As the much-anticipated Bitcoin halving approaches, analysts are abuzz with predictions about the digital asset’s future. With previous halving events showing significant impacts on bitcoin’s price, all eyes are on whether history will repeat itself.

Bitcoin Rally: Bitfinex Alpha Report Highlights

With just 10 days left until the halving, bitcoin’s price remains steady around the $70,000 mark. Different analysts predict a potential surge post-halving, reaching a cycle top of above between $150,000 and $300,000. This optimistic outlook is fueled by the historical trends observed after previous halving events.

A report by Bitfinex titled “Bitfinex Alpha Report” outlines a straightforward regression model predicting a 160% post-halving price surge in the next 14 months. However, the report acknowledges the complexity introduced by bitcoin already reaching an all-time high before the halving—a first in Bitcoin’s history. This anomaly brings both bullish indicators and uncertainties to the market dynamics.

Bitfinex analysts said:

“Using a straightforward regression model, we predict a 160% post-halving price surge in the next 14 months, taking the price to between $150,000 – $169,000.”

“The current cycle stands out from all previous cycles because the price of Bitcoin has already reached a new all-time high (ATH), even before the halving. This anomaly could be interpreted as a bullish indicator, but it also introduces a level of uncertainty in the market dynamics.”

Key Factors Driving Price Movements

One crucial factor affecting bitcoin‘s post-halving trajectory is the active engagement of Short-Term Holders (STHs) at higher price levels. These holders, including new spot buyers and institutional investors through spot Exchange-Traded Funds (ETFs), contribute to the current range-bound volatility. Additionally, the broader macroeconomic landscape, including job market growth and Federal Reserve policies, adds further complexity to bitcoin’s price movements.

The Bitfinex report indicates that approximately 1.875 million bitcoin, which amounts to 9.5% of the total circulating supply, have been bought at prices exceeding $60,000. A notable portion of these purchases is attributed to short-term holders, including new spot buyers, as well as around 508,000 bitcoin held in US spot ETFs.

This suggests active engagement from short-term holders at elevated price levels, reflecting changes in ownership dynamics influenced by market activity and institutional participation through spot ETFs. Moreover, the increase in movements of big entities known as whales indicates a transition in the market cycle towards gradual distribution of dormant supply and profit-taking activities.

Comparing Previous Halving Cycles

Analyzing past halving cycles provides valuable insights into bitcoin’s potential future performance. The report highlights that historically, bitcoin has experienced substantial price rallies following halving events. For instance, after the 2020 halving, BTC surged 700% within 11 months, reaching a peak of $69,000. These trends offer a guideline for expectations regarding bitcoin’s post-halving market behavior.

Notably, Arthur Hayes, co-founder of BitMEX, suggests that bitcoin prices could see a sharp decline during the halving period due to quantitative tightening by the Federal Reserve. However, he emphasizes that this could potentially ignite a ‘firesale’ of bitcoin, leading to new opportunities for investors.

In a blog post dated April 8, Hayes expressed his thoughts:

“That is why I believe Bitcoin and crypto prices in general will slump around the halving […] It will add propellant to a raging firesale of crypto assets.”

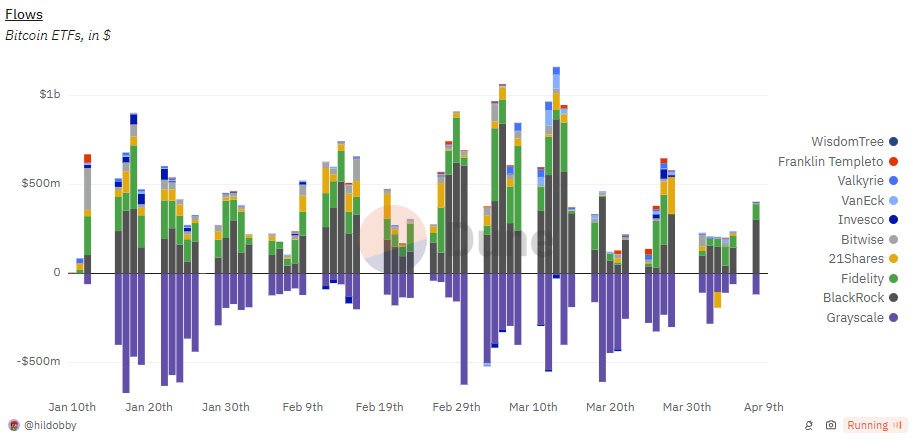

Bitcoin ETFs’ Impact

The influx of investments from United States spot Bitcoin ETFs has significantly contributed to bitcoin’s price rally. These ETFs have amassed a substantial portion of bitcoin’s circulating supply, highlighting the growing institutional interest in the bitcoin market.

As of February 15, Bitcoin ETFs constituted around 75% of new investments in bitcoin, crossing the $50,000 threshold, as per CryptoQuant findings. Since inception, these ETFs have gathered 841,900 BTC, valued at $59.2 billion, equivalent to 4.28% of bitcoin’s circulating supply. Dune Analytics projects a yearly absorption of 2.6% of bitcoin supply based on recent accumulation trends. Notably, last week, Bitcoin ETFs saw over $500 million in net inflows, with $286 million on April 8 alone.

Conclusion

As the Bitcoin halving draws near, analysts and investors brace themselves for potential price fluctuations and market dynamics. While historical trends offer valuable insights, the unique circumstances surrounding this halving inject a level of uncertainty into bitcoin’s future trajectory. Nevertheless, the overall sentiment remains optimistic, with many analysts predicting a significant post-halving surge, potentially propelling bitcoin’s price to new heights.

In the words of Bitfinex analysts:

“This estimation aligns with the observed trend of diminishing percentage increases following each halving event. With a conservative estimate placing the price of BTC at between $57,000 and $65,000 at the time of the halving, a 160 percent price increase would lead to BTC price ranging from approximately $150,000 to $169,000 at the peak of the cycle.”

With careful observation and strategic decision-making, investors await the outcome of this pivotal moment in Bitcoin’s journey towards mainstream adoption.