Bitcoin’s price surged past the $50,000 mark on Monday, signaling a potential end to the 1-month-long selloff in Grayscale Investments’ spot fund.

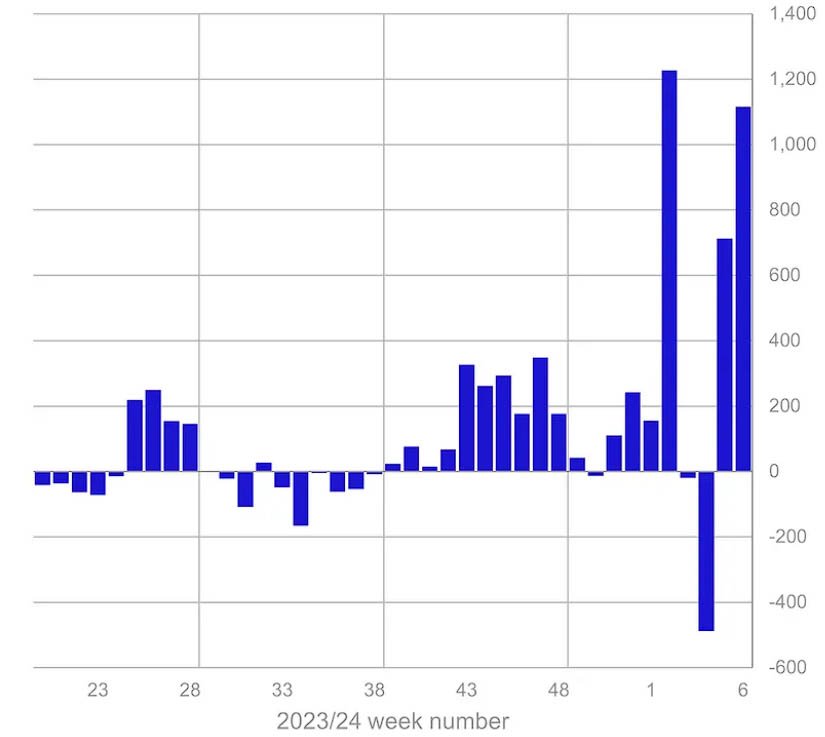

Bitcoin rally to $50,000 coincided with increased inflows into spot Bitcoin Exchange-Traded Funds (ETFs) over the past week, reaching over $1.1 billion in net flows as outflows from the Grayscale Bitcoin Trust (GBTC) continue to slow down.

CoinShares’ report on February 12 highlighted the substantial inflows into newly issued spot-based Bitcoin ETFs in the US, totaling $2.8 billion since their January 11 launch.

However, it acknowledged that the potential sale of the Genesis holdings of $1.6 billion GBTC can “prompt further outflows in the coming months.”

Meanwhile, these massive inflows into spot ETFs, along with the uptick in the BTC price, have propelled total Assets Under Management (AUM) for digital asset investment products to $59 billion.

According to the report, over 73% of digital assets held by the firms are in bitcoin.

Bitcoin Rally: $50K After Over 2 Years

Bitcoin investors have been eagerly awaiting the resurgence of BTC to the $50K level, which was last traded more than two years ago. Notably, during December 2021, Bitcoin traded at this level before experiencing a substantial decline towards $15,522 in November 2022, following the FTX collapse.

Furthermore, Bitcoin has previously breached the $50K mark twice in February and August 2021, both times making a solid rally afterwards. This demonstrates its capacity to achieve remarkable highs.

Bullish Outlook

Independent trader and analyst Rekt Capital noted that bitcoin’s rise above $49,000 was anticipated, affirming that “the signs were there.” Bitfinex analysts echoed this sentiment, stating that bitcoin is poised to achieve a new year-to-date high amidst reduced outflows from GBTC and increased inflows into digital asset funds.

Bitfinex analysts expressed a bullish outlook for the market, citing long-term bitcoin holder dynamics by stating:

“These inflows, coupled with the impending 2024 bitcoin halving and the sustained high levels of illiquid supply, with more than 70% of bitcoin in the hands of long-term holders, paint an exceptionally bullish picture for BTC price movements.”

Moreover, according to data from Apollo, the one-month-old Bitcoin ETFs, not including Grayscale’s GBTC, now hold over 203,000 BTC. This holding actually surpasses MicroStrategy’s 190,000 BTC.

Despite the positive momentum, the sudden rise in Bitcoin’s price triggered a spike in digital asset market liquidations, exceeding $152 million, with ongoing updates indicating a rising tally.

Notably, Bitcoin short position liquidations amounted to more than $55 million in the last 24 hours, reflecting the market’s dynamic response to Bitcoin’s upward trajectory.

As bitcoin continues to move upward, several industry experts are coming forward to make bold price predictions. Recent reports by Bloomberg hint at a potential Bitcoin “supercycle.” It forecasts a massive bull run, sending the BTC price towards the $500,000 mark. On the other hand, former Bitmex CEO Arthur Hayes boldly predicts the digital currency will reach $1 million.