Bitcoin, the world’s largest digital currency by market capitalization, has experienced significant fluctuations recently, with over-the-counter (OTC) desk balances reaching levels not seen since June 2022.

The surge in bitcoin OTC desk balances has sparked discussions among market analysts, with some cautioning that the increase may foreshadow a potential decline in bitcoin’s price.

This article will explore what these rises mean for bitcoin and the broader digital asset market.

Over-the-counter (OTC) desks play a crucial role in the bitcoin market, facilitating large trades without affecting the market price. These desks are often used by institutional investors, high-net-worth individuals, and miners who wish to buy or sell large amounts of bitcoin discreetly.

Unlike exchanges, where trades are public, OTC desks offer privacy and better execution prices, making them an attractive option for those looking to move substantial amounts of bitcoin.

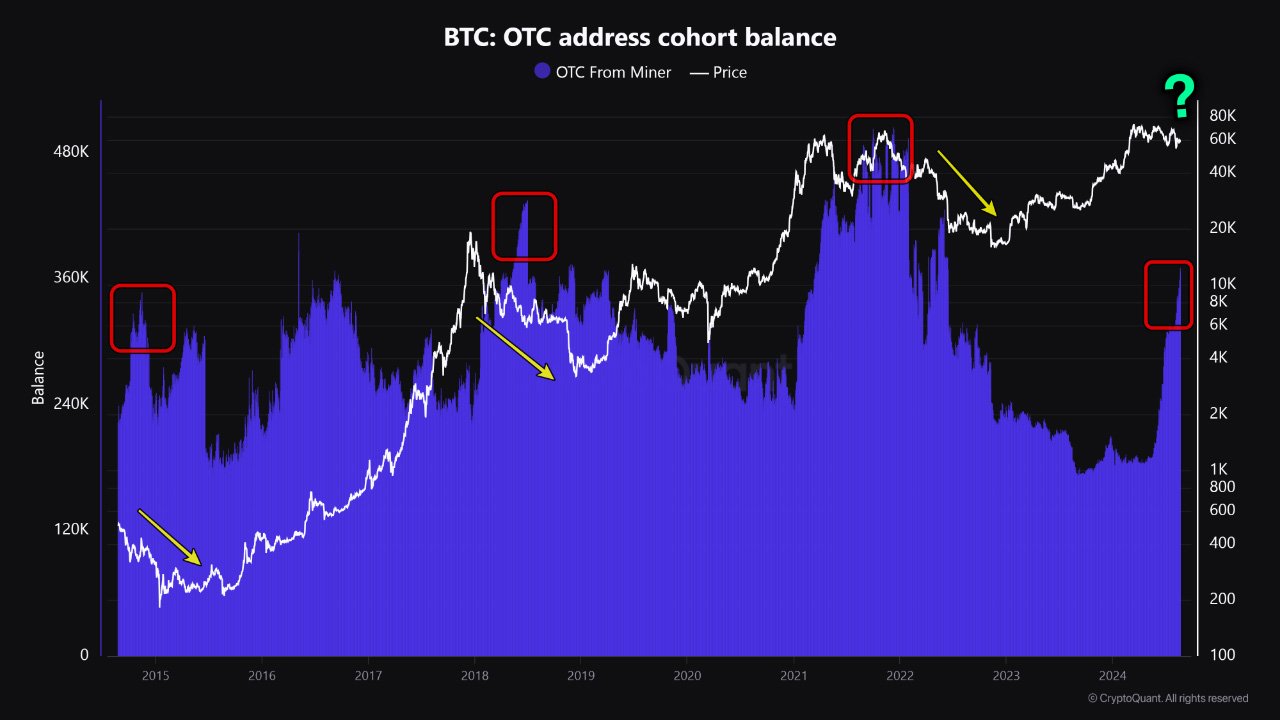

According to data from CryptoQuant, the balance of bitcoin held in OTC desks has soared in recent months. As of August 2024, the OTC desk balances have reached 368,000 BTC, marking a significant increase of 153,000 BTC from the 215,000 BTC recorded in June 2024.

This surge represents a 70% rise in just three months, and it is the highest level of OTC desk balances since June 2022. This sharp increase in OTC desk balances has caught the attention of market analysts. A CryptoQuant analyst noted:

“Historically, increases in Bitcoin OTC desk balances have been associated with declines in Bitcoin prices.”

This observation has raised concerns that the current rise in OTC desk balances might indicate a looming sell-off that could drive down bitcoin’s price.

Miners, who are responsible for verifying transactions and securing the Bitcoin network, are among the primary users of OTC desks.

After the latest Bitcoin halving, which reduced the block reward from 6.25 BTC to 3.125 BTC, miners have felt the economic pressure. With their earnings cut in half, many miners have turned to OTC desks to sell their bitcoin and cover operating costs.

Related: Immediate and Long-Term Effects of Bitcoin’s Fourth Halving

The substantial rise in OTC desk balances suggests that miners have been offloading significant amounts of bitcoin, potentially preparing for a downturn in the market. CryptoQuant’s report adds:

“Miners often turn to OTC deals to sell Bitcoin, seeking better execution without impacting the market price as they might on exchanges. The substantial rise in OTC desk balances suggests significant selling activity among miners.”

In fact, the increase in OTC desk balances mirrors the trends seen in late 2021, when bitcoin’s price was high but faced increased distribution, eventually leading to a correction in 2022.

A similar pattern seems to be emerging now, with 370,000 BTC currently held on OTC desks, marking a 60,000 BTC increase over the past 30 days alone. This trend indicates that large holders, including miners, may be offloading their positions, potentially exerting downward pressure on the market.

The rise in OTC desk balances has coincided with significant price movements in the bitcoin market. Bitcoin’s price has been trading around $60,000, gaining 2.18% over the last 24 hours.

However, despite this short-term gain, the increase in OTC desk balances suggests that the market may be facing underlying selling pressure.

The Federal Reserve’s recent actions have also played a role in bitcoin’s price movements. The release of the Fed Minutes from the July meeting hinted at a potential rate cut in September 2024, which has been seen as a positive development for risk assets like bitcoin.

Following the release, bitcoin’s price rose 3.7%, and US spot Bitcoin ETFs saw modest inflows of $39.50 million on the same day, marking the third consecutive day of gains that week.

However, the on-chain data paints a more complex picture.

While the Fed’s actions may have provided a short-term boost to bitcoin’s price, the rising OTC desk balances and the low long-to-short ratio suggest that the market sentiment remains cautious.

As noted by a market analysts, the long-to-short ratio is below one, indicating that more traders are anticipating a decline in bitcoin’s price.

Technical analysis of bitcoin’s price movements provides further insights into what the future may hold.

As of August 2024, bitcoin is trading around the $60,000 mark, approaching a key resistance level at $62,190. This level is significant as it represents the 61.8% Fibonacci retracement drawn from the high on July 29 to the low on August 5.

It also aligns with the previously breached trendline and the 100-day Exponential Moving Average, making it a crucial resistance zone.

If bitcoin fails to close above the $62,066 level, it could face a potential decline to $57,115 before possibly dropping further to the $49,917 daily support level. This scenario aligns with the cautious outlook suggested by the rising OTC desk balances.

The Relative Strength Index (RSI) on the daily chart has flipped over its neutral level of 50, and the Awesome Oscillator (AO) remains below its neutral level of zero. Both indicators point to a sustained bearish momentum if bitcoin fails to break through the key resistance level.

On the other hand, if bitcoin can close above $62,066, it could signal a further rise towards the August 2 high of $65,596, setting a higher high on the daily chart. This scenario could lead to a 6% price increase, with the next target being the weekly resistance at $69,648.

While the rise in OTC desk balances and the associated market movements are important, they must be viewed within the broader context of bitcoin’s current market phase.

According to on-chain analyst Willy Woo, bitcoin has transitioned from a bearish phase to a neutral phase, but consolidation is likely to continue ahead.

Woo noted that the recent market reset, triggered by events like the Mt. Gox repayment and the sell-off from the German government, has cleared much of the speculative froth from the market.

“I feel like we are 66% the way there,” Woo said, referring to the consolidation phase. “Much of the speculation has left, we still need more of the spot BTC to be absorbed.” He added that bitcoin’s price action “needs to get really boring” before a rally can truly begin.

This sentiment is echoed by other analysts who believe that the current rise in OTC desk balances may be a sign of a cautious market preparing for further consolidation.

While the recent price gains and the Fed’s actions have provided some optimism, the underlying data suggests that the market may not be out of the woods yet.