As bitcoin’s price retreated below the $43,000 mark, industry analysts pointed to bitcoin miners offloading their holdings as a primary driver of the recent downturn. Bitfinex analysts released a report on Tuesday attributing much of the price drop, particularly post-SEC approval of spot Bitcoin ETFs, to miners capitalizing on the market surge to exit or leverage their positions.

Motivated by the impending halving scheduled for April this year, miners are strategically selling their bitcoin reserves.

Bitcoin Price Drop: Impact of Bitcoin Halving

Notably, halving reduces bitcoin rewards for miners, leading to a potential decline in their business profitability. The Bitfinex report emphasized that selling now provides bitcoin miners with operational liquidity and strategic adjustments to market conditions post-ETF approval. It states:

“Selling now provides the capital for miners to upgrade infrastructure and is a reminder of the significant influence on market liquidity and price discovery that miners have.”

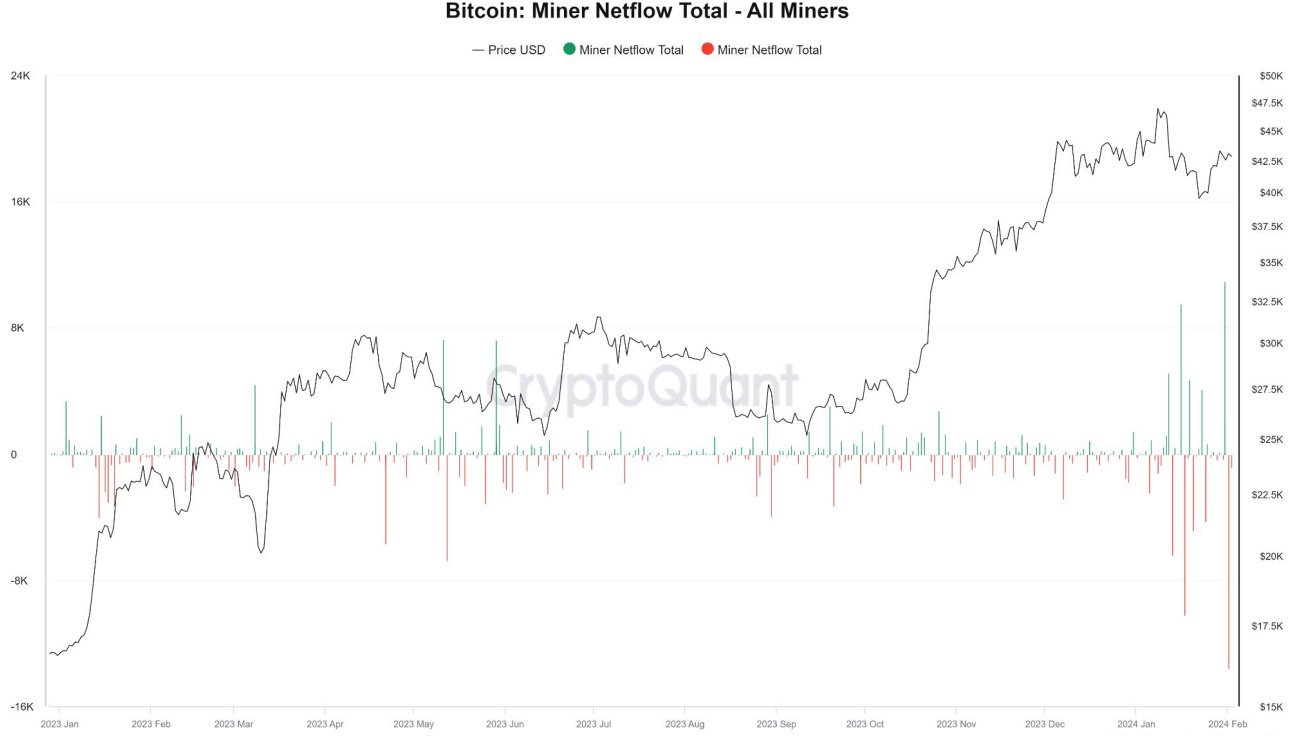

According to the report, miners’ reserves saw a substantial drop shortly after the approval of spot Bitcoin ETFs. On January 12, 2024, the second day of trading for the newly approved ETFs, Bitcoin experienced a sharp decline, with a notable increase in bitcoin miners’ outflow to exchanges. Glassnode data reveals that over $1 billion worth of BTC was sent to exchanges on that day, marking a six-year high in miner outflow.

Further exacerbating the situation, on February 1, there was a significant movement of 13,500 BTC out of bitcoin miners’ wallets, the highest negative outflow since the metric’s creation. This followed a day of considerable inflows, around 10,000 BTC, indicating potential rebalancing within certain mining companies. The net outflow of 3,500 BTC over a single day is the highest observed since May 2023.

Strong Hands Still Strong

Despite the significant bitcoin miner outflow, the report notes that long-term Bitcoin investors appear reluctant to sell at current market prices, as indicated by the “Supply Last Active” metrics. Bitfinex analysts write:

“Recently, there has been a minor decline in the supply last active within the one-year and two-year bands. Notably, a significant portion of this activity is associated with the Grayscale Bitcoin Trust (GBTC), as long-dormant holdings have been solved or swapped into other BTC ETFs.”

Halving Hype

Looking ahead, Bitcoin is gearing up for its next halving in April, reducing bitcoin miner rewards by 50% per validated block. This cyclical event, occurring around every four years, aims to control the supply of new bitcoin, enhancing its scarcity over time. The last halving in 2020 reduced the block reward from 12.5 bitcoin to 6.25 bitcoin, and the upcoming halving will further cut it to 3.125 BTC per block.

As of the latest data, the world’s largest digital asset has experienced a slight increase of around 1.5% in the past 24 hours, settling at $43,200. The ongoing interplay between miner behavior, market dynamics, and the approaching of halving adds complexity to the BTC price trajectory, capturing the attention of investors and industry observers alike.