Bitcoin’s price has taken a hit, dropping from $63,800 to $60,200 recently, leaving Bitcoin bulls to regroup and reassess their strategies amid the market turmoil. Several renowned analysts took to X to analyze the current bitcoin price drop and market situation.

Keith Alan, a well-known analyst, pointed out that FireCharts 2.0 data showed over $100 million in ask liquidity between $63.5k and $66k, while $70 million in bids ranged from $59.5k to around $63k.

Historically, the side with the highest concentration of liquidity in the near range tends to dominate the market.

Despite the recent downturn, Alan remained optimistic about the macro outlook, stating that while it’s challenging to predict the next big move, certain conditions must be met to push BTC back to all-time high territory.

This includes a larger concentration of bid liquidity compared to ask liquidity within the active trading range. Alan outlined two potential scenarios for bitcoin’s price movement.

The first involves establishing a confirmed bottom through retesting support levels, particularly the historical consolidation range of $58,000 to $60,000. The alternative is validating a resistance/support (R/S) flip above $69,000, indicating bullish momentum. He states:

“At the moment, it appears the path of least resistance (pardon the pun) is to retest support. Will the historical consolidation range at $58k – $60k hold or will bears push further to the local low at $56.5k or beyond it.

Depending on how you are trading it, you may see dip buying opportunities.”

Bitcoin Price Drop: Danger Zone ‘Almost’ Over

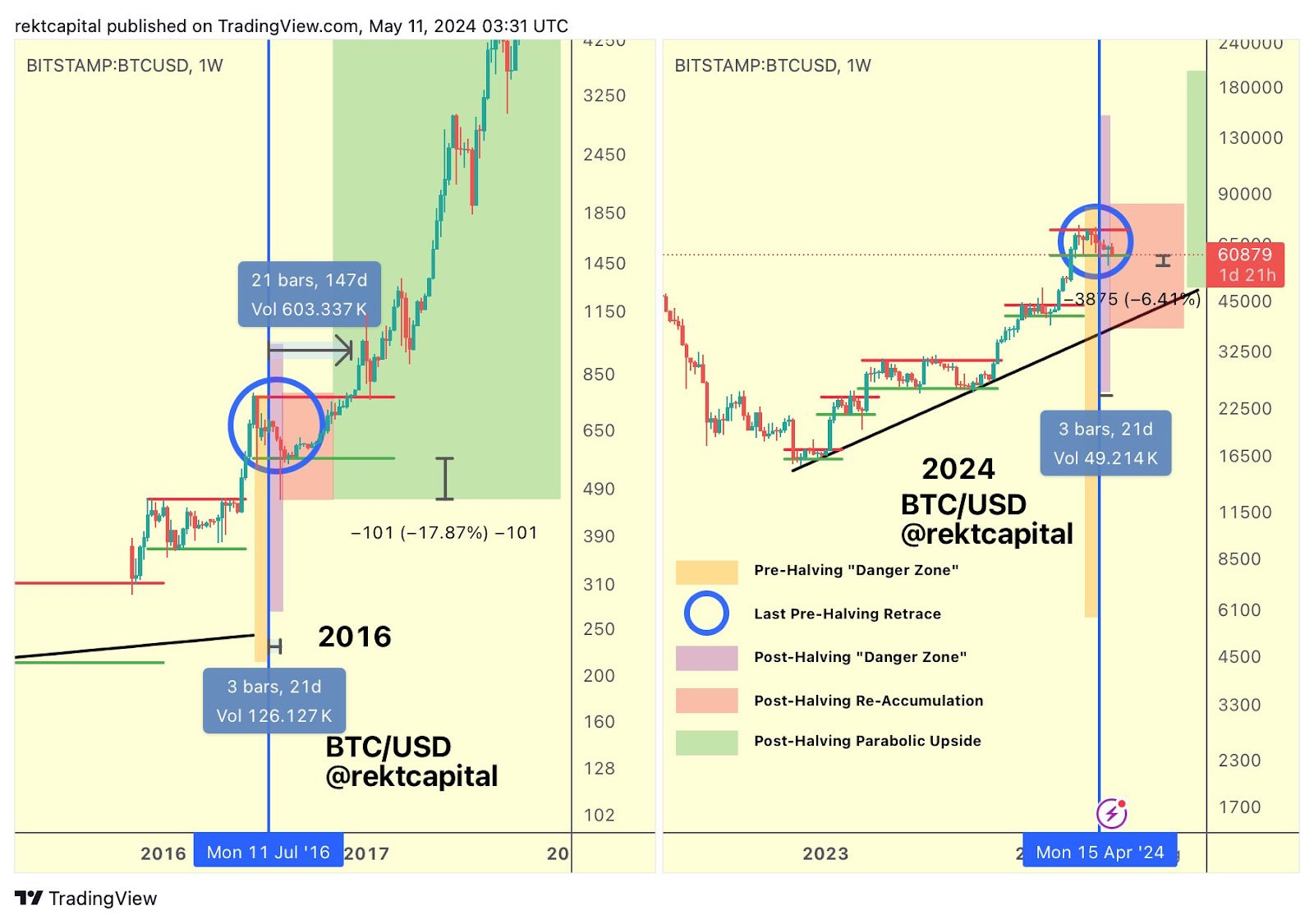

Rekt Capital, a well-known trader and analyst, has also offered insights into bitcoin’s recent downturn, drawing parallels to historical patterns. He noted that approximately 21 days after the Halving, Bitcoin experienced a significant -11% downside wick in 2016, followed by a reversal towards the upside.

As bitcoin is currently experiencing the zone around 21st day after the halving, Rekt Capital highlighted historical data indicating that downside volatility often occurs around the Re-Accumulation Range Low.

In line with historical trends, this cycle also saw a -6.5% downside wick occurring 14 days after the halving, satisfying what Rekt Capital refers to as the “Danger Zone.”

Rekt Capital emphasized that bitcoin’s current situation is reminiscent of past cycles, and if it manages to hold above $60,600 until the end of the week, it could signify the end of the Post-Halving “Danger Zone” and a potential return to more favorable market conditions.

Meanwhile, on May 10, a substantial bitcoin transfer of 820 BTC, worth more than $50 million, was observed from an unknown wallet to Coinbase. This significant accumulation follows recent selling and profit-taking activities.

The timing of this accumulation is particularly intriguing, as it coincides with a period of steadily increasing inflows into the Bitcoin network. Just a week prior, Bitcoin whales acquired a staggering 47,000 BTC in a single day, valued at nearly $3 billion.

This influx of capital into the market led CryptoQuant CEO Ki Young Ju to speculate that it may signify the beginning of a re-accumulation phase, potentially paving the way for a bullish reversal in the near future.