The Bitcoin market witnessed a seismic shift in the past week with the introduction of Bitcoin Spot Exchange-Traded Funds (ETFs). The impact has been profound, as outlined in the data compiled from various sources.

Bitcoin Spot ETFs Drive Unprecedented Volume

In the first week of trading, spot Bitcoin ETFs collectively recorded a staggering $14 billion in volume, marking a significant milestone in the Bitcoin space.

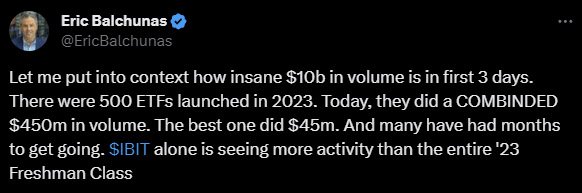

Notably, this volume eclipses the combined trading activity of 500 traditional ETFs launched in 2023, as noted by Eric Balchunas, Bloomberg Intelligence analyst, emphasizing the immense interest and demand for these newly introduced funds.

Balchunas highlighted this remarkable trading volume in the first three days. To provide context, he compared it to the combined trading volume of 500 ETFs launched in 2023, which amounted to only $450 million in total. The most successful ETF among them achieved $45 million in trading volume, emphasizing the extraordinary activity surrounding Bitcoin ETFs compared to the entire 2023 ETF class.

On a similar note, Ophelia Synder, co-founder of 21Shares, a Bitcoin ETF issuer, posted on Twitter:

“A ridiculously impressive number given that most institution **still** do not have access to these products and most advisors can’t actively advise their clients on the space. The ETFs are in early days.”

Grayscale’s Exodus and Bitcoin’s Price Dip

While the spot Bitcoin ETFs collectively demonstrated remarkable performance, Grayscale dominated the scene, accounting for over half of the total trading volume. However, the success was result of substantial outflows, with over $2.2 billion exiting the Grayscale Bitcoin Trust ETF (GBTC). Analysts speculate that the outflows might be attributed to various factors, including the recent bankruptcy of Grayscale’s subsidiary, Genesis.

The correlation between Grayscale’s outflows and the 15% decline in Bitcoin’s price raises intriguing questions. Arkham Intelligence reveals, Grayscale, in response to the ETF redemptions, transferred thousands of bitcoin to Coinbase. This move, coupled with the sudden influx of bitcoin into the market, contributed to sell pressure, potentially causing the recent dip in bitcoin’s value.

According to Arkham Intelligence reports, Grayscale moved over 10,890 BTC to Coinbase Prime just on Friday.

While the recent GBTC redemptions constitute a small part of the 19.6 million BTC in circulation, the company’s significant holdings could impact the market if outflows persist. Atlascap Invest anticipates that the selling pressure will have a direct impact on the digital asset’s price over the next 1-2 months.

Rival ETFs Gain Traction

As Grayscale faces outflows, competitors like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have seized the opportunity. IBIT, in particular, showed promising signs and is on track to potentially surpass GBTC as the “liquidity king.” These developments highlight the dynamic nature of the market and the shifting preferences of investors.

Grayscale Bitcoin Trust, once a dominant force, underwent a transformation into a spot Bitcoin ETF. The conversion aimed to align with investor preferences, allowing for trading closer to the market value. However, this shift also exposed Grayscale to challenges, notably losing assets rapidly in the face of competition from newer, lower-fee ETFs.

Having noted this transformation, Bloomberg Intelligence analyst, James Seyffart, stated:

“a meaningful percentage of those assets to find their way back into Bitcoin, mostly other ETFs”

On a similar note, Rachel Aguirre, BlackRock’s U.S. iShares ETF product leader, informed Bloomberg on Jan. 17 that BlackRock’s ETF is experiencing inflows from “a number of different directions”, addressing the movement of capital from GBTC to IBIT.

Grayscale’s Losses and Competitors’ Gains

Despite its initial supremacy, Grayscale experienced a decline from $28.6 billion in assets to $23.7 billion within the first week of spot Bitcoin ETF trading. The outflows amounted to approximately $1.7 billion, making it evident that Grayscale is facing challenges in retaining investors. In contrast, rivals like BlackRock and Fidelity attracted inflows, with IBIT leading the pack with over $1 billion in new assets.

During an interview with Bloomberg, Michael Sonnenshein, the CEO of Grayscale, shared his insights:

“We are certainly not surprised to see some of the flows in the product over the first couple of days.”

Conclusion: A Shifting Landscape

The debut of spot Bitcoin ETFs has reshaped the Bitcoin market landscape, creating both opportunities and challenges. Grayscale, once the dominant player, is now navigating through significant outflows, while competitors like BlackRock and Fidelity are gaining momentum.

The market’s response to these ETFs has implications for Bitcoin’s price, highlighting the intricate relationship between fund dynamics and bitcoin valuations. As the industry continues to evolve, investors and enthusiasts are closely watching how these developments will impact the future of digital asset investment.