Bitcoin is experiencing a surge in its Realized Cap, reaching an all-time high amidst a flurry of capital inflows. This metric, which evaluates the total value of the asset based on the last blockchain transactions, has been steadily climbing, indicating a substantial injection of fresh demand and liquidity into the Bitcoin market.

Understanding Realized Cap

Realized Cap, as explained by Glassnode, a prominent on-chain analytics platform, provides insights into the overall capital invested by investors in acquiring bitcoin. Unlike traditional market capitalization metrics, Realized Cap considers each coin’s value in circulation to be equal to its price during the last transaction on the blockchain. This approach accounts for the cost basis of all circulating coins, reflecting the cumulative USD liquidity ‘stored’ in the asset class.

Glassnode noted:

“As these coins change hands, we can also consider this to be an injection of fresh demand and liquidity into the asset class. This mechanic is elegantly expressed by the Realized Cap metric, tracking the cumulative USD liquidity ‘stored’ in the asset the class.”

Unprecedented Capital Inflows

Analysts at Glassnode note that capital inflows into Bitcoin have been unprecedented, with the realized cap metric “increasing at an unprecedented rate of over $79 billion per month”. The launch of spot Bitcoin ETFs has played a pivotal role in driving institutional interest in bitcoin, leading to a surge in investment activity. According to IncomeSharks, a digital assets analyst, the influx of capital into bitcoin has been remarkable, with newly launched funds in the US attracting over $12 billion in net inflows.

Despite recent fluctuations in the price of bitcoin, the influx of capital into the market continues unabated. While bitcoin experienced a correction of around 10% from its all-time high in March, the realized cap has continued to climb, reflecting sustained investor confidence. Glassnode’s analysis indicates that long-term holders of bitcoin are actively distributing their holdings to new investors at higher prices, contributing to the surge in realized cap.

Glassnode mentioned:

“Long-Term Holders are well into their distribution cycle, realizing profits, and re-awakening dormant supply to satisfy new demand at higher prices.”

Implications for Investors

For investors, the surge in this metric signals a reawakening of dormant supply and a shift in investor behavior patterns. As profit-taking dominates short-term holder activity, long-term holders are increasingly realizing profits and revaluing their coins from lower-cost bases to higher ones.

This revaluation serves as an indicator of fresh demand and liquidity entering the Bitcoin market, driving the metric to new highs. According to Glassnode analyst James Check, the realized cap is rising due to increased valuations of older coins, including those from GBTC, and HODLers selling.

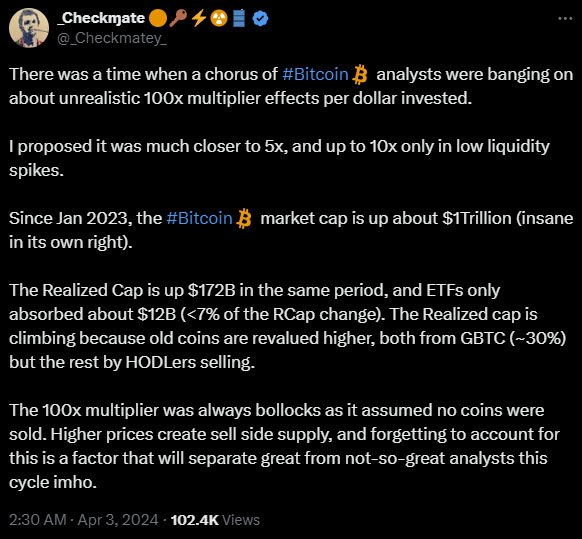

Check discusses the historical expectations of Bitcoin analysts regarding multiplier effects on investment returns, contrasting them with his own proposed multiplier of 5x, or up to 10x during low liquidity spikes. He notes that since January 2023, the Bitcoin market cap has increased by about $1 trillion, with the Realized Cap rising by $172 billion in the same period.

He highlights that ETFs absorbed only about $12 billion of this change, indicating a small fraction of the metric change. Check attributes the climbing numbers to the revaluation of old coins, primarily due to GBTC (~30%) and HODLers selling. He dismisses the notion of a 100x multiplier as unrealistic, arguing that it ignored the sell side supply created by higher prices, which he believes is a critical factor distinguishing superior analysts from others in this cycle.

The uptick in demand for bitcoin is accompanied by a higher appetite for speculation, further fueling the volatility that characterizes bitcoin markets. Analysts caution that while the surge in realized cap reflects strong investor interest, it may also contribute to increased market volatility. As investors navigate this dynamic landscape, monitoring realized cap trends can provide valuable insights into market sentiment and investment opportunities.

Conclusion

In conclusion, the surge in bitcoin’s realized cap to an all-time high reflects a significant influx of capital into the market. Driven by the launch of spot Bitcoin ETFs and sustained institutional interest, this metric provides valuable insights into investor behavior and market trends. Despite fluctuations in bitcoin’s price, the surge in realized cap signals growing confidence and liquidity in the market, with implications for both short-term traders and long-term investors.

As the Bitcoin market continues to evolve, monitoring metrics like realized cap can help investors make informed decisions and navigate market volatility effectively. With bitcoin poised to resume its rally, the stage is set for further growth and innovation in the Bitcoin space.

Remember, while Bitcoin’s realized cap may be reaching new heights, always exercise caution and conduct thorough research before making investment decisions in this volatile yet profitable market.