In the ever-evolving world of digital assets, predicting bitcoin’s price trajectory has always been a challenging task. However, recent developments have shed new light on this matter, thanks to the emergence of the “Bitcoin Power Law” model. This article aims to look into what this model entails and what it predicts for Bitcoin’s future.

Understanding the Power Law Model

The Power Law Model, conceptualized by former physics professor Giovanni Santostasi in 2018, offers a unique perspective on bitcoin’s price evolution. It gained popularity again in January when finance YouTuber Andrei Jeikh discussed it in a video for his subscribers.

As per the Oxford Dictionary, a Power Law is “a relationship between two quantities such that one is proportional to a fixed power of the other.” It operates on the principle of power laws, which describe a mathematical relationship where one value is proportional to a fixed power of another value. Santostasi’s model applies this concept to bitcoin’s price, aiming to forecast its journey over time.

Power laws are found across various fields, including finance, where they predict returns on ventures and waiting times for stock changes. Recently, they’ve emerged in bitcoin price predictions.

Bitcoin Power Law: Mathematics Meets Finance

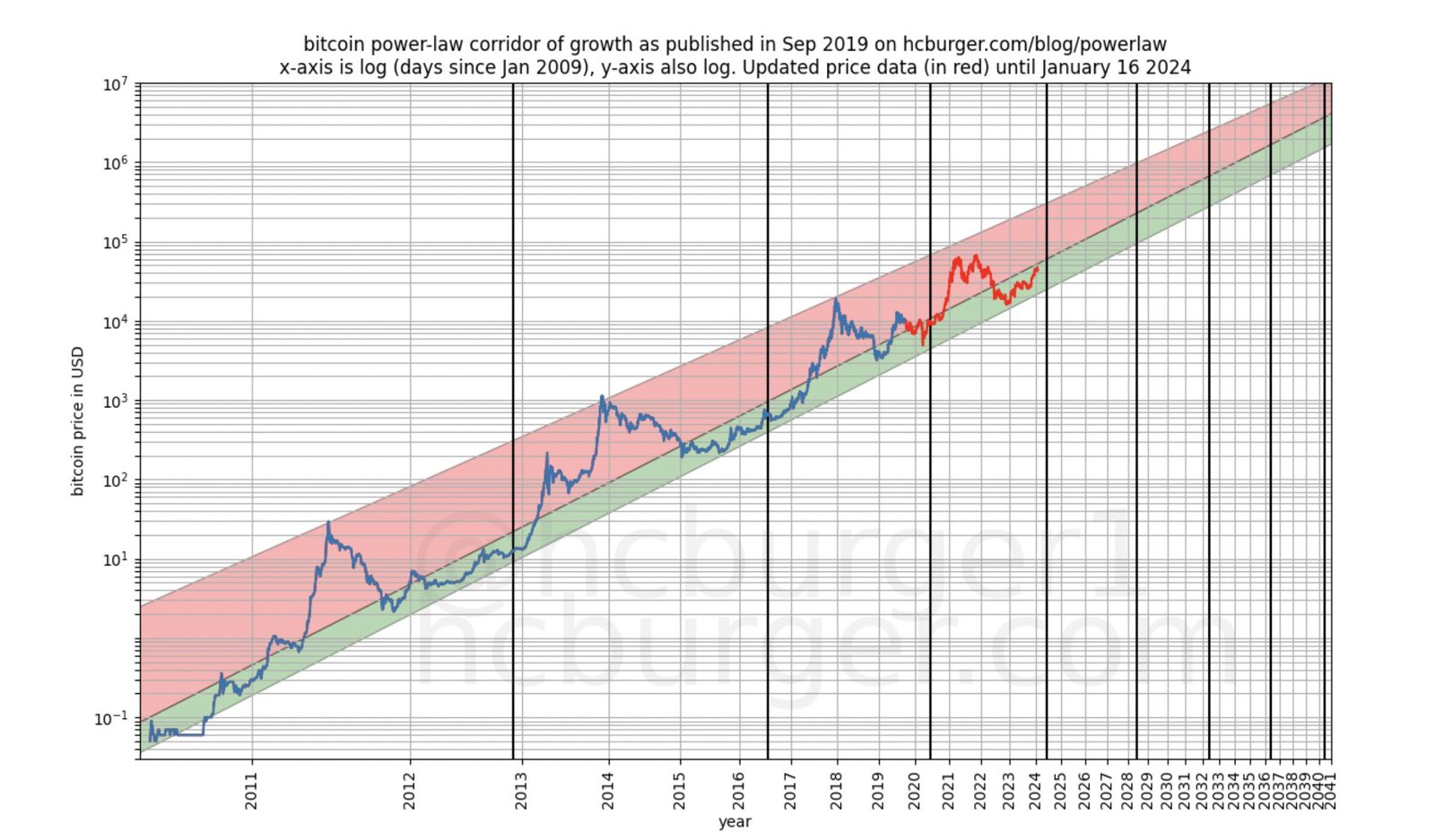

Rooted in algebra and natural laws, the Power Law Model blends scientific principles with financial analysis. It utilizes a formula represented as Estimated Price = A * (days from GB)^n, with GB symbolizing Bitcoin’s Genesis Block and (n) set at 5.8. This formula maps out bitcoin’s price trajectory from its inception, offering insights into its potential future value.

Santostasi explains the rationale behind his model, stating, “When we try to understand data, we always like it when data is linear.” This linear approach mirrors the behavior of various natural phenomena, providing a framework for analyzing Bitcoin’s price movements.

He explains:

“The linear chart that they usually show in TV — what [Jim] Cramer is talking about — looks messy […] But when do you the log of the y-axis, and you start to see some regularity there, it doesn’t look that messy, it looks like a very nice pattern.”

Santostasi penned a Reddit post just last month, revisiting a model he had crafted years ago:

“Many didn’t believe me and said the past doesn’t predict the future […] Well, after five years, it turns out that BTC continues its power law behavior with a similar exponent.”

Bold Predictions and Skepticism

The Power Law Model’s projections are nothing short of remarkable. It suggests that bitcoin’s price could skyrocket to $1 million per coin by 2033 and even reach an astonishing $10 million by 2045. These forecasts have sparked both excitement and skepticism within the Bitcoin community.

Fred Krueger, a BTC proponent involved in developing the model, emphasizes the significance of Bitcoin’s potential growth.

Krueger, often cites Hal Finney‘s $10 million prediction, connecting it to their pricing model, underlining Finney opinion in 2009, where he highlighted bitcoin is an “amusing thought experiment”, and imagines bitcoin becoming “successful” one day as the dominant payment system worldwide.

Finney had said:

“Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. With 20 million coins, that gives each coin a value of about $10 million.”

This vision aligns with the model’s optimistic outlook on bitcoin’s future value. Santostasi forecasts BTC to hit $210,000 in Jan 2026, then drop to $60,000 later that year, according to his model.

Distinguishing Factors

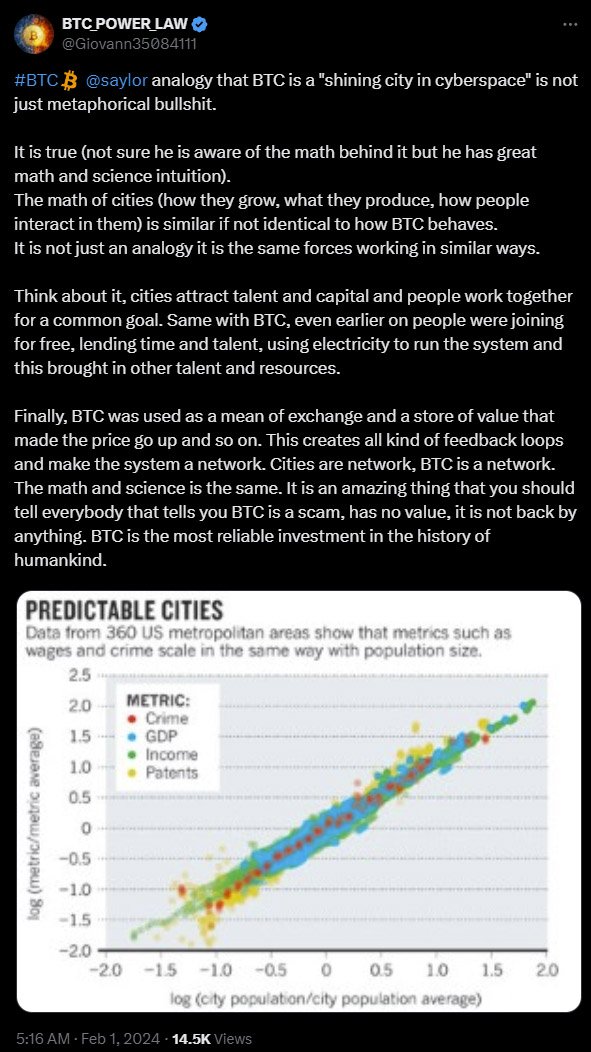

What sets the Power Law Model apart from other predictive models, such as Plan B’s stock-to-flow (S2F) model, is its foundational belief in Bitcoin’s growth resembling that of a city. Santostasi compares Bitcoin’s growth trajectory to that of a city expanding steadily over time, rather than experiencing abrupt and unpredictable fluctuations.

Critics, however, remain skeptical of mathematical models’ reliability in predicting financial markets. Despite claims of a 95.3% accuracy rate, detractors argue that unforeseen events could derail the model’s predictions. Many believe the rise and fall of the FTX exchange to be such a factor, that heavily influenced the Bitcoin and broader digital asset market.

While Santostasi acknowledges some aspects of the stock-to-flow model, he critiques its projection of perpetual, exponential price growth in Bitcoin. He compares Bitcoin’s expansion to urban development, echoing Michael Saylor’s portrayal of Bitcoin as a “shining city in cyberspace”.

Validation and Regression Analysis

To bolster the credibility of the Power Law Model, Santostasi and Krueger conducted regression analysis to validate its accuracy. By analyzing Bitcoin’s historical price movements since its inception, they demonstrate the model’s ability to capture the underlying patterns governing Bitcoin’s price evolution.

Santostasi underscores the importance of logarithmic modeling, stating that contrary to the heavily criticized stock-to-flow model, the power law follows a logarithmic pattern rather than an exponential one. This distinction allows for a more nuanced understanding of bitcoin’s price dynamics, accommodating significant fluctuations while still adhering to the model’s overarching principles.

Looking Ahead

As Bitcoin continues to garner attention as a prominent asset class, the implications of the Power Law Model’s predictions are significant. Proponents believe that understanding Bitcoin’s growth through a scientific lens offers valuable insights for investors and enthusiasts alike.

Despite skepticism from some quarters, the Power Law Model represents a novel approach to forecasting bitcoin’s price trajectory. As the Bitcoin landscape evolves, the accuracy of this model and its impact on investment strategies will undoubtedly remain a topic of keen interest.