Bitcoin and the broader digital asset market experienced a sharp decline as the long-anticipated repayment process from the defunct exchange Mt. Gox began. This event has caused significant market turbulence, adding to the already volatile nature of digital currencies.

The Japan-based digital asset exchange Mt. Gox, once the world’s largest, announced that it has started repaying its creditors, a decade after a massive hack resulted in the loss of 850,000 bitcoin, valued at over $57 billion today.

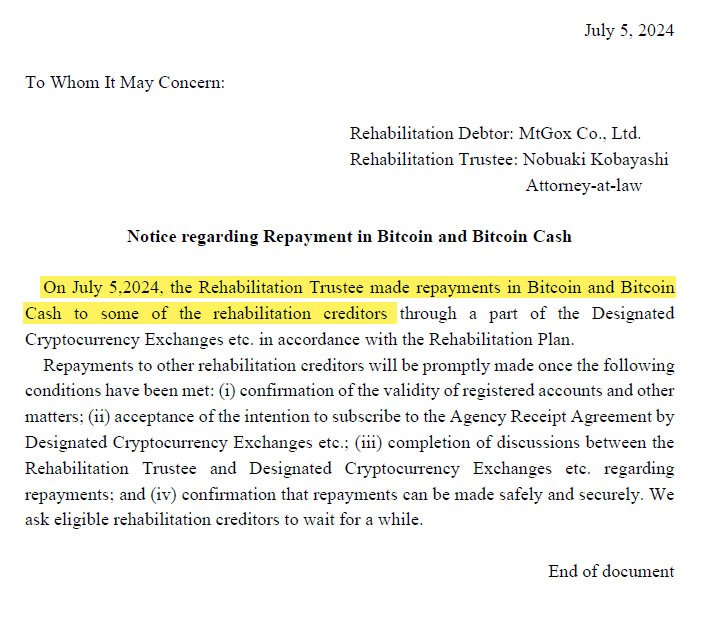

The rehabilitation trustee, Nobuaki Kobayashi, confirmed that the repayments are being made in bitcoin and Bitcoin Cash through several designated exchanges, including Bitbank and Kraken.

Kobayashi stated, “We ask eligible rehabilitation creditors to wait for a while,” as the process involves validating registered accounts and completing necessary discussions with the exchanges.

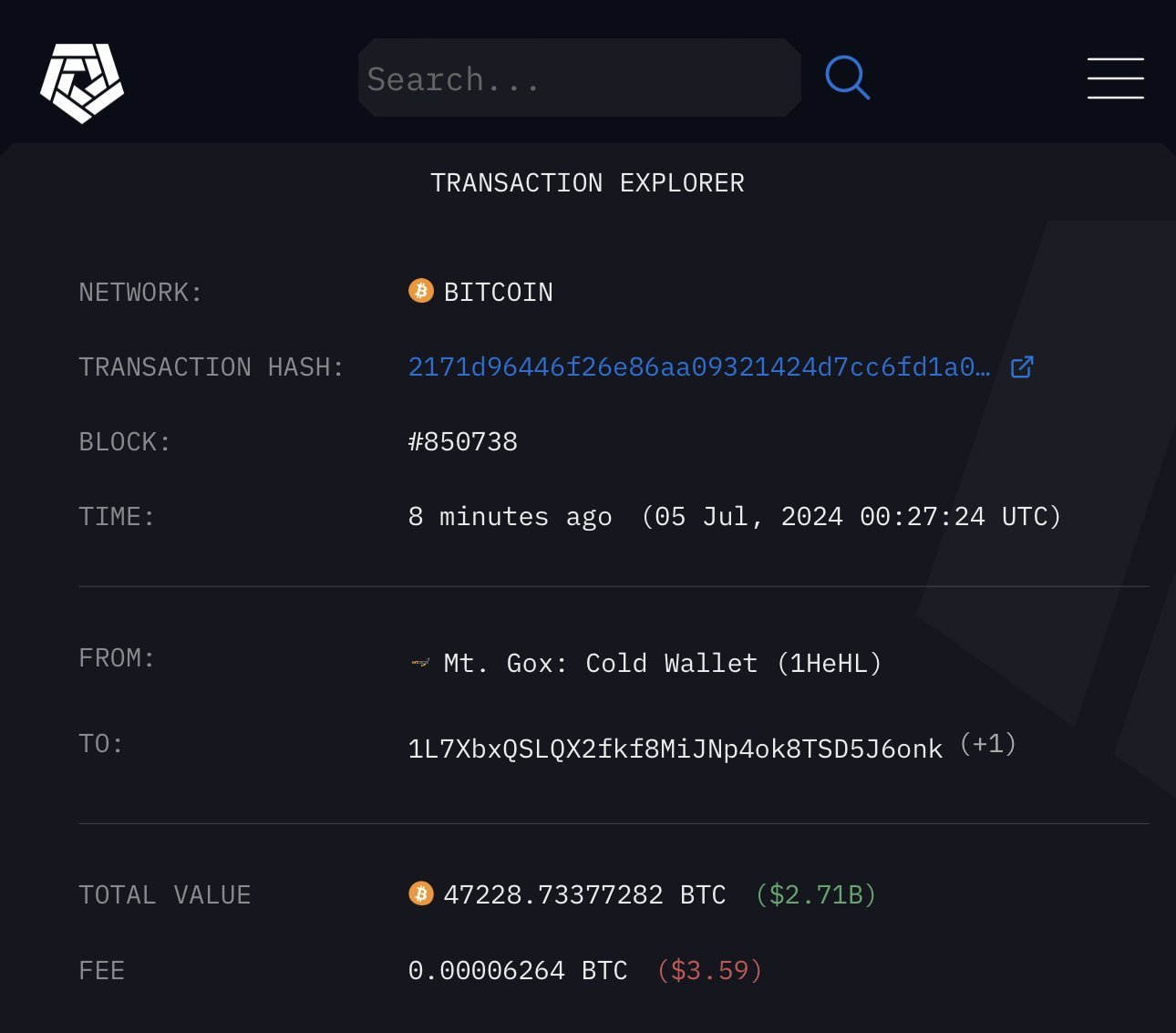

Despite the lengthy wait for these repayments, this announcement brought significant selling pressure to the bitcoin market. Based on data from blockchain analytics firm Arkham Intelligence, the exchange moved bitcoin from its ‘cold storage’ at 12:30 am UTC on July 5.

Following the announcement, bitcoin’s price plummeted, dipping below the $55,000 mark for the first time since February. This decline erased over $170 billion from bitcoin’s market capitalization within 24 hours.

The broader market reaction was also swift and severe. According to Coinglass data, over $748 million in bullish bets were liquidated across centralized exchanges on July 4 and 5.

Long traders, who had been betting on a price increase for bitcoin, faced significant losses, with approximately $225 million in positions liquidated.

The primary concern driving the sell-off is the potential market impact of the repayment process.

Mt. Gox has moved a substantial amount of bitcoin—47,228.7 BTC, valued at $2.71 billion—to a new wallet address, sparking fears that a large volume of these coins could be sold, further depressing prices.

Market analysts have expressed varied opinions on the potential impact. Some fear that the influx of these previously locked-up coins could shift supply and demand dynamics, pushing bitcoin’s price as low as $50,000.

Others argue that the market can absorb these sales gradually, given the typically high daily trading volumes of bitcoin.

Willy Chuang, COO of WOO X exchange, commented:

“Mt. Gox moved 47,228 BTC […] which has caused some market fear due to the large potential sell-off […] However, it’s worth noting that despite these concerns, the long-term impact may be less severe as the market gradually absorbs the selling pressure.”

Mt. Gox was the leading bitcoin exchange in its early years, handling over 70% of all bitcoin transactions before its collapse in 2014. Since the hack that led to its downfall, the bankruptcy proceedings have been protracted, with creditors waiting nearly a decade for their assets.

The recent repayment process marks a significant milestone in resolving Mt. Gox’s insolvency case. While some creditors may have to wait up to 90 days to receive their payouts, this development is a positive step towards closure for those affected.

The market, however, remains jittery. Alongside the Mt. Gox repayments, other factors have contributed to the recent downturn in bitcoin’s prices.

For instance, the German government’s sale of roughly 3,000 bitcoin, worth approximately $175 million, from a confiscated stash has added to the selling pressure.

Related: Governments Moves Large Batches of Bitcoin, Sparking Speculation

Additionally, political uncertainties and concerns over interest rate policies in the U.S. have also played a role in weakening sentiment towards digital assets.

Despite the immediate market turmoil, industry insiders maintain a cautiously optimistic outlook for bitcoin and the broader market.

Analysts at digital asset data firm CCData believe that bitcoin has not yet reached the peak of its current appreciation cycle. They suggest that the ongoing halving event, which reduces the supply of new bitcoin entering the market, historically precedes significant price expansions.

CCData noted:

“We have observed a decline in trading activity on centralised exchanges for nearly two months following the halving event in previous cycles, which seems to have mirrored this cycle. This suggests that the current cycle could expand further into 2025.”

Tom Lee, co-founder and head of research at Fundstrat Global Advisors, weighed in on the arguments in this regard, saying that he remains bullish on bitcoin’s future despite the recent Mt. Gox repayments.

He stated: “If I was invested in crypto, knowing that one of the biggest overhangs is going to disappear in July, I’d think it’s a reason to actually expect a pretty sharp rebound in the second half.”

The start of Mt. Gox’s repayment process has undeniably stirred the market, leading to a sharp decline in bitcoin’s price and significant volatility across other digital assets.

While the immediate impact has been negative with substantial losses for traders and a drop in market capitalization, the long-term effects remain to be seen.

As the market adjusts to the influx of previously locked-up bitcoin, and as the Mt. Gox insolvency case moves closer to resolution, investors and analysts alike will be watching closely.

The hope is that the market can stabilize and continue its growth trajectory once the immediate selling pressure subsides.