Analyst James Butterfill, Head of Research at CoinShares, has recently predicted a potential positive demand shock for Bitcoin in the near future due to increased interest from Registered Investment Advisors (RIAs). This surge in demand could be catalyzed by substantial inflows of capital into the digital asset market, particularly through spot bitcoin Exchange-Traded Funds (ETFs).

A Long Way to Go

In a recent blog post, Butterfill pointed out that spot bitcoin ETFs have yet to become available to the RIA market. He explained that fund platforms commonly used by RIAs typically require three months of trading data before including newly issued ETFs.

Notably, only the investment advisory firm Carson Group currently permits trading of four major spot bitcoin ETFs. Butterfill emphasized the potential magnitude of inflows from the RIA market, citing its representation of approximately $50 trillion in assets. He states:

“Given that the RIA market represents about $50 trillion in assets, the potential inflows could be significant. For instance, if 10% of RIAs chose to invest 1% of their portfolios, this could result in approximately $50 billion in additional inflows.”

Demand Shock: Bitcoin ETF Demand-Supply Imbalance

Butterfill observed the increasing demand and decreasing supply dynamics within the bitcoin market. He noted that the launch of multiple spot bitcoin ETFs on January 11 has led to an average daily demand of 4500 bitcoin, while the daily minting rate stands at only 921 new bitcoin. The analyst states:

“This has led to the dramatic price rises we have seen in recent weeks, as the newly minted supply cannot keep up with demand, leading to ETF issuers having to source mainly from the secondary market.”

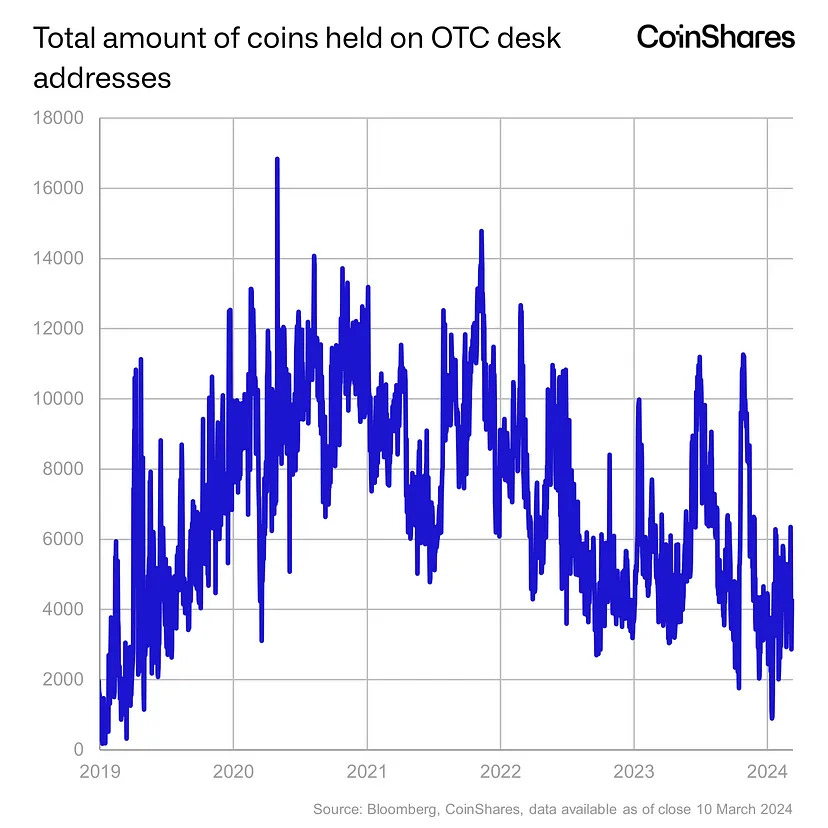

Butterfill underscored the imbalance between supply and demand, pointing out that ETF issuers primarily source bitcoin from the secondary market due to the insufficient supply of newly minted bitcoin. This trend is evident in the data, with holdings of bitcoin on Over-The-Counter (OTC) desks dropping by 74% since their peak in 2020, likely due to increased ETF demand in recent years.

Success, But With a Twist

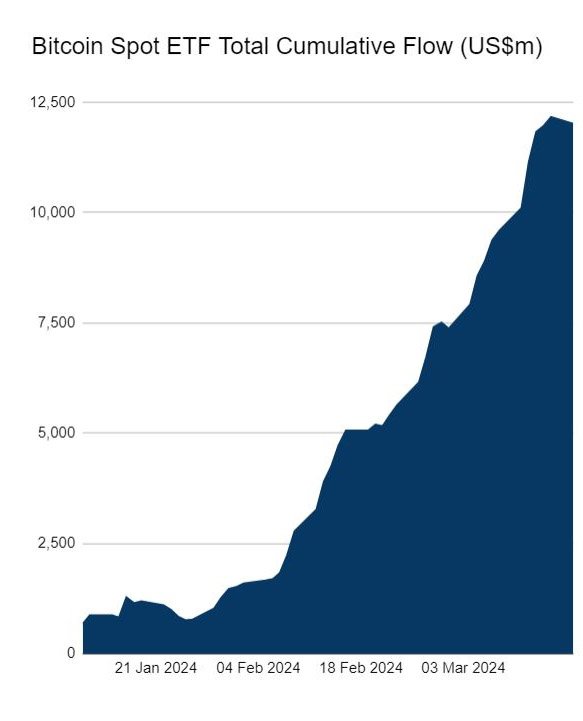

Last week, net inflows for U.S. spot bitcoin ETFs reached record levels, with BlackRock’s IBIT leading the pack by bringing in $2.48 billion in inflows. Moreover, Fidelity’s FBTC and VanEck’s HODL impressively followed IBIT by contributing $717.9 million and $247.8 million, respectively, to the inflow.

However, Grayscale’s converted GBTC fund experienced $1.25 billion in outflows, along with $29.4 million in outflows from Invesco’s BTCO. Notably, since spot bitcoin ETF trading commenced on January 11, total net inflows have surpassed $12 billion.

Despite the overall success of spot bitcoin ETFs, there have been some downturns. Notably, BTC is currently experiencing a correction period, with prices hovering around the $64,000 mark. This correction has led to a decline in investor confidence, with spot ETFs collectively witnessing a net outflow of $154 million on March 18, marking the first outflow day since March 1.