Bitcoin, the world’s largest digital currency by market capitalization, is facing a critical test this September.

Historically, this month has not been kind to bitcoin. Dubbed the “September Effect,” bitcoin has often experienced negative returns during this period, raising concerns about what might happen this time around.

As analysts and investors closely monitor the market, several key factors could influence bitcoin’s price trajectory in the coming weeks. Data reveals that bitcoin has delivered positive returns in September only three times over the past decade.

The average monthly return for bitcoin in September is -4.78%, making it one of the worst-performing months for the asset.

Analyst Ali Martinez recently highlighted this trend on social media, noting that bitcoin typically performs poorly in September, aligning with its past narrative. He said:

“If you think August was tough for Bitcoin, keep in mind that September often brings negative returns as well.”

However, some believe this year could break the trend.

According to Spot On Chain, there is a chance that a negative August — when Bitcoin fell by 8.73% — could pave the way for a more positive September. Historically, 43% of negative Augusts have been followed by a positive September, suggesting that the worst may be behind us.

Many believe as recent macroeconomic news seemingly had little impact on bitcoin prices, the digital asset will likely stay within the $58k-$65k range for the near future.

Additionally, investment in spot Bitcoin exchange-traded funds (ETFs) has declined. According to data from Farside Investors, these investment vehicles have experienced steady outflows over the past four days.

As bitcoin moves into September, a month historically linked with market fluctuations, opinions among analysts vary on what to expect. While some, such as the analyst Stockmoney Lizards, believe September could be a pivotal moment, others are more reserved in their outlook.

There are negative outlooks among analysts as well.

According to Lookonchain, a significant bitcoin holder or institution recently transferred approximately 2,364 BTC, valued at about $140 million, to Binance. When major holders begin selling off their assets, it often amplifies negative sentiment in the market.

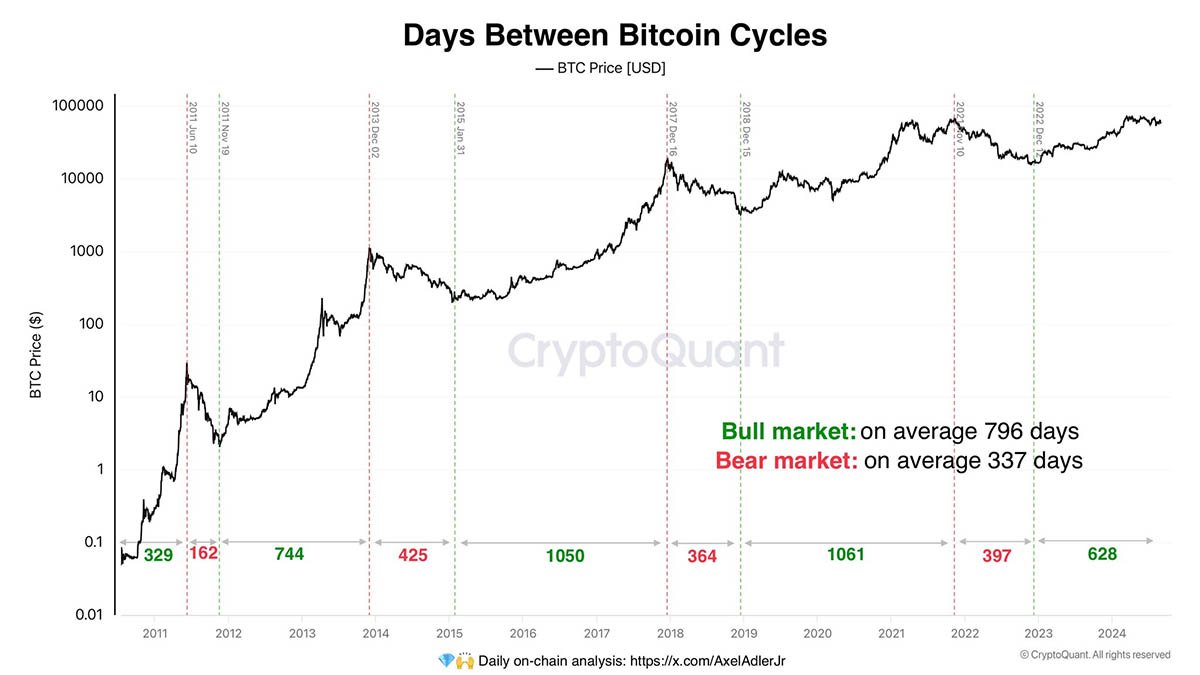

Another analyst, Axel Adler Jr., indicates that bitcoin’s current bull market, lasting 628 days, might still have more to go before peaking.

Historically, Bitcoin bull markets last about 796 days, and the ongoing correction could present a buying opportunity as the market has not yet reached its typical peak.

For bitcoin to defy the “September Effect,” it must overcome several resistance levels.

Currently, bitcoin is struggling to reclaim the $60,000 mark, a crucial psychological level for many investors. As of now, bitcoin is trading at around $58,000, after slipping below this level recently.

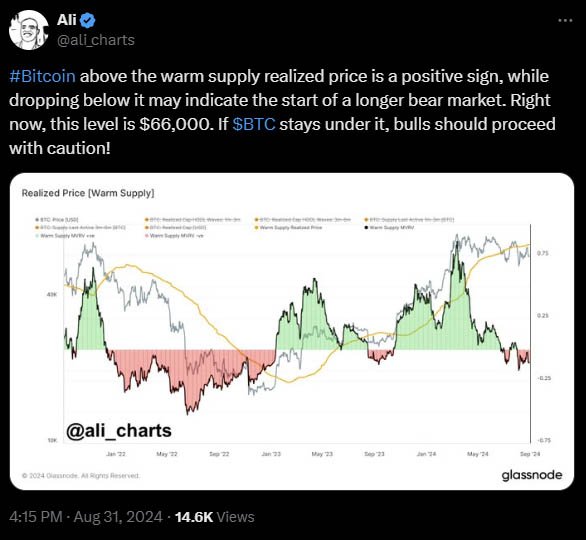

Analysts suggest that it needs to break above $66,000 to signal a potential bullish trend. Ali Martinez pointed out that if bitcoin continues to trade below this key level, it could indicate a prolonged bearish phase.

Other analysts are also watching for potential bullish price levels.

According to recent technical analysis, bitcoin could move up to $68,500 if it breaks above a descending channel. Further upside momentum may even lead to a retest of $72,000, a level where sellers might re-enter the market.

On the downside, there are critical support levels to keep an eye on. If selling pressure continues, bitcoin could fall to around $53,000 or even drop further to $47,000. These levels could provide buying opportunities for investors looking to accumulate bitcoin at a discount.

Several factors could help bitcoin overcome its historical September slump. One of the most important things to note is the potential for an interest rate cut by the Federal Reserve.

Lower interest rates generally lead to more liquidity in the economy, which can strengthen bitcoin’s appeal as a store of value. Innokenty Isers, CEO of Paybis, suggests that if the Federal Reserve cuts interest rates in September, it could boost bitcoin’s value.

This could enhance bitcoin’s appeal as a store of value, as evidenced by institutional investors increasingly accumulating bitcoin. If the Fed’s policies continue to weaken the dollar, more investors may shift to riskier assets like bitcoin, which offer higher growth potential.

According to data from the CME FedWatch Tool, most investors expect the Federal Reserve to halt its policy of raising interest rates for the first time since March 2020. Such a move could ignite a surge in riskier investments like bitcoin.

Another positive trigger for the market could be the upcoming release of former Binance CEO Changpeng Zhao from prison, scheduled for September 29. Some believe his release might spark a bullish trend.

Additionally, bitcoin’s Market Value to Realized Value (MVRV) ratio remains in the “opportunity zone,” suggesting that the current market conditions might favor buying pressure.

Another potential catalyst is the ongoing interest in Bitcoin exchange-traded funds (ETFs). If the trend of alternating between positive and negative months continues, ETFs could become a renewed buying force in September.

While many are cautious, some in the market remain optimistic about a significant price rise. Data from bitcoin options trading shows a notable concentration of bullish bets on bitcoin reaching $90,000 by the end of September.

The total open interest in bitcoin options suggests increasing optimism, with a significant amount of call options placed at the $90,000 strike price. This indicates that some traders are expecting a substantial upward movement in bitcoin’s price.

Looking further ahead, options data for December also reflects strong bullish sentiment, with many traders betting on bitcoin potentially reaching $100,000 by the end of the year.

The market’s growing confidence in bitcoin’s fourth-quarter performance is evident in the clustering of open interest at these higher strike prices.

Despite the challenges, there are reasons to be optimistic about bitcoin’s performance this September.

While the “September Effect” suggests that bitcoin could face another tough month, there are several factors — including potential interest rate cuts, strong support levels, and bullish sentiment in the options market — that could help bitcoin defy its historical trends.