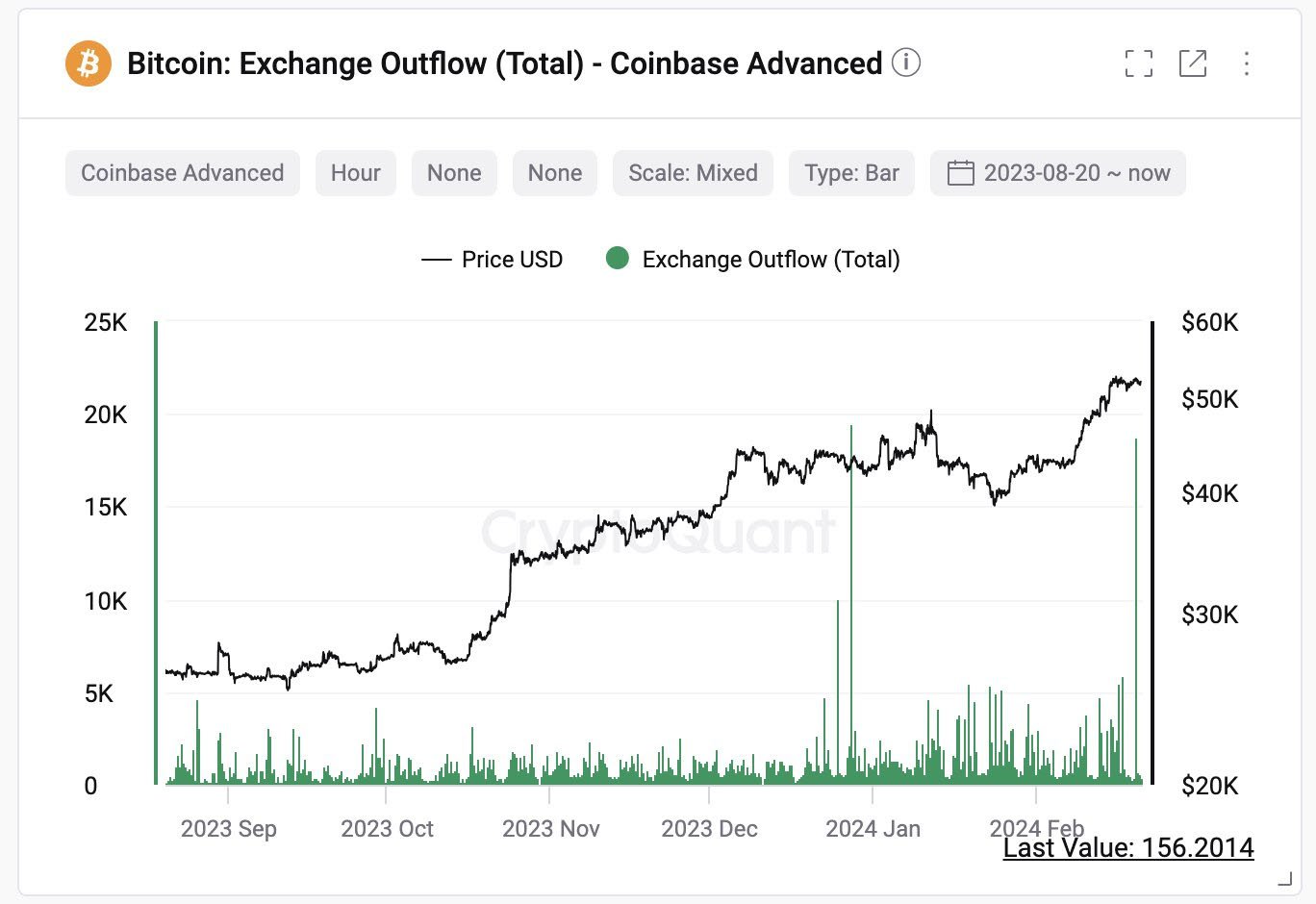

Investors Ditching Exchanges

Interestingly, according to data by Glassnode, exchange-held bitcoin has been experiencing continual decrease. BTC trading has fallen from 2.356 million BTC to 2.314 million BTC in 2024 alone. This marks the lowest bitcoin holdings by exchanges, sending the percentage of BTC supply from 12.03% to 11.79% YTD.

In particular, in recent weeks, Bitcoin whales have withdrawn over $1 billion worth of BTC from Coinbase to non-exchange addresses. This shift could indicate growing adoption of non-custodial wallets.

The data does not explicitly clarify if the Bitcoin addresses of spot Bitcoin Exchange-Traded Funds (ETFs) have been included or not. However, the overall trend underscores the mounting pressure on bitcoin’s finite supply.

As of the latest market data, bitcoin is currently trading around $51,700, having faced challenges in maintaining levels above $52,000. Despite this, the digital asset has displayed stability, particularly after a major surge linked to the launch of spot Bitcoin ETFs in the United States.

The analysis of recent actions of bitcoin hodlers offers comprehensive insights into the current landscape, considering factors such as price stability, withdrawal patterns, and the impending halving event.