The Bitcoin market has been buzzing with activity as Grayscale Bitcoin ETF (GBTC) experiences a notable slowdown in outflows. Investors are closely watching the developments, hoping for signs of stability and potential positive shifts in bitcoin’s price performance.

GBTC Outflows Ease

Recent data reveals that outflows from Grayscale’s Bitcoin Trust have slowed for the second consecutive day, sparking optimism among market participants. On January 24, daily outflows dropped to $429 million, the smallest since the ETF’s launch on January 11. This represents a 33% slowdown compared to the start of the week on January 22.

Analyst Insights

Bloomberg ETF analyst Eric Balchunas notes the apparent downward trend in the Grayscale outflows. While being cautiously optimistic, he acknowledges the persistence of a significant outflow volume. The Grayscale Bitcoin Trust has seen a total outflow of 106,092 BTC, approximately $4.4 billion, over nine trading days.

Balchunas stated:

“$GBTC outflows today were ‘only’ $425m, lowest bleed since day one and seemingly trending down. That said it’s still a pretty large number.”

However, analysts, including Balchunas, emphasize that a slowdown in daily outflows doesn’t necessarily signal the end of the “bleeding” for GBTC. There are uncertainties about when the massive exodus might stop.

Chris Burniske, Partner at Placeholder VC and former head of digital assets at Ark Invest, recently shared his insights about bitcoin price swings. He stated:

“[I] wouldn’t be surprised if we test the mid-to-high 20s before all is said and done, and we can make an actual move towards previous ATHs […] Don’t ignore we also just saw many of our first parabolas of the cycle, and they’re now breaking […] and macro looks precarious on a number of levels.”

Bitcoin Rebounds Above $41,000 Amidst ETF Developments

Amid the slowing outflows from GBTC, Bitcoin has rebounded above the $41,000 mark. BitMEX Research data shows that on January 25, GBTC witnessed outflows of $394.1 million, down from $429.3 million just two days earlier. This positive momentum has contributed to a liquidation of over $110 million, with Bitcoin’s price currently trading at $41,328.

The recent uptick in Bitcoin’s price triggered substantial liquidations, predominantly in short positions, resulting in a loss of over $110 million in the past 2 days. Long positions also contributed around $54 million to the total liquidation amount.

JPMorgan Analysis

JPMorgan analysts suggest limited further downside for Bitcoin, attributing the recent price decline to profit-taking in GBTC. They highlight the potential impact of GBTC’s 1.5% fee, warning that if not reduced, ongoing outflows could lead to a loss of market share to competitors with lower fees.

Grayscale’s Bitcoin ETF: Analyzing the Slowdown

Grayscale’s Bitcoin ETF, GBTC, has been experiencing a gradual decline in outflows despite withdrawals surpassing $5 billion in BTC. Analysts attribute the sell-off to investors taking profits and shifting to more cost-effective spot Bitcoin ETF alternatives.

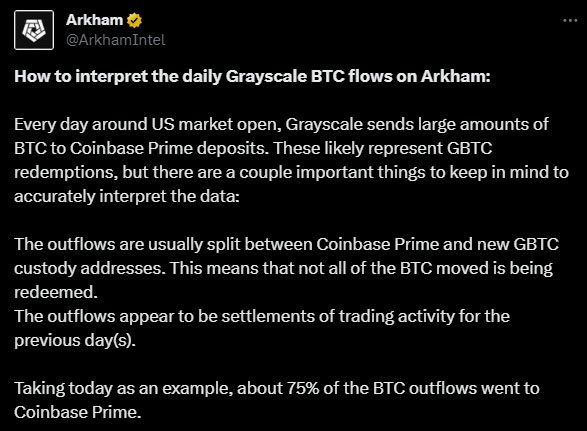

Blockchain tracking firm Arkham Intelligence warns of potential misinterpretation of GBTC outflow data. The data is split between Coinbase Prime and new GBTC custody addresses, indicating that not all BTC moved from GBTC is necessarily being redeemed.

Arkham explaines:

“Due to the input-output structure of its blockchain, Bitcoin transaction outputs are often split amongst multiple addresses […] GBTC custody wallets frequently send to multiple addresses […] This means that some of the BTC sent in a transaction may go to a different address than the main recipient shown in the transaction panel.”

Positive Indicator

Analysts interpret the slowdown in GBTC outflows as a positive indicator for bitcoin’s price trajectory, suggesting resilience in the face of recent market challenges.

Analyst JA Maartun recently presented a chart showcasing Grayscale’s waning influence on BTC prices. Despite the sell-off, bitcoin’s value not only held steady but also exhibited a remarkable uptick, absorbing Grayscale’s selling pressure. Maartun expressed:

“All selling pressure from Grayscale was absorbed and the price even managed to increase, which is impressive.”

Ted, another analyst, debunked the exaggerated narrative of GBTC selling. His assessment uncovered that within the past 90 days, nine new spot BTC ETFs brought in over 120,000 BTC, surpassing the outflow from GBTC.

Bitcoin Holds Steady as Grayscale ETF Outflows Slow

Bitcoin has found stability around the $40,000 mark as the heavy tide of GBTC outflows slows. Despite massive liquidations, bitcoin climbed back above $42,000 on Saturday afternoon.