After months of relative quiet, Bitcoin is seeing a revival of retail investor activity.

A growing number of small investors are returning to the market, marking a potential turning point for the scarce digital asset that has struggled to break past the $70,000 mark in recent weeks.

Bitcoin has been on a rally, posting a 32% gain from its September lows. This surge appears to have reignited the interest of retail investors, who had been largely inactive throughout 2024.

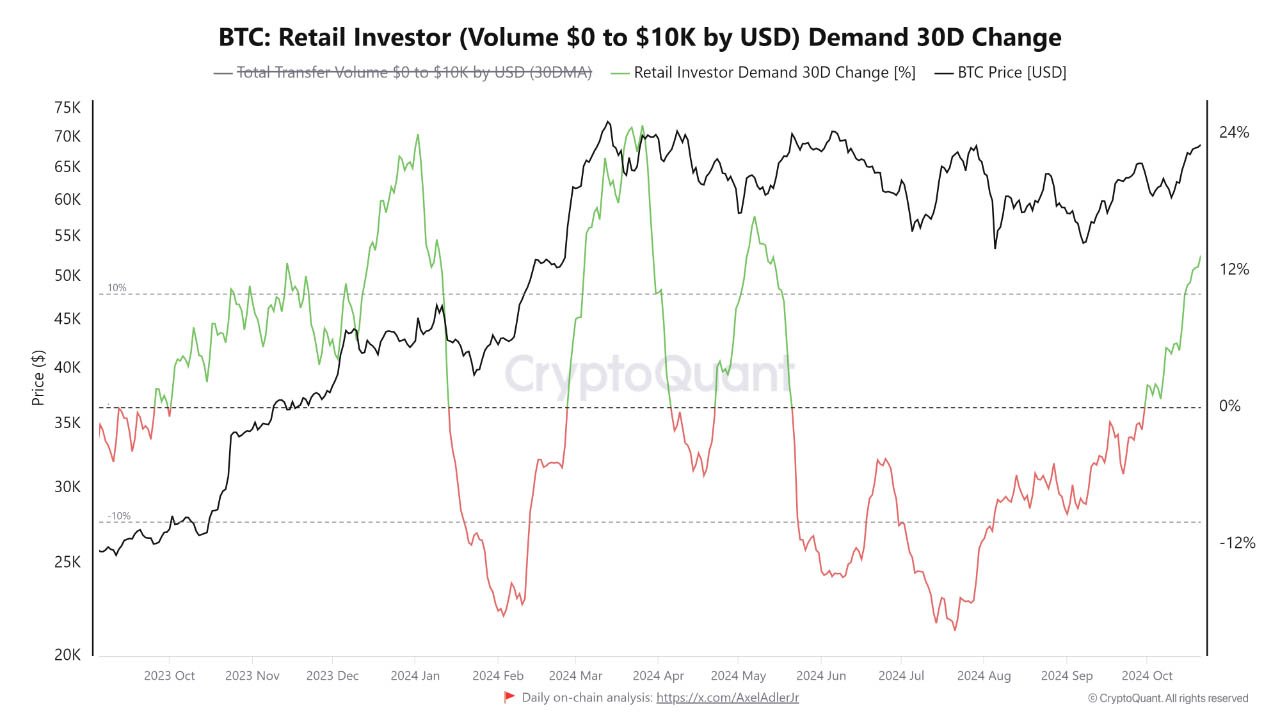

On-chain data shows a significant increase in small-value transactions, which are usually made by retail investors. According to CryptoQuant, Bitcoin transactions under $10,000—a key measure of retail activity—have grown by 13% in the past 30 days.

This is a notable shift, as small investors had been sitting on the sidelines for much of the year. The report states:

“This pattern of activity is much more sensitive to market sentiment and news than fundamentals, but it can be a source of information about the flow of capital on the network.”

The author highlighted that the 13% grow of retail demand over the past 30 days, echoes a similar trend last seen in March near bitcoin’s previous peak.

He argues that the recent increase in bitcoin’s value is attracting small investors back into trading, indicating a shift toward lower risk aversion after a four-month decline in activity.

There are several factors behind the resurgence in retail bitcoin investment. Bitcoin’s consistent rise in value since September has certainly played a role, with the digital asset approaching $70,000 again in October.

In addition to bitcoin’s price movements, broader macroeconomic factors may also be contributing to this renewed interest. For instance, the potential for a Federal Reserve rate cut in November has sparked optimism across financial markets.

Additionally, political developments, such as pro-Bitcoin sentiments expressed by Donald Trump in his 2024 presidential campaign, have further boosted confidence among traders.

Related: Fed Rate Cuts Could Lead to Major Price Swings for Bitcoin

CryptoQuant also noted that the market cap of stablecoins—which are often used by retail traders—reached a three-year high in October. This suggests increased trading activity and further indicates that retail investors are returning to the market after a period of risk aversion.

The market for bitcoin is typically divided between institutional investors—large-scale investors like hedge funds and pension funds—and retail investors, who invest their personal funds.

While institutions often dominate in terms of the volume of funds they manage, retail investors play a crucial role in driving market sentiment.

Retail investors tend to react more quickly to news and price changes than institutional players, making them an important indicator of market momentum.

According to the report, the increase in small investor activity could serve as an early signal of capital flowing into the bitcoin market, potentially leading to further price gains.

Interestingly, while retail activity is on the rise, many small investors seem to be favoring derivatives over traditional spot trading.

Derivatives, such as futures and options, allow traders to speculate on bitcoin’s price movements without actually owning the asset. This can be a more attractive option for retail investors looking to leverage their positions or hedge against potential losses.

In October, derivatives trading volume hit $260 billion, the highest level in a year, while spot trading remained stable. This shift in behavior suggests that retail investors are becoming more sophisticated in their strategies, opting for higher-risk, higher-reward instruments like derivatives.

QCP Capital highlighted the recent price action of digital assets in its most recent update to its Telegram channel subscribers on October 22, stating, “Both BTC and ETH have yet to clear July highs but are closing in on key 70k and 2800 resistance levels”. It added:

“A break above these levels is likely to attract massive retail attention. With the US elections just 15 days away and equities looking strong, the market is definitely optimistic as Risk Reversals have flipped in favour of Calls across all tenors.”

Despite the rise in on-chain activity, not all signs point to a full-scale retail resurgence.

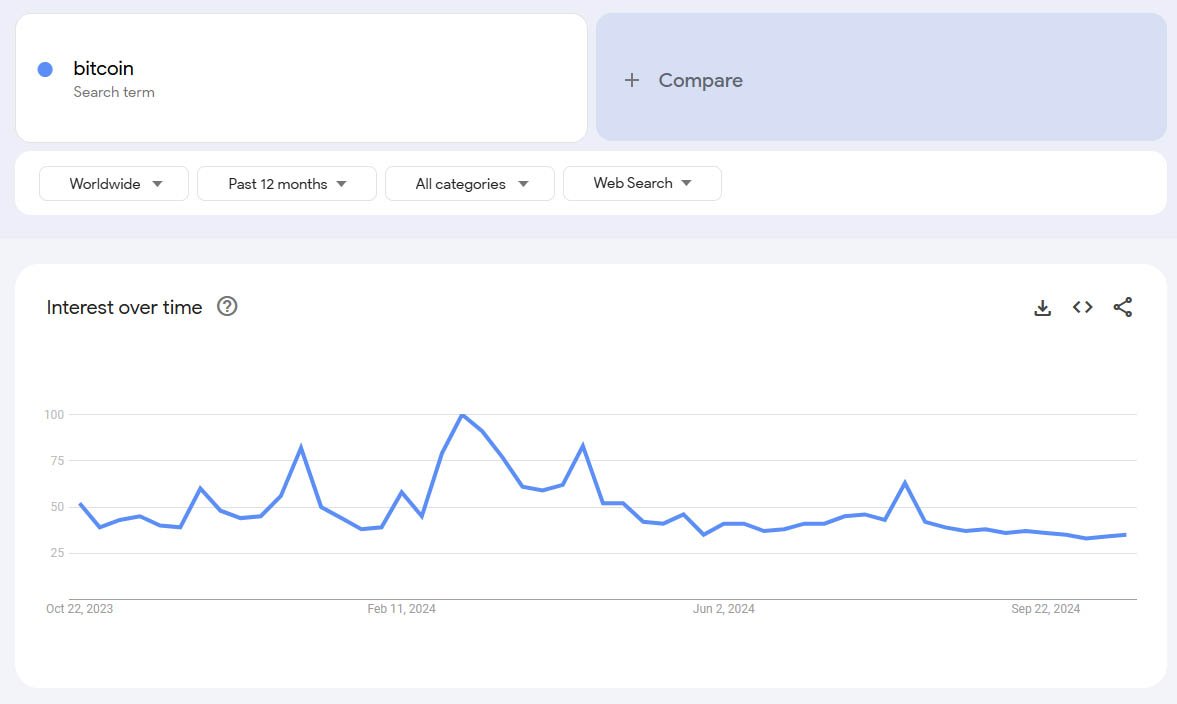

Google search trends for Bitcoin have remained low throughout the year, with global interest sitting at just 33 in October—significantly lower than the peak in March. This suggests that many potential retail investors are still hesitant to jump back into the market.

Several factors could explain this caution. The ongoing cost-of-living crisis has forced many individuals to prioritize essential expenses over investments.

Additionally, the fallout from the collapse of major exchanges like FTX and Celsius may still be fresh in the minds of some investors, dampening enthusiasm for the space.

While retail investors are slowly making a comeback, their full return may take time.

However, the recent uptick in small transactions and derivatives trading points to a growing appetite for risk among individual traders. If this trend continues, retail investors could play a key role in driving bitcoin’s next big rally.

Whether bitcoin will break past its previous highs remains to be seen, but one thing is clear: retail investors are once again becoming a driving force in the market.