Today, the Bitcoin market is going to witness a significant event as several reports indicate a massive expiry of Bitcoin options. With billions of dollars’ worth of contracts set to settle, analysts predict heightened volatility in the coming days.

Unprecedented Bitcoin Options Expiry Event

Reports suggest that the expiry event is unprecedented in scale, marking one of the largest expiries in the history of Bitcoin derivatives trading. According to various sources, including reports from Deribit, the leading Bitcoin derivatives exchange, over $9.5 billion in Bitcoin options are set to expire.

Options contracts are legal agreements that give the buyer the right to buy or sell an underlying asset, such as Bitcoin, at a predetermined price and time. The expiry date is when these contracts settle, potentially leading to significant market movements based on the volume and nature of the expiring options.

Key Insights

The reports offer crucial insights into the nature and consequences of this upcoming expiry event. Specifically, data from Deribit suggests that a considerable portion of these options are likely to expire “in-the-money,” meaning they could trigger buying pressure in the market.

Deribit’s chief commercial officer, Luuk Strijers, highlighted that a majority of these options are anticipated to expire in-the-money, emphasizing that the substantial number of options reaching this status is likely to push prices upward, thereby increasing volatility within the bitcoin market.

Market Dynamics

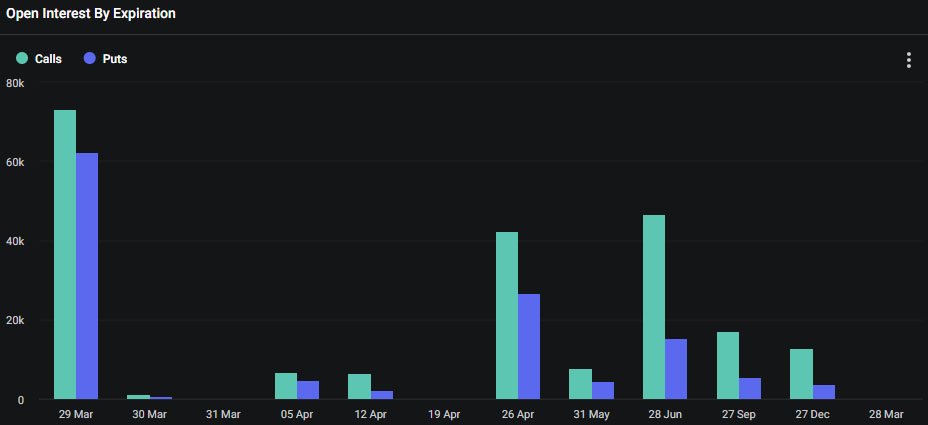

Analysts emphasize the significance of open interest, which represents the total number of outstanding derivative contracts. The surge in open interest recorded by Deribit reflects increased market participation and signals heightened liquidity, marking a notable milestone in the bitcoin derivatives landscape.

The expiry event is expected to have notable implications for the prices of Bitcoin. With Bitcoin’s spot price hovering below $70,000, a significant portion of the open interest is expected to expire in the money, potentially leading to increased buying activity and upward pressure on prices.

Expert Opinions

Industry experts offer varying perspectives on the potential outcomes of the expiry event. While some analysts anticipate increased buying activity and upward pressure on prices, others warn of potential speculative movements as traders strive to cover their positions or capitalize on expected volatility.

Analyst Michael van de Poppe remarked that bitcoin remains resilient above key levels, poised for another record-breaking high as long as it maintains its position above $67,000. He said: “Overall, upwards returns seem relatively skewed for Bitcoin pre-halving.” However, he cautioned that a correction in bitcoin’s price could be immediately bought by whales and investors, suggesting a complex market landscape.

Conclusion

As the bitcoin market braces for the largest options expiry in history, investors and traders alike are preparing for potential market turbulence. With billions of dollars’ worth of contracts set to settle, the coming days could see significant price movements in Bitcoin.

Between opportunities for gain and risks of loss, this expiry event could serve as a catalyst for a new wave of volatility in the market. As traders monitor developments closely, the impact of this event on market dynamics remains to be seen.