The leading digital asset has demonstrated resilience, posting a gain of around 2.4% in the past 24 hours following a period of bitcoin price drop, with its value reaching $66,000. This upward movement comes as global equities also show signs of recovery, caused by uncertainty sparked by fears of escalating conflict in the Middle East.

André Dragosch, the Head of Research at ETC Group, noted a significant shift last week in the global digital asset hedge fund beta, along with a dominance of bitcoin long futures liquidations. However, he emphasized that the digital asset has rebounded from the losses experienced due to geopolitical tensions, particularly in light of the recent bitcoin halving event.

Halving Effects in 100 Days

In a report released on Monday, Dragosch presented data from an in-house “cryptoasset sentiment index,” which indicated a recovery from a year-to-date low prompted by last week’s geopolitical turmoil.

He pointed out that while the positive effects of the halving event have yet to fully impact the market, any such effects are expected to manifest around 100 days after the event. Dragosch explained that the supply deficit created by the bitcoin halving takes time to accumulate, stating:

“The reason is that the supply deficit induced by the bitcoin halving only tends to accumulate over time and is rather insignificant in the very short term.”

Bitcoin Price Drop: A Potential 67% Gain

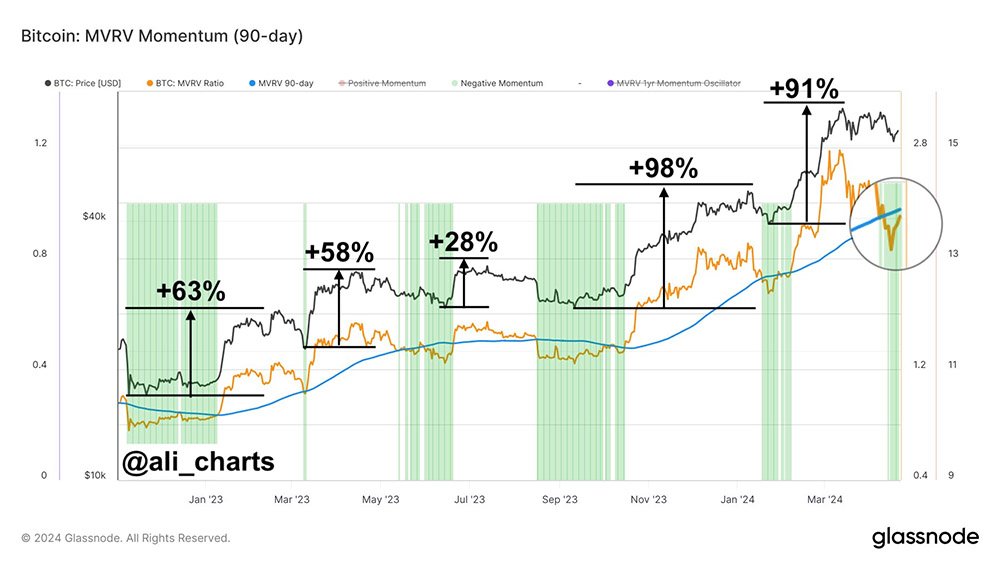

Meanwhile, renowned analyst Ali Martinez drew attention to Bitcoin’s Market Value to Realized Value (MVRV) ratio, which has fallen below its 90-day average. This dip suggests a potential buying opportunity with a speculated 67% gain, as historically observed.

Martinez highlighted that whenever the MVRV ratio dips below its 90-day average, it typically signals a favorable buying opportunity. This trend has been consistent since November 2022, with an average gain of 67% each time. He writes:

“This opportunity is upon us again, indicating it might be the perfect time to buy BTC.”

Notably, the MVRV ratio is a significant metric in the digital asset space, representing an asset’s market capitalization divided by its realized capitalization. A higher MVRV ratio generally indicates a higher potential profit, often leading to increased selling pressure.

Bitcoin Halving and the Immediate Effects

These developments in the digital asset market occur against the backdrop of the halving event, prompting intense discussions. A recent spike in Bitcoin transaction fees has sparked interest, as ETC group explains:

“Along with the latest Halving, we saw a significant spike in transaction fees in the Bitcoin core network which has sparked renewed discussions around the viability of Bitcoin as a means-of-exchange. In fact, we saw a record-high in daily revenue for Bitcoin miners just yesterday of around 107 mn USD of which around 80 mn USD came from transaction fees alone.”

According to data by YCharts, the average transaction fee recently spiked to $128, but it has now settled down around $11.

Nonetheless, the market has witnessed increased activity, with Bitcoin currently trading around $66,000 level, marking a significant increase of around 50% since the beginning of the year.