In a world of economic uncertainty, where traditional financial markets are facing turbulence, Bitcoin emerges as a potential beneficiary amidst the declining Japanese yen.

Reports suggest that while this situation may spell disaster for US treasuries, it could offer a silver lining for investors eyeing alternative stores of value like Bitcoin.

The recent developments in global finance have sent ripples across the digital asset landscape, with Bitcoin poised to capitalize on the shifting dynamics. The insights provided by various sources may bring to light the potential implications of the Japanese yen’s crisis on Bitcoin’s trajectory.

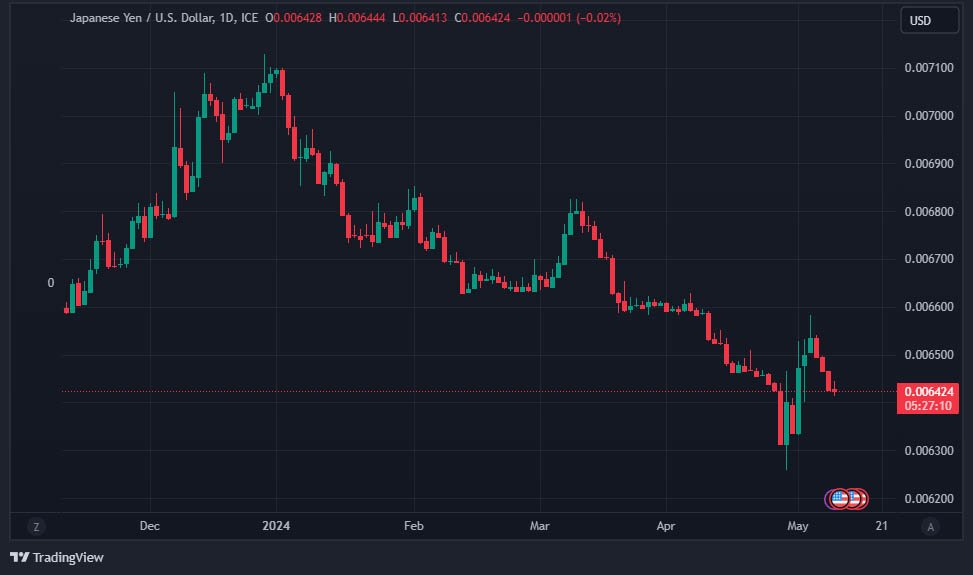

The weakening Japanese yen, marked by a 2.39% decrease over the past 30 days, has sparked discussions about its implications for global financial markets.

Japanese Yen Decline: Crisis For Japan and US

Dante Cook, head of business at Swan Bitcoin, highlights the significance of this trend, stating: “This spells disaster for Japan and the U.S. potentially.”

He underscores Japan’s position as the largest holder of U.S. treasuries, emphasizing the potential repercussions of a currency devaluation, noting:

“Japan is the largest holder of US treasuries, only 4% of its forex reserves are in gold, the rest are almost exclusively in US Treasuries.

The potential sell-off of U.S. treasuries by Japan in an effort to shore up its currency spells disaster not only for Japan but potentially for the U.S. as well.”

Amidst the uncertainty, Bitcoin emerges as a potential safe haven for investors seeking refuge from traditional securities.

Cook suggests that the market may witness a surge of liquidity, potentially favoring Bitcoin as an alternative store of value. He notes, “Bitcoin has already been enjoying a massive liquidity influx from institutional investors,” indicating growing confidence in this new asset class.

The approval of 11 spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) in January has further bolstered Bitcoin’s momentum.

These ETFs have collectively seen total net inflows of $11.78 billion, reflecting institutional interest in the Bitcoin market. Cook predicts, “I see this as just the beginning of another massive wall of liquidity entering the markets,” highlighting the potential for sustained growth.

The current state of uncertainty in traditional financial markets has also led to increased interest in riskier altcoins. Cook suggests that investors may explore alternative avenues beyond Bitcoin, seeking higher returns amidst market volatility.

As Bitcoin continues to navigate through complex market dynamics, its role in global finance is evolving. The bitcoin’s resilience and growing acceptance highlight its potential to redefine financial paradigms.

Cook asserts, “Nothing stops this train,” underscoring Bitcoin’s resilience amidst changing market conditions. Cook also notes Argentina’s entry into Bitcoin mining, highlighting the ongoing evolution of game theory in the Bitcoin space.

Many analysts have offered insights regarding Bitcoin’s potential for experiencing a significant price surge. Ki Young Ju, Founder & CEO at cryptoquant, said:

“Bitcoin network fundamentals could support a market cap three times its current size compared to the last cyclical top, potentially sustaining a price of $265K.”

Crypto Ceaser, an analyst and trader, shared the same sentiments, saying: “Whilst this target is particularly high it is a legitimate target and technically a diminished return (measured from low to high).”

Daan Crypto, another analyst and trader, added: “It’s still at relatively low levels compared to last cycle. Likely to see that change as time goes on and price leaves this range.”