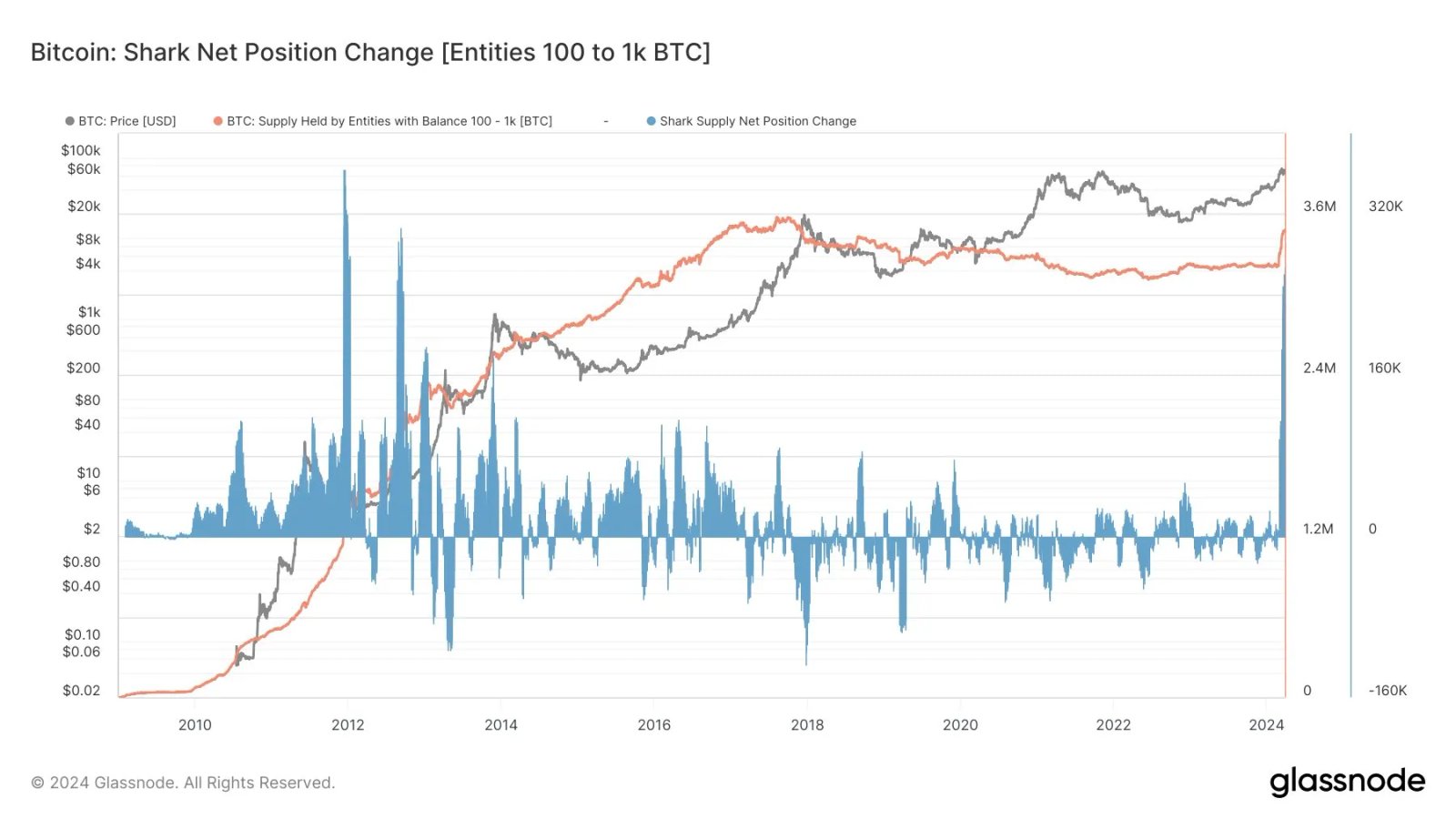

As the bitcoin price moved upward in the past few months, holders with stashes less than “whales”, often referred to as “bitcoin sharks,” displayed a record-breaking accumulation spree, biggest since 2012. Over the past month, these entities, holding between 100 and 1,000 BTC each, collectively purchased more than 268,000 BTC, valued at nearly $18.6 billion at the current market prices.

Analyst James Van Straten sheds light on this development in a recent analysis posted on social media platform X, emphasizing the substantial net buying moves made by the sharks.

The surge in shark accumulation is evident from the positive trend in the net position change metric, which tracks the net amount of bitcoin entering or exiting wallets associated with these entities. The current level of accumulation marks the highest observed since 2012, underlining the substantial influx of capital into Bitcoin.

Bitcoin Sharks vs. Whales

Notably, data by Glassnode reveals that these entities constitute a significant segment of the bitcoin investor landscape, with holdings ranging from around $6.93 million to $69.3 million.

While sharks wield considerable influence in the market, they are notably smaller in scale compared to “whales,” who typically hold over 1,000 BTC each. Nonetheless, their buying behavior remains closely monitored due to its potential impact on market dynamics.

Meanwhile, Bitcoin whales are also exhibiting bullish behavior. Recent data indicates that the most significant Bitcoin whales are actively amassing billions of dollars’ worth of the premier digital asset in 2024. Insights from market intelligence firm Santiment demonstrate a rise in the proportion of wallets holding between 1,000 BTC and 10,000 BTC, climbing from 23% on January 1 to over 25% this week.

Long-Term ‘HODL’ Strategy

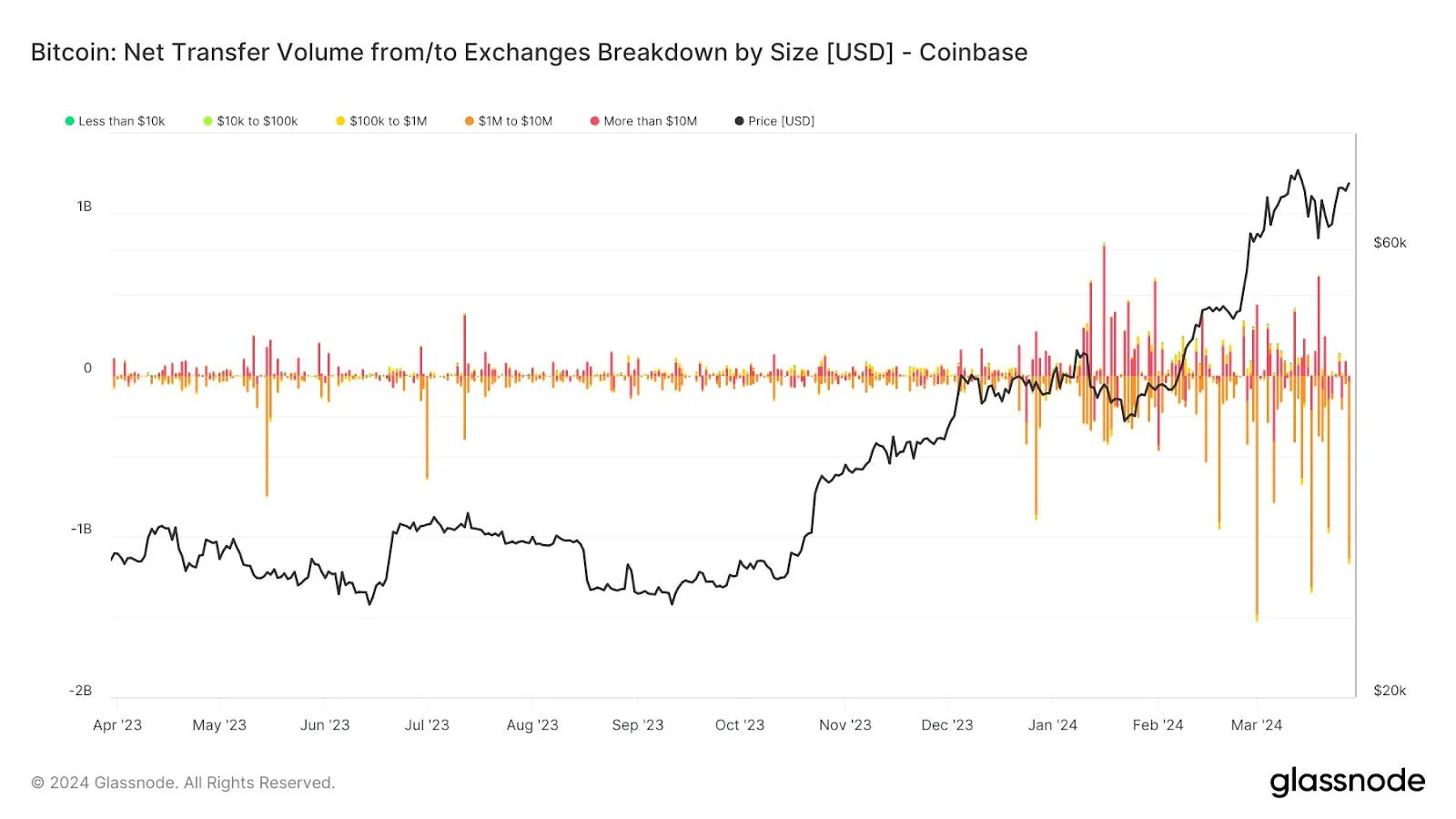

This influx coincides with a period of bullish momentum for the digital asset, with bitcoin recently reaching new all-time highs. Notably, the positive sentiment extends beyond accumulation, as evidenced by significant outflows from the digital asset exchange Coinbase.

Straten highlights Coinbase’s recent observation of $1.1 billion worth of Bitcoin leaving its wallets, marking the third-largest net outflow this year. Such movements away from exchanges often signal investors’ preference for self-custody, indicative of a long-term “HODL” strategy.

Despite these bullish indicators, bitcoin’s price has experienced a period of consolidation in recent days, lacking a clear directional bias. Presently, BTC is trading around $70,000, up by over 8% in the last seven days.

Impact of Upcoming Halving

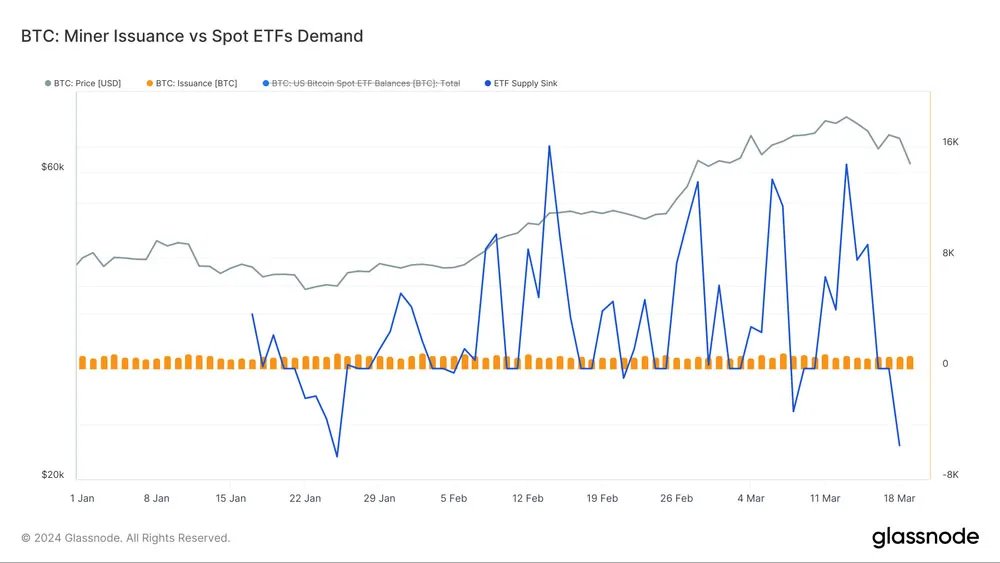

The impending halving event propels bitcoin’s price upward, with market data provider Glassnode indicating that the significant buying power of Bitcoin Exchange-Traded Funds (ETFs) is poised to overshadow the traditional supply squeeze effect expected from the upcoming Bitcoin halving scheduled for April this year.

According to Glassnode analyst Marcin Miłosierny, the supply dynamics of Bitcoin are increasingly shaped by the actions of long-term holders (LTHs). Miłosierny advises traders to closely monitor the activity of LTHs, highlighting that their decisions to sell or hold can significantly impact market liquidity and sentiment.

Furthermore, Miłosierny suggests that achieving an all-time high (ATH) before the halving presents a new scenario, while the cycle’s progression mirrors past trends when aligned from the April 2021 ATH.

Read more on the subject: